How I Turned a Three-Bagger Into a 50% Loss

A case study in behavioral finance and what happens when you can't admit you're wrong

In February 2024, I pitched Innovative Food Holdings (IVFH) on my blog. I not only misspelled the name and no one noticed, but the investment has also turned out far worse than expected. While it’s nothing unusual for an investment to disappoint, I think this can serve as a prime case study in behavioural finance. IVFH was a three-bagger one year after my pitch, and now it’s worth half the price when I pitched it. How could this have happened?

Act I: The potential

November 2023. While searching for new ideas, I stumbled upon Innovative Food Holdings in the MicroCapClub. What sparked my interest was the involvement of Pappas and Gramm, both of whom had bought stakes and taken board-seats ealier. They also replaced the old CEO with a new one. And while the numbers hadn’t shown much progress yet, the Q3 2023 earnings call was full of promise and common-sense capital allocation going forward. Ironically, that same Q3 quarter, just two years later, proved to be the (temporary) low point in the “Pappas-and-Gramm” era of the company.

“So we’re going to dramatically shift our capital allocation to better align to our business and profit objectives. This will require several chess piece moves. First, we are exploring strategic alternatives for the e-commerce business with a variety of different potential paths forward, but all of which eliminated the profit drag on the total business. You will see us continue to cut marketing spend, which will result in continued revenue declines in e-commerce. Second, we are exploring, making some big moves in our real estate portfolio, looking at unlocking the value in our Florida office building and our Pennsylvania warehouse. Lastly, we are simplifying other nonmaterial parts of the business so we can help the company focus on the core.

We have exited several partnerships, and we are selling our small consulting business called Grow Brand Management. With these strategic moves, we expect to unlock somewhere between $7 million and $13 million in capital based on their appraised values and net of the associated loans. This will eliminate ongoing losses associated with those businesses.

So what will we do with this capital we’ve unlocked? Our hope is to reinvest into our Professional Chef business.”

-Q3 2023 earnings call

Reading this, I think any investor would be interested in the setup. The company was cheap, if you believed it would be able to sell its warehouse for $18M and return to the previously earned margins on the drop-ship side. I calculated that, assuming both would happen, shares would be as cheap as 5x EV/FCF.

Spoiler: neither of those things happened.

So the thesis was: They shut down the unprofitable e-commerce part, reallocate capital to the profitable B2B business, sell the warehouse, and scale to their publicly stated medium-term goal of $100M in revenue and $10M in EBITDA without dilution.

Act II: The rise

The pitch was well received. There’s a high chance that my IVFH pitch was the first thing you read from me. What followed in the 12 months after the pitch was nothing but an upward spiral. Everyone loved the company and especially the CEO. Shares rose from $0.70 to $2.35 at the peak in February 2025. But what had driven that development?

IVFH made progress toward its strategic goals. They confirmed the shutdown of their e-commerce arm and were about to sell parts of it for a small amount. They announced partnerships with new, big customers for their dropship business to offset the high customer concentration with US Foods and to scale the business further.

I felt confirmed in my pitch, and despite the fact that the warehouse wasn’t sold yet, I felt like I had struck gold with IVFH—at least that was what the share price demonstrated to me. However, with the Q2 2024 earnings results, the first warning signs started to appear. Back then, the company had earned $0.8M in adjusted EBITDA and specialty food service revenue continued to decline. They stated:

”While this quarter was in line with our revenue expectations, we’re not satisfied with the business’s performance, and we are making material progress on our turnaround efforts. In fact, we continue to be confident that we’ll return our foodservice business to year-over-year growth in the back half of the year (...).”

- Press release Q2 2024 earnings

One of the three areas they had mentioned as a future growth driver was the launch of their new retail cheese business. They started a ten-store launch that quarter.

Act III: Overvaluation

The continued weakness in their specialty foodservice business was quickly forgotten by the market as attention shifted to their newly started retail cheese operation. This was topped by the bullish news that: “Innovative Food Holdings, Inc. Announces Fulfillment of Largest Purchase Order in the Company’s History”

$676,000 worth of cheese. The market rewarded that with an $11.4 million increase in market cap, a testament to the bullish nature and positive echo chamber that surrounded IVFH at that time. Operationally, while the company also made some progress, shares started to run on anticipation—very bullish anticipation instead of reality.

While earnings in Q3 saw a small increase in foodservice revenue (+5%), the dropship side of the foodservice business continued to decline, albeit less:

”In fact, our focused growth channels contributed $809 thousand to our growth this quarter, with our legacy drop ship business experiencing lesser declines than in Q2.”

