My Portfolio revealed - and why I don‘t view it as a Portfolio

Take a look inside my Portfolio

I started investing in 2016, at the age of 17. Back then I invested only in ETFs, two years later extended my strategy by adding positions in the following companies: BASF, Facebook, Amazon, Starbucks and Tesla.

Tesla went on to become my first 10-Bagger, which I sold out of in 2021.

While I am still holding Amazon and Facebook, I sold BASF a couple of years earlier, just like I did with Starbucks.

From 2018-2020, I invested all my capital to start and grow my own business, an online marketing agency - which was the best investment so far.

However at the end of 2020, I returned to the stock market. I started, where I left off by investing in known blue-chip companies. But in the next 12-24 months, I saw myself going down the investment rabbit hole that lead me into microcaps.

The reasoning behind this is fairly simple and (in my mind) rational. At the end of the day, it comes down to game selection. Playing only games, in which you have an edge. As a retail investor that works with a small amount of capital, you have to look in obscure places. As once Warren Buffet said.

Since you have no way to compete with full-time experienced hedge-fund analysts in analysing a blue chip company, the best way to gain an edge, is to look at companies in which hedge-funds simply cannot invest in.

This leads us to illiquid microcaps. The more illiquid, the better, the smaller, the better, the more obscure, the better.

There are many ways to skin the cat, but what I look for are anomalies. Good businesses, trading at a discount, ideally with a clear catalyst.

Something that is a no-brainer.

This is also the reason, why i don‘t do DCFs anymore. I believe, if you need an excel sheet to make a decision, you shouldn’t do it. It has to be so obvious that a “back of the envelop” calculation is enough to determine an undervaluation. After all, I prefer to be directionally correct, rather than precisely wrong. And excel sheets can give you the illusion to overestimate your knowledge of an uncertain future.

