A bad company/good company setup - led by new management

Buying an improving business at a cyclical low

I am back with the last write-up for 2024. This is a typical bad company/ good company setup. Well to be honest, horrible company/decent company would probably be the better adjectives, but that just doesn't sound as good!

Anyway, here are the quirks:

The company has two operating segments, and there is good reason to believe that the bad segment will be sold.

If this segment were sold, I believe it would be worth at least 59% of the current market cap. While the remaining/good business is worth roughly current market cap alone.

Despite industry-wide headwinds in both segments, the new management team has increased gross margins from 5% in Q1 2024 to 15% in Q3 2024.

And the best news for people concerned about liquidity. The stock trades on the Nasdaq and has an average daily trading volume of roughly $700k (yes, for me that’s liquid), making this a great idea for small value funds in my opinion.

Despite that, there is only one old write-up on ValueInvestorsClub and an old write-up on MicroCapClub, but no recent write up covering this new situation.

Name: Ascent Industries

Ticker: ACNT

Shares Outstanding: 10,092,966

Current Share Price: $10.84

Market Cap: $110 million

Enterprise Value: $102 million

Overview

Ascent Industries or previously known as Synalloy operates in two segments: Tubular Products, where they currently own two subsidiaries, American Stainless Tubing and Bristol Tubular Products, which manufacture stainless steel and nickel alloy tubing, separation equipment, heavy wall seamless pipe & tubing.

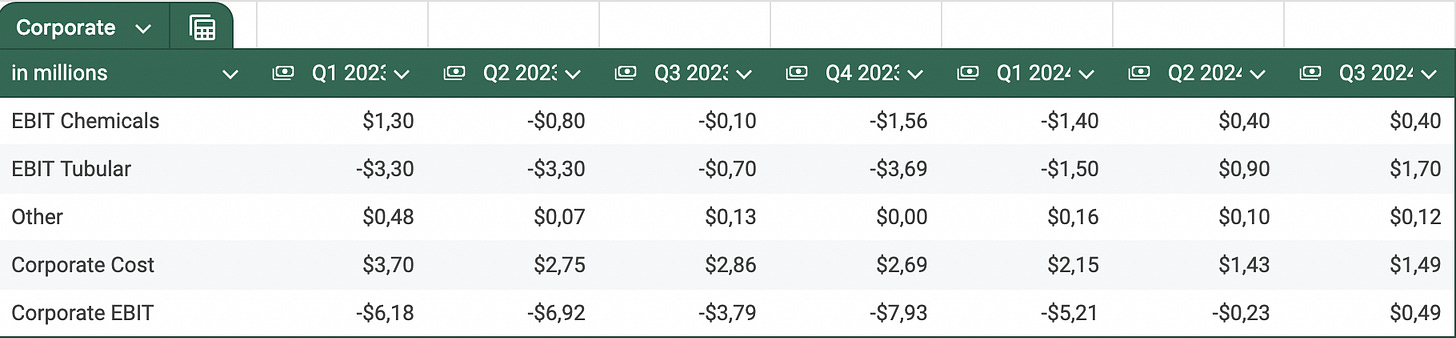

This segment is a pure commodity. With low steel prices, this segment's earnings have been suffering since 2023. Going from $33 million EBIT in 2022 (including a divested subsidiary) to -$11.5 million EBIT in 2023. However, under new management, the segment has been profitable in the last two quarters ($0.9 million in Q2, $1.7 million in Q3).

Its other segment is specialty chemicals. Ascent currently has three manufacturing facilities located in Cleveland, Tennessee; Fountain Inn, South Carolina; and Danville, Virginia.

While I would not consider this a great business because of its asset-heavy and partially commodity-like nature, it is higher quality than the steel segment and less lumpy. They produce specialty chemicals for various end markets such as carpet, paper, metals, mining, agriculture, fiber, paint, textile and automotive, and also produce chemicals for other chemical companies. Client requirements for their products can often be highly specific, reducing their commoditized nature.

They tend to have recurring revenues and long-term customer relationships, making revenues more predictable and less lumpy. The problem: Due to destocking trends in end markets, the entire specialty chemicals industry has been suffering from lower revenues since 2023. Again, despite industry headwinds, the new management has been able to improve EBIT in this segment from -$1.40 in Q1 of this year to $0.4 in EBIT in Q2 and Q3.