- Press release Q3 2024 earnings

A sign that the technology change at US Foods had a more permanent effect on them than previously anticipated. But again, even that played little importance as shareholders shifted their focus to the new retail business and the two acquisitions announced. This sentiment probably peaked with the news in December:

“Innovative Food Holdings, Inc. Announces Corporate Name Change to Harvest Group Holdings, Inc., A Reverse Stock Split, and Private Placement, in Preparation for Uplisting to Nasdaq”

You have to admit that was a very well-done raise, financed by existing shareholders and embedded in the bullish news of the uplisting.

The issue: only the raise took place. The other issue—and maybe I’m being a bit too harsh here—but going back to the original goal stated in 2023, this wasn’t part of the original plan:

”Now we aren’t going to jump to $1 billion overnight, so our first milestone in that journey is what we call our 100/10 plan. This entails getting to our first $100 million in revenue and driving $10 million in adjusted EBITDA. We want to achieve this first milestone with 0 incremental debt and no other capital raises over the next 2 to 3 years.”

-Q3 2023 earnings call

The year 2024 ended with $72.5M in revenue and $3.2M in adjusted EBITDA. Revenue grew by 11% organically, but mainly due to a $5.2M increase from their retail business. Meaning shares at that time traded at their peak valuation at 37x EV/EBITDA and 1.6x EV/Sales.

Act IV: The downfall

Q1 2025 earnings saw more of the same: a slight decline in their dropship business and no profits (yet) from their retail operation. The stock market started to lose its patience. Shares had already fallen from their peak of $2.35 to $1.70 but accelerated their decline after the earnings to $1.35.

But two more blows were about to drop. Despite stalling progress operationally, there was still some hope that a) the retail cheese business would become profitable and that b) the praised management team would be able to turn it around.

However, in August, IVFH announced its exit from the cheese business and also (finally) the sale of their Pennsylvania warehouse.

While at this time, these were probably the right decisions given its unprofitability, the news also showed that shareholders’ expectations had been too high for almost everything. The warehouse was planned to be sold for $9.7M instead of the $18M communicated previously. The money raised (among other things) for the working capital needs of the cheese business never resulted in any profits for shareholders—just remember the reaction to the first order.

Shares collapsed to $0.70. A roundtrip at this point for me.

But there was one more thing…

Act V: Complete collapse

Innovative Food Holdings Announces Leadership Transition

This was the last domino the market needed to scare the last remaining bull out of IVFH. Everything that had been fueling the narrative had not come true at this point—not even the warehouse had been sold. Gary Schubert, the previous CFO, took over as CEO, and apparently they had decided to dump all the negative news into the Q3 earnings call. And oh boy, things looked ugly. The most concerning for me was the previously well run local distribution business basically collapsed and the acquisitions also are going terrible:

”We received a few questions on the decline of the local distribution business, causes, leadership fixes and Golden Organics issues. After acquiring Golden Organics and LoCo Food Distributions, we incurred double-digit declines. Recently, the local distribution performance, excluding acquisitions, declined 21.5% in Q3. As stated, this was driven primarily by controllable factors, including inconsistent service levels, fulfillment accuracy and leadership gaps that affected customer trust and repeat ordering.”

- Q3 2025 earnings call

The warehouse hasn’t been sold, and the price of the warehouse will get cheaper:

”Second is the Pennsylvania facility sale. We remain under the sale agreement with the buyer signed on July 28. The due diligence period expired without resolution on October 6 due to a roof repair issue, which required additional inspection time. Last week, both parties executed a third amendment to the agreement. As part of that amendment, the purchase price was reduced by $500,000 to offset required roof repairs and the buyer was granted additional time to close, now scheduled for mid-January. We currently have nonrefundable deposits totaling $500,000 with an additional $250,000 in nonrefundable deposits if another extension is requested.”