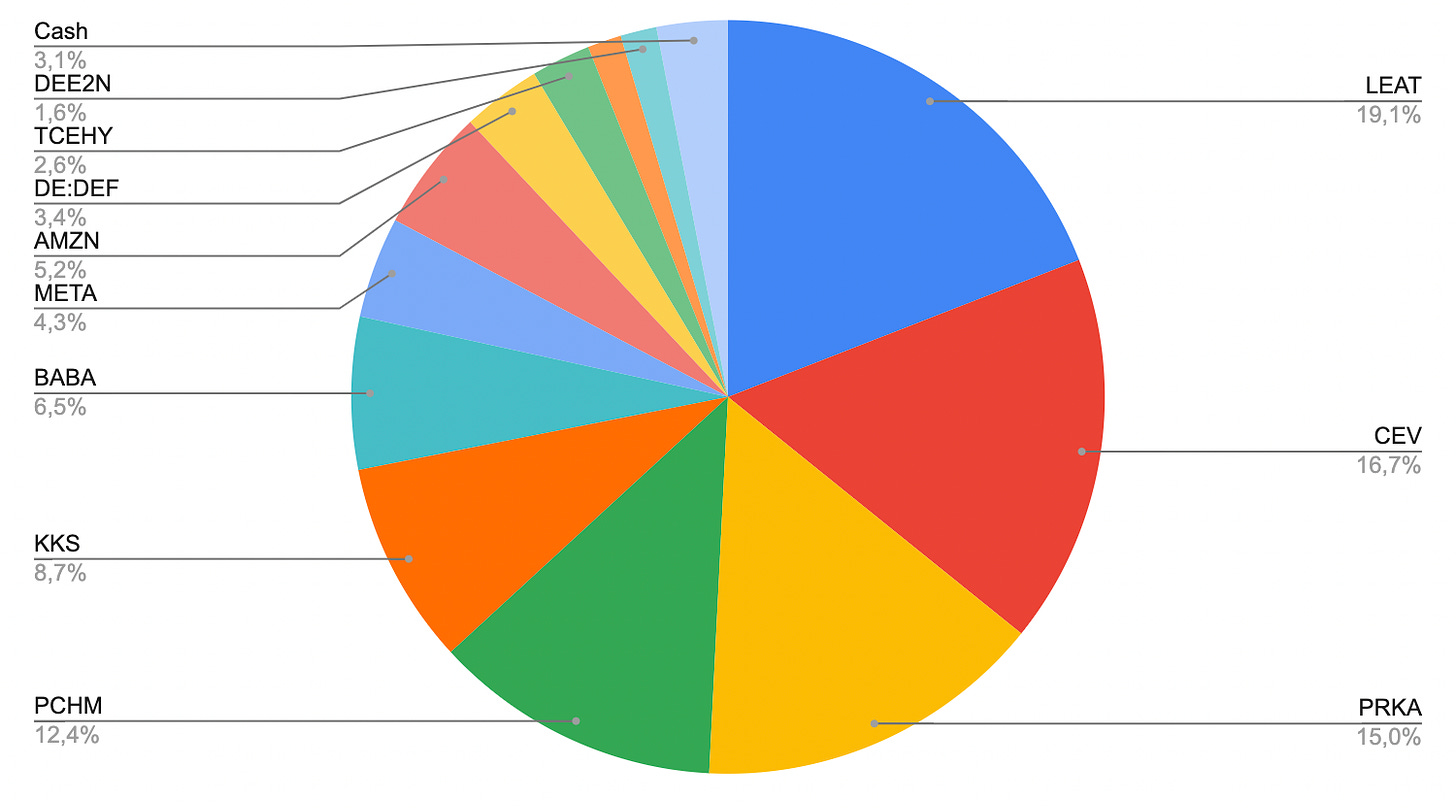

Revealing my portfolio:

First of all, please remember this is NOT investment advice. Obviously, I hold a position in all these stocks. My investment strategy may not be suitable for you and your situation, so please do your own due diligence. This article is for entertainment purposes only.

1) Leatt ($LEAT)

Market Cap: $128m

Net Income ‘21: $12,57m

P/E ‘21: 10

Leatt develops and sells protective gear in the MTB and Motocross space. From helmets to boots, they offer a head-to-toe product line in both markets.

Originally they were know as the “safety-brand” and now are building a reputation to become a “cool brand” in the MTB and MX industry. In the last 2 years they had tremendous tailwinds from covid and the increase in E-Bike sales. However these tailwinds seem to be long lasting and they are doing an excellent job to manage the growth and the inventory levels.

2) Centrotec ($CEV.HM)

Market Cap: €460m

Net Income in ‘21: €57,7m

P/E 21: 8,5

I just did a write up on this company, which you can read here.

In short: After the delisting it is very hard to get information on this company and shares have been more illiquid in the past which created the undervaluation.

Combined with a huge increase in demand for heating pumps in Germany, which should drive sales, creates an interesting opportunity.

3) Parks! America ($PRKA)

Market Cap: $31m

Net Income ‘21: $2.8m

P/E ‘21: 11

I also did a previous write up on this company (See here). In short, I think it is a very great, stable business that generates a lot of Free-Cashflow. In the last 3 years they are investing a lot into the business, including one acquisition. So the case is, that these re--investments play out over the longterm, even if they suppress Free Cashflow in the short term.

4) PharmChem ($PCHM)

Marketcap: $16m

Net income ‘21: $1.8m

P/E ‘21: 9

PharmChem offers a Sweat-Patch Device to test for drug-abuse. Compared to the classic urine-test, this sweat-patch is way more comfortable and easy to use since you just put it on your arm and wear for around 2 weeks. In 2021 an activist took over the company. The first thing they did was to repurchase shares, they also announced a new CEO and hired a salesforce-team. Apparently all these actions didn‘t lead to the desired success in the next months. Some of the newly hired sales guys don‘t work there anymore and the CEO was replaced by another CEO (the brother in law of the chairman).

Also Harris Perlman (known as @OtterMarket) was announced as Chairman of the board. So there is a lot going on. Tice Brown (the activist) is the largest shareholder and is not compensated in any other way by the company. He owns approximately 30%, therefore the incentives are aligned. I am curios to see what the future will bring, but this a a very, very asset light business, which can generate 2m in FCF per year in the soon future.

5) Kaspi ($KSPI)

Market Cap: $9,2 billion

Net Income ‘21: $1 billon

P/E ‘21: 9

I did a Twitter thread on this on, almost one year ago. It is still a great business, but being a company from Kazakhstan, the geopolitical risks are more apparent now than ever. The business itself, however, seems not be affected by the current situation around russia and the Ukraine. Still, it is down a lot compared to the highs at the end of 2021. This might be the most riskiest investment since it is pretty hard to calculate the risks of geopolitical macro events.

Besides these I‘d like to highlight Defama ($DEF.DE) a german Microcap, which has performed very well in last 12 months and Endor ($DEE2N).

Why I don’t view it as a portfolio

I will probably build 99% of my wealth in the next 50-70 years. Therefore my current „wealth“ represents only 1% of my lifetime wealth. Future inflows of money will be much greater that the overall sum of my current portfolio.

Even if I would put all my money into 1 stock, I’d still be heavily diversified over my lifetime since it’s represent only such small amount of money. That’s the reason I don’t view my portfolio as a portfolio but as a serious of investment I make.

Future outlook

The biggest leverage for the future will be to increase the inflows of money that I can invest. So that‘s priority number 1. After that I am looking more into special situations with shorter holding periods, instead of compounders.

I believe this approach to be the best in terms of risk-reward, however there are also certain disadvantages, such as value-traps or catalyst that never play out, which has to be avoided.

Disclaimer: I hold a position in all these stocks. My investment strategy may not be suitable for you and your situation, so please Do your own diligence. This article is for entertainment purposes only and is NOT investment advice.