Playmates Toys: Toy maker trades below Cash and less than 5x 2023 earnings

Playmates Toys(869.HK): An attractive opportunity for the shorter term

Disclaimer: This is not investment advice and meant for entertainment purposes only, I hold a position in the discussed company and therefore may be biased in my opinion. Please be aware that this is an illiquid microcap, please only buy and sell with a limit-order.

Edit: This is a closed idea, I no longer own shares in Playmates Toys

Name: Playmates Toys

Ticker: $869.HK

Market Cap (MM): 838HK$ (11.19.2023)

Enterprise Value (MM): -115HK$ (11.19.2023)

P/E 2023 (e): ≈ 5x

Overview:

Playmates Toys is a Toy maker trading below net-cash. It designs and produces toys for Teenage Mutant Ninja Turtle ("TMNT"), Ladybug Miraculous, Star Treck and Spy Ninjas. The company has a long relationship with Teenage Mutant Ninja Turtle, Playmates Toys is listed on the Hong Kong Stock Exchange. While this may be a red flag for some investors, I believe the company has no more exposure to HK/China than the average US toy company. Revenues are generated in the US (about 60%) and Europe (about 30%). CEO Michael Chan graduated from Yale and worked with KKR's private equity team in Menlo Park, California. Playmates Toys is owned and controlled by Playmates Holdings, which is also controlled by the Chan family. Historically, their results have been highly correlated with the demand for TMNT toys, as this is the largest toy line they produce. A Nickelodeon series of Teenage Mutant Ninja Turtle was released in 2012, followed by a movie in 2014. The EBIT and share price pretty much followed these developments, peaking at HKD 2.1 billion in revenue and around HKD 640 million in EBIT in 2014

The opportunity:

A new TMNT movie got released in August 2023. A series will be released in 2024. Playmates Toys is benefiting immensely from that.

Playmates Toys' revenue streams are more diversified than during the last peak. They are profitable even without TMNT.

Even though, we cannot expect that they contribute the cash pile to shareholders, in the past (and currently) they are paying out at least 30% of earnings in dividends.