- Q3 2025 earnings call

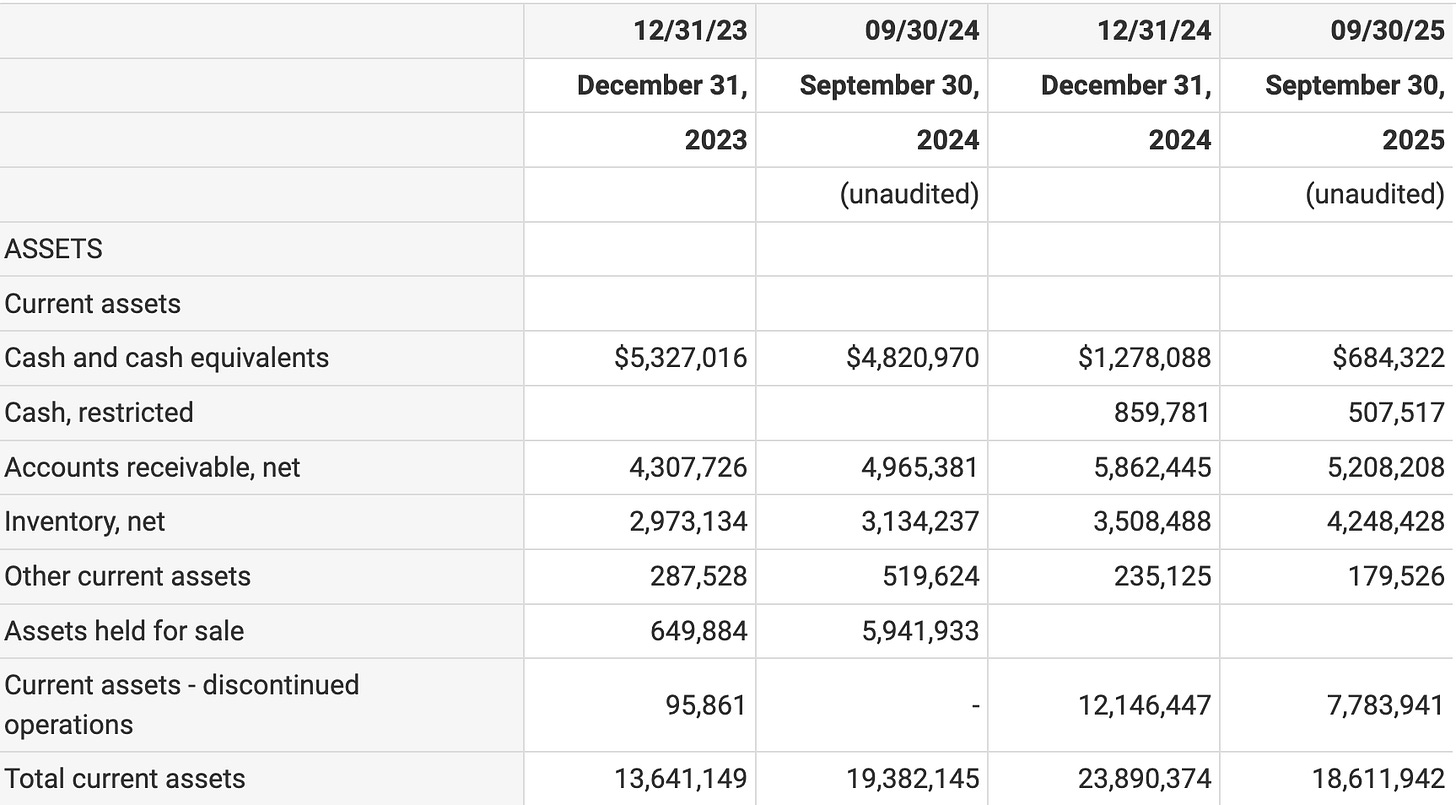

Oh, and all these quarters of burning cash had left their mark on the balance sheet as well:

Rubbing my nose in my own mistakes

I don’t think it was a mistake to buy shares in late 2023/early 2024. The situation smelled like potential—and that’s when you ideally want to buy, when you see the potential just before it translates into the numbers. If I saw the situation right now, I would be interested in it. I would likely buy it, but I don’t think I would size it as big as I did. The reason isn’t that I think large positions are stupid; I just think I underestimated some risks back then.

The story mainly revolved around the previous earnings they had achieved (10% EBITDA margin) with US Foods. I underestimated the dependence on US Foods and also the impact of their technology shift (moving to a marketplace model). I also overstated the business quality. While the dropship side is asset-light, the only competitive advantage was the relationship with US Foods. Once that changed to a transactional relationship, the “moat” disappeared. In a company with a sub-$50M market cap, the chance of finding a moat is only slightly higher than winning the lottery. So contemplating the error of buying IVFH in the first place for a lack of sustainable moat is the wrong place to dig. The real error I made here was not tactical but psychological.