Buying commodity-like companies is usually something investors despise. Earnings are highly cyclical and most companies over-earn at the top of a cycle while being in the red at the bottom. I argue that investing in commodity-like businesses can generate great returns if the companies are managed correctly and, more importantly, bought at the right time.

I could end the pitch here by saying that we are buying distressed assets at the bottom of the cycle and we are just going to wait for the industry to recover. I suppose that would even work. But there is more to it. I believe we do not even need the industry to recover to make money here. Let's dive into Ascent's history to understand what the future might hold.

History

In April 2019, Privet Fund made an offer to take Ascent (back then Synalloy) private for $20 per share.1 The offer was quickly declined by Synalloy.2

Back then, the company was generating most of its profits and revenues from the tubular segment. They had four subsidiaries selling metals (compared to only two today) and two facilities producing specialty chemicals (compared to three today).

Eventually, UPG joined Privet in a proxy fight, they owned togehter 25% of the company, and succeeded in replacing the board and CEO. You can see an old presentation from 2020 here. Chris Hutter from UPG became the CEO of then Synalloy at the end of 2020.

Under Hutter‘s leadership, they acquired a specialty chemical company for $32.9 million, or 6x EBITDA.3 They shut down Munhall facility (Tubular segment)4, and they sold their Specialty Pipe & Tube subsidiary for $55 million,5 making the company debt-free.

However, despite some of this progress, when the markets faced headwinds in 2023, the company became unprofitable and the share price collapsed from $18 to as low as $7. During this time, Ascent decided to hire Bryan Kitchen, first as the president of their Chemical Segment,6 and then as their CEO7. Importantly, with him as CEO came also his old colleague, Ryan Kavalauskas as CFO.

Management

Part of this investment thesis is the management. Bryan and Ryan have worked together in the chemical industry for 10 years. First at Advancion Corporation as Vice President and Senior Analyst, and then as CEO and CFO at Clearon. Clearon was acquired by Solenis in late 2022. Solenis is a chemical giant with about $4 billion in sales, according to my research.

In other words, they both know each other very well and have a long background in the chemical industry. They even managed to hire other people from Clearon. I think this is further evidence that specialty chemicals is the future of this company.

In general, it was impressive what kind of people they were able to attract. They hired people in key roles from Baker Hughes ($43 billion market cap), Ameresco ($1.3 billion market cap), and Brenntag ($8.6 billion market cap).

The financials

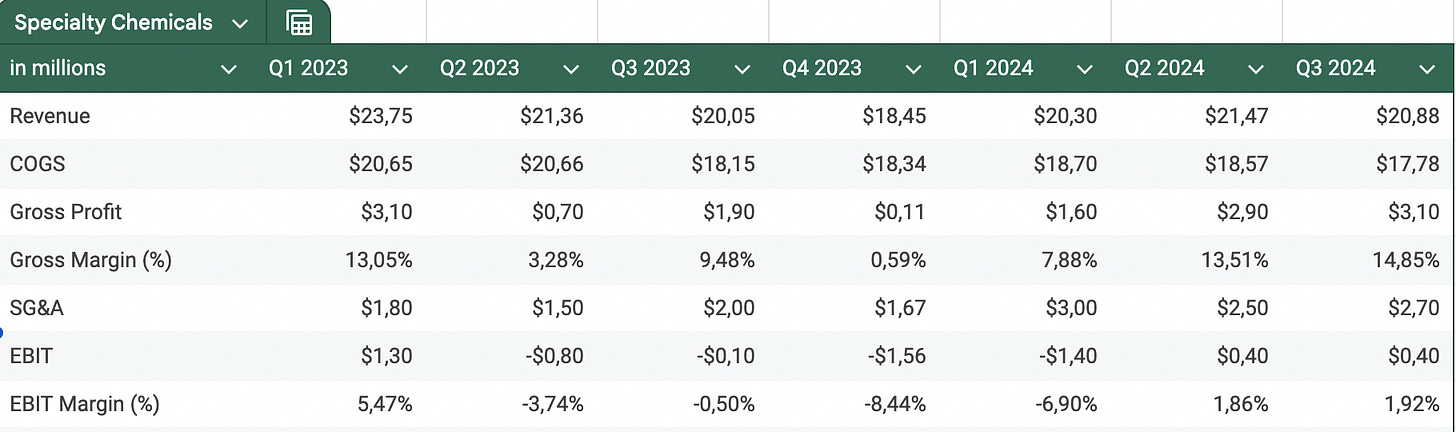

First, let’s look at the specialty chemical segment:

Until 2023 the segment has been profitable. The jump from 2021 to 2022 was due to the acquisition of DanChem. Historical EBIT margin has been around 6-8% (8-11% for EBITDA).

Let’s take a closer look at the last few quarters:

Bryan Kitchen took over as President of the Chemicals segment in September 2023 and as CEO in February 2024. So I would not judge the numbers before the first quarter of 2024. In particular, I think the gross margin improvements are impressive. Despite lower revenue levels than in Q1 2023, gross margins are higher. In fact, they are almost as high as they were in 2020, when the segment had the highest margins in its recent history.

The increase in gross margins is explained as follows:

The increases were primarily attributable strategic sourcing initiatives and product line management resulting in lower raw material costs as well as labor and overhead improvements. - 10Q - 2024 Q3

Bryan Kitchen explained in Q2 earnings call:

“Our road to improve profitability in Q2 was underpinned by aggressive self-help and was accelerated by the recapitalization of talents across the enterprise. To be more specific, our team delivered a 28% or nearly $4 million reduction in material costs and a 30% or nearly $3 million reduction in labor and overhead as compared to the same quarter prior year.”

- Earnings Call Q2 2024

In the Q2 Bryan Kitchen furthermore pointed out that the low revenues were to some extent on purpose as they are shifting away from lower margin products:

“In fact, we've taken the decision to terminate nearly 22% of capital projects from the approved 2024 budget that when scrutinized did not meet our return thresholds.

These dollars will be reallocated to growth projects and/or other needs based on clear return on investment hurdles.”

- Earnigns Call Q1 2024

It is also important to note that within the specialty chemicals segment, Ascent operates its custom manufacturing business, where it typically performs specific manufacturing tasks for larger chemical companies and sells its branded products to the end customer, which offers higher margins and clear differentiation to competitors. In other words, custom manufacturing is more or less commoditized while branded products are not.

“Our goal is to occupy our capacity with healthy margin business. This requires a deliberate shift in our product sales mix, moving more towards ratable and predictable branded product sales.

Fortunately, we're not starting from scratch. Our starting point is to dust off our current branded product portfolio rather than needing to invest heavily into R&D. Our new team is beginning to develop an exciting pipeline of new opportunities across both branded product sales and custom manufacturing.”

- Earnigns Call Q4 2023

Overall, things are already improving in this segment. Please keep in mind that specialty chemicals are still facing headwinds. While the industry as a whole seems to have bottomed out, demand is still weak. Despite this, gross margins are almost at an all-time high, driven by lower sourcing costs and the shift to higher margin products. From what I understand, custom manufacturing has historically comprised the majority of their business. While branded products have been part of their portfolio, they have contributed only a very small percentage of revenue. With the new emphasis on branded products, I anticipate that margins will continue to improve, particularly as the industry recovers and the segment returns to its previous revenue levels.

Tubular products

I'm going to keep this part short because I don't think it's going to play a big role in the future of the company. You can see the margins are all over the place. When steel prices are high and demand as well, they enjoy pretty healthy margins, but if that turns, it gets ugly. The drop in revenue from 2022 to 2023 was due to the sale of Specialty Pipe & Tube.

If we look at the last few quarters, we see the same pattern, Bryan and his team have been able to drive gross margin improvements in the face of significant headwinds. Gross margin improved due to “improved strategic sourcing initiatives and product line management resulting in lower raw material costs.8”

Those who read the Chemicals table carefully might argue that SG&A costs increased, so the increase in gross margin might just be a change in accounting (from COGS to SG&A), which is not the case. The reason for the increase is that what was previously included in corporate costs has been shifted to the chemical segments. Another sign of what the future may hold for this company.

Overall, Q3 was the first profitable quarter since Q4 2022. Again, I want to emphasize that market conditions did not improve. This was just self-help.

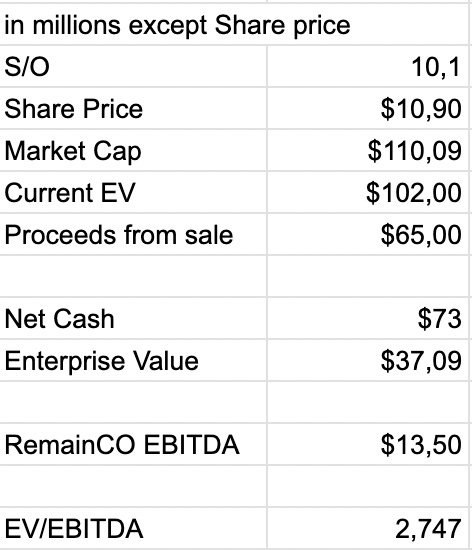

Valuation

So far, I think I have demonstrated that the new management team has improved the business. Now the question is, what is this business worth? There are several ways to value it and I will walk you through my thought process.

I will start by valuing the chemicals segment. As I explained, the chemical industry is currently suffering from the post-Covid destocking trend.

Ascent's end markets are quite diverse, ranging from paper, metalworking, coatings, water treatment, paints to mining and oil and gas. While not all end markets are equally strong or weak, the industry as a whole will eventually recover.

In 2022, the segment generated $107 million in revenue and $11.7 million in EBITDA.

I believe that under Bryan's leadership, in a recovering market, the Chemicals segment can deliver significantly higher margins than the 11% EBITDA margin from 2022. In fact, the gross margin today in a depressed market is already higher than it was in 2022.

Moreover, DanChem was acquired at the end of 2021, so it is reasonable to assume that the integration was probably not yet 100% efficient in 2022.

In addition, branded products were hardly a factor back then.

Anyway, I think $110 million in sales with a 15% EBITDA margin is not unreasonable. In fact, the acquired DanChem business had 18% EBITDA margins. Currently corporate cost are roughly $6 million per year. With a good chunk of it already shifted to speciality chemicals, I assume on a standalone basis we can cut that $6 million at least by half. Bringing us to $13.5 in EBITDA.

What is an appropriate multiple for a chemicals company? DanChem was acquired at 6x EBITDA, while peers are trading at around 8x EBITDA.

If we would assume 7.5x EBITDA as a fair muitple for speciality chemicals, that would equal a valuation of $13.5 million in EBITDA x 7.5 = $101.25 million.

Current market cap: $110 million (Enterprise Value= $102 million).

What would the Tubular business be worth, if it got sold?

The Specialty Tube Business was sold for $55 million. In 2022, it generated revenues of $152 million and operating income of $5.2 million. This equates to 0.36x sales and 9.5x EBIT.

The remaining two subsidiaries generated $154 million in revenue and $22 million in operating income in 2022. Using the same revenue multiple, we would get to $55 million, and using 9.5x 2022 EBIT, we would even get to $200 million.

But we are not in 2022 anymore, taking the recent quarter of $1.70 million EBIT and annualizing it, we would get $6.8 million EBIT. Multiply that by 9.5 and you get a valuation of about $65 million.

Valuing the steel business at a minimum of $65 million seems to be a conservative minimum. If the steel business were sold for $65 million, we would have an enterprise value of $37 million. Or less than 3x EV/EBITDA for the normalized earnings of the remaining chemicals business.

Now you may say, but how can you be so sure, that they will sell the tubular business?

Here is why I think it is more likely than not that they will sell the remaining steel subsidies.

Hint #1:

Even before they promoted the new management team, Privet stated that the main focus would be specialty chemcials:

“Over the past 2 years, Chris and I have recognized the inherited challenges facing our tubular segment and have focused our growth and capital allocation priorities on our Specialty Chemicals business, which we firmly believe has the potential to be the long-term growth engine for Ascent”. - Earnings Call Q1 2023

Hint #2:

The sale and closure of two of the four subsidiaries they had until 2022. Combine that with the acquisition of a chemical company in 2021, and you have a clear trend.

Hint #3:

They promoted the guy with over 10 years experience in the chemical industry after he served as President of the chemical segment for a few months.

Hint #4:

They allocated SG&A expenses from the corporate level to the chemicals segment.

Hint #5:

Commentary on the recent earnings call:

Unknown Analyst

”Okay. What do you anticipate happening first, a sale of one or both the tubular businesses or a purchase of the chemical business?”Benjamin L. Rosenzweig Ascent Industries Co. – Executive Chairman

“Stay tuned.”

Unknown Analyst

“Stay tuned?”

Benjamin L. Rosenzweig Ascent Industries Co. – Executive Chairman

“Stay tuned.”

- Earnigns Call Q3 2023

The only thing that speaks against that is that they have not done it yet. Other than that, everything points clearly to a potential sale of the segment. But even if it does not happen in the next twelve months, the company would still be undervalued.

Risks

Ascent has stated on several occasions that it would look for potential acquisitions in the chemical industry once the company is stabilized. Timing is very important, especially with cyclical companies. Selling the steel business at depressed earnings and buying a chemical business potentially later at peak earnings could be a bad combination.

Focusing on branded products presents a significant growth opportunity, but it could potentially fail or lead to the unintended neglect of custom manufacturing.

Having said that, it is an advantage that Bryan Kitchen already has some experience in selling branded products at Clearon.The Privet Fund sold its entire position (17% of the company) on the open market in September of this year.9 Mink Brook Capital later increased its position to almost 10%10 and the Radoff Family Foundation also increased its stake from 2% to almost 10%11. UPG remains a shareholder. The question is whether Ben Rosenzweig from Privet will remain Executive Chairman.

The sale of Privet is obviously not something you like to see as an investor. I don't know why they sold their stake. However, it is a good sign that at least Mink Brook Capital increased its position.

In addition no one knows when the chemical industry or steel prices will recover. It could take a long time.

Conclusion

I think the current setup of Ascent (ACNT) is very attractive. We have an experienced management team that has worked together before, surrounded by a decent board. Both segments are currently at cyclical lows, although they have already increased margins in both segments, with further upside potential, especially as revenue growth returns.

The potential sale of the tubular segment would be the best case scenario, combined with smart acquisitions in the chemicals segment. But even if that does not happen, we are buying a company run by great management at a cyclical low, trading only slightly above tangible book value, does not sound like a scenario where it is likely to lose money.

You don‘t have a gift for Christmas yet? Consider gifting a subscribtion to Treasure Hunting!

Disclaimer: This is not investment advice and meant for entertainment purposes only, I hold a position in the discussed company and therefore may be biased in my opinion. Please be aware that this is an illiquid microcap, please only buy and sell with a limit-order.

I bought the stock at an average price of $10.20 per share and may be biased in my opinion.

https://www.sec.gov/Archives/edgar/data/95953/000114420419020719/tv519455_ex99-1.htm

https://www.sec.gov/Archives/edgar/data/95953/000009595319000056/exhibit991-pressrelease.htm

https://ir.ascentco.com/news-events/press-releases/detail/18/synalloy-acquires-leading-specialty-chemicals-contract

https://ir.ascentco.com/news-events/press-releases/detail/243/ascent-industries-reports-first-quarter-2024-results#:~:text=On%20June%202%2C%202023%2C%20the,effective%20on%20August%2031%2C%202023.

https://ir.ascentco.com/news-events/press-releases/detail/238/ascent-industries-announces-sale-of-specialty-pipe-tube

https://ir.ascentco.com/news-events/press-releases/detail/234/ascent-industries-appoints-j-bryan-kitchen-as-president-of

https://ir.ascentco.com/news-events/press-releases/detail/239/ascent-industries-promotes-new-executive-management-team

https://www.sec.gov/ix?doc=/Archives/edgar/data/95953/000009595324000070/acnt-20240930.htm

https://www.sec.gov/Archives/edgar/data/95953/000110465924101782/tm2424499d1_sc13da.htm

https://www.sec.gov/Archives/edgar/data/95953/000121465924018851/p1113243sc13ga2.htm

https://www.sec.gov/Archives/edgar/data/95953/000092189524002156/sc13g09076acnt_09202024.htm

Any updated thoughts on this after the sale ?

https://planetmicrocap.podbean.com/

with CEO and CFO..