Earnings Update: August 2025 (Part 2)

My take on the Q2 earnings from the profiled companies

Disclaimer: This is not investment advice and meant for entertainment purposes only, I hold positions in the discussed companies and therefore may be biased in my opinion.

Here's the second part of my earnings update. This time, I’ll address the elephant in the room. I'll provide an update on IVFH, the former darling that now trades at a 52-week low. Since I wrote about it publicly one year ago, I didn't want to go radio silent when it hasn't worked, so I decided to put IVFH above the paywall. You'll find more optimistic updates below the paywall.

Innovative Food Holdings (IVFH)

In investing, there's a fine line between having conviction and accepting that you were wrong and walking away from an investment. So far, I have mostly leaned toward conviction with IVFH, although I now own fewer shares than I did at the end of last year.

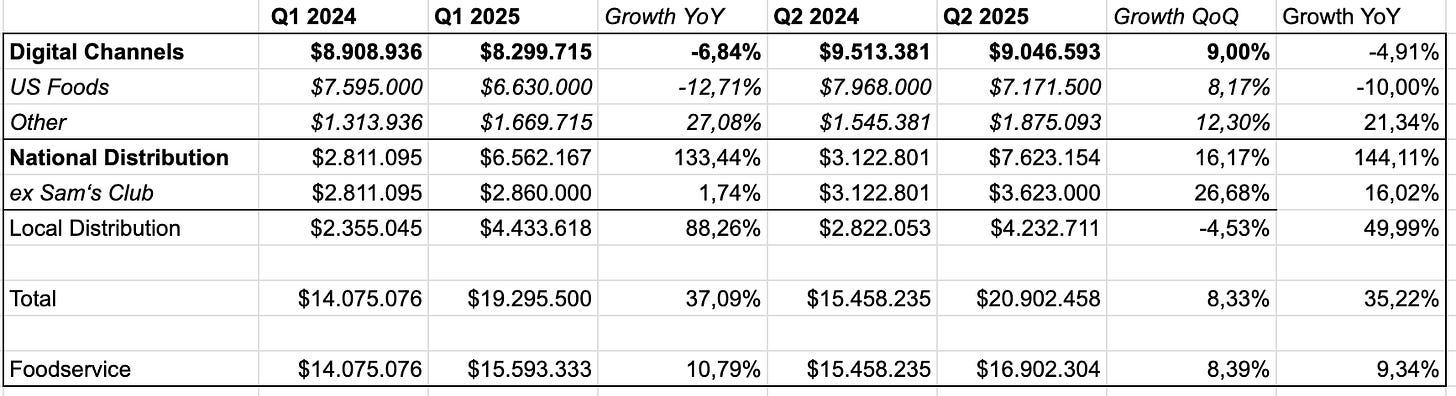

The company never generated any profits from the promised cheese conversion business and ultimately ended that experiment. Meanwhile, their cash cow—their drop-ship business through US Foods—continued to decline. For comparison: In Q2 of 2023, we saw $1.1 million in adjusted EBITDA. The most recent quarter had $0.2 million in adjusted EBITDA. Management stated that EBITDA would have been "materially" higher without the cheese business. Investors could view the sequential increase in US Foods sales from Q1 as a glimmer of hope.

Local distribution has increased significantly due to acquisitions. Sam’s Club accounts for the majority of their cheese conversion business.

Now that they have exited the cheese business, there will be no more unprofitable cheese. The only remaining question is whether they can stop the decline in drop-ship sales by expanding their catalog. Bill said a lot during the earnings call, and I had a meeting with him to better understand their plan to increase their catalog. But first, let me quickly recap what happened with US Foods.

As you know, US Foods has been IVFH’s biggest customer for a long time. Then, they opened their marketplace. In the first year, it was framed as just a technological change—a one-time hit—because IVFH essentially lost its sales data. Last summer, however, US Foods opened the marketplace to new vendors, increasing competition. IVFH hasn’t been able to offset this loss with catalog growth since then because growing the catalog has never really been a focus, and the process of onboarding new vendors has been painfully slow.

Now, for the first time, they’re actually taking steps to fix that. Whether will work is an open question, but that’s the KPI to watch. They are currently addressing the problem by increasing their headcount and, ultimately, by using their AI tool, which should replace the complicated, Excel-heavy process with a simple one. The increased headcount has already resulted in some improvements.

”We also added head count to the largest bottleneck of our catalog setup process, which helped us to accelerate items set up. In the last 4 weeks, we set up over 400 items more than we set up for the rest of the year to date. Beyond catalog growth, we also recently extended our business into 5 new regional markets with Performance Foodservice Group and we'll be exhibiting at US Foods first national Food Fanatics Show in Las Vegas later this month.”

So with this kind of first batch of vendors that we brought through with the latest acceleration that I'm mentioning, again, this is not even with the AI yet, right, because we're -- it's just through the added headcount that we put in place, but that probably took us about 6 or 8 weeks to get them through the process and that we expect that to just accelerate as we get the AI platform launched and rolled out to added vendors as we move forward.”- Earnings Call Q2 2025

Ultimately their goal is to increase the number from 100 per week, through their AI tool further:

”I did say in the comments today that we set up 400 items in the last 4 weeks. I certainly believe that we can accelerate from where we are today as we get the rest of the technology and team in place. 100 items a week would be a nice acceleration from where we've been historically. I think I said in prior earnings calls that we had averaged 13 items per week. So going from 13 to 100 is a nice bit of acceleration, but I think I'll be much happier when we're doing 200, 300, 400 a week. And really item setup becomes nothing of a hurdle whatsoever, but we're only held back by the speed at which we can source new vendors.”

- Earnings Call Q2 2025

It does seem that M&A will play a smaller role going forward, with the full focus on the dropship business. This is ironic because that was the thesis one year ago. Unfortunately, there has been little progress on that front since then.

The biggest question for me is whether easier vendor sourcing will ultimately result in a better business, because if it gets easier for them, it gets easier for others as well.

”As far as competitors, there are definitely competitors out there that are playing a brokerage role like this. I still to date haven't seen anybody that has the reach that we have with access to all 3 of the big broadline distributors and additional sales channels beyond that. So some of this is the access that we currently have. And again, pursuant to the speed that we move at it's critical that we're always working ahead of them and building out additional sales channels and additional capabilities that those competitors don't yet have.”

- Earnings Call Q2 2025

It sounds like they have some first-mover and (currently) size advantages over their competitors. The CEO also mentioned that they are prioritizing perishable items since food safety and compliance are more complicated. Therefore, new competitors haven't focused on perishable items.

To give a metaphor: imagine being one of the first people to set up vendors on Amazon’s marketplace or as a better comparison on eBay, when it launched. You knew the setup, where to find vendors, how to attract them, how to guide them through the process. That’s kind of the situation here.

US Foods’ marketplace is already bigger than Sysco’s, and Sysco’s is still just getting started. Both clearly want to grow revenues through their marketplaces. If IVFH can capture that first-mover advantage, this could still end up working well.

Right now, it hasn’t and the market no longer gives them the benefit of the doubt, because they have squandered it.

Right now, it's a simple but not easy bet. Will they be able to grow their catalog, and will this growth result in a sustainable increase in earnings? It‘s kind of heads I lose much, tails I win much situation.