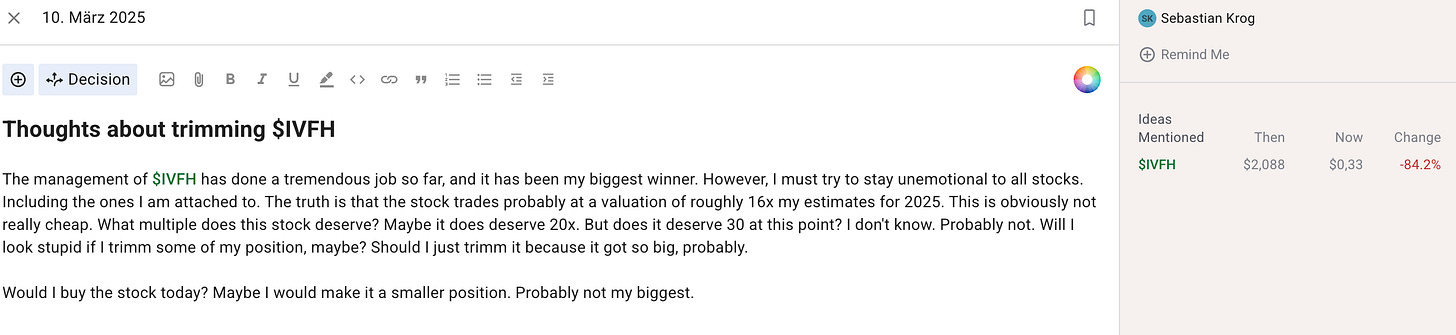

In February, I knew the stock was overvalued. I even had a small sell order in place, which I didn’t follow through on. Here is what I wrote in my journal on March 10th, 2025:

My first error (and learning): Your biggest position always needs to be the best risk/reward in your portfolio. In a concentrated portfolio, your performance will depend on your biggest positions. If your biggest position got there by running up a lot, you tend to like the stock because you made money with it, and yes, the stock “deserved” its place in the portfolio. But, like every financial disclaimer says, “past performance is not indicative of future performance.” Yes, it’s also a thin line between overoptimising and “letting winners run.” I wouldn’t have sold all of my shares at that point, but as I laid out, I should have trimmed.

From now on, once I think my biggest position is not my best idea, I know I have to adjust the portfolio. It doesn’t matter if my biggest position is up 100%, 1,000%, or down 50%. Position sizes have to represent your assessment of r/r attractiveness going forward. The biggest advantage of a private investor is that I am nimble—I can change my mind as r/r changes.

Furthermore, you tend to like stocks that have made you money more than they deserve. Vice versa, you probably hate stocks that have lost you money more than they deserve. Both shouldn’t cloud your judgment on a stock, but they do.

The real error, however, accrued after Q1 earnings. In March, I wrote:

“$IVFH -- this company is now difficult to value. Realistically. If I run my numbers are correct: (73-80m in revenue, SG&A 15-16m, they need at least 28% GM, better 30% to achieve 6-7m in EBITDA. The stock would still not be cheap then. Therefore, IF they are not showing greater than 25% GM in Q1, I would sell 1/4 of my position.”

Gross Margin came in at 22.9%. I sold 16% of my position instead of 25%. I should have sold 100% in hindsight and without hindsight probably still more than 30%.

I had plenty of time to continue selling shares, but I just couldn’t accept being wrong on the stock I was vocal about. I didn’t want to accept the truth. I even bought back a smaller chunk later at $1.15. My ego had taken over.

After the dreams of the cheese business disappeared and it was obvious that the company faced real issues, sunk cost fallacy prevented me from selling a significant portion of my shares at $0.89. I just sold what I had bought back at $1.15 plus a bit more.

Later, I did sell more shares at low prices, justifying it by realizing some tax losses.

The first post-mortem I wrote was about Parks!America, a mistake I made on an analytical level—misjudgment of capital allocation, overpaying on elevated earnings.

This IVFH post-mortem is of a different nature. The error was not as much analytical but purely psychological. I guess it was a lesson I needed to learn, not just in investing but in life in general. I am glad I did, in a weird way, and I really hope that this is now burned into my memory. I am hopeful it is, and if so, it would make me a better investor.

To sum it up: I know that when I make 5 big bets, I will be wrong in 2 or 3 of them. I don’t know which ones I will be wrong about. The point is not to predict this—you can’t change reality. That’s like being mad (and not accepting) that it rains because you wished for sun that particular day. That’s the recipe for being miserable in life and losing money in the markets. The secret is to accept the truth regardless of what your preference was and to dance in the rain. That’s how you make money in the market and how you stay happy in life. Or as Ryan Holiday put it: Ego is the enemy.

I write this as someone who is interested in seeing you develop as an investor. Are you learning the wrong lesson? If a business collapsed within 1-2 years, was it not a serious analytical mistake in the first place? You should not be looking to invest in something so fragile when the downside is a near wipeout/huge impairment over such a short period.

Also, the 5 big investments, 2/3 wrong, is, in my view, a flawed framework. I don't think history or empirical evidence supports the "only need to be right 50% of the time" approach as the optimal way to compound wealth for an individual. There's a good reason the greatest to ever play this game, who has some of the highest outperformance of anyone, focused firstly on not losing money, and having a very high hit rate in terms on not making losing investments.

Just things to consider as you develop into an ever better investor, Sebastian!

"From now on, once I think my biggest position is not my best idea, I know I have to adjust the portfolio" - Thanks for sharing, I find that I'm constantly testing my psychological biases when comparing my top 5 ideas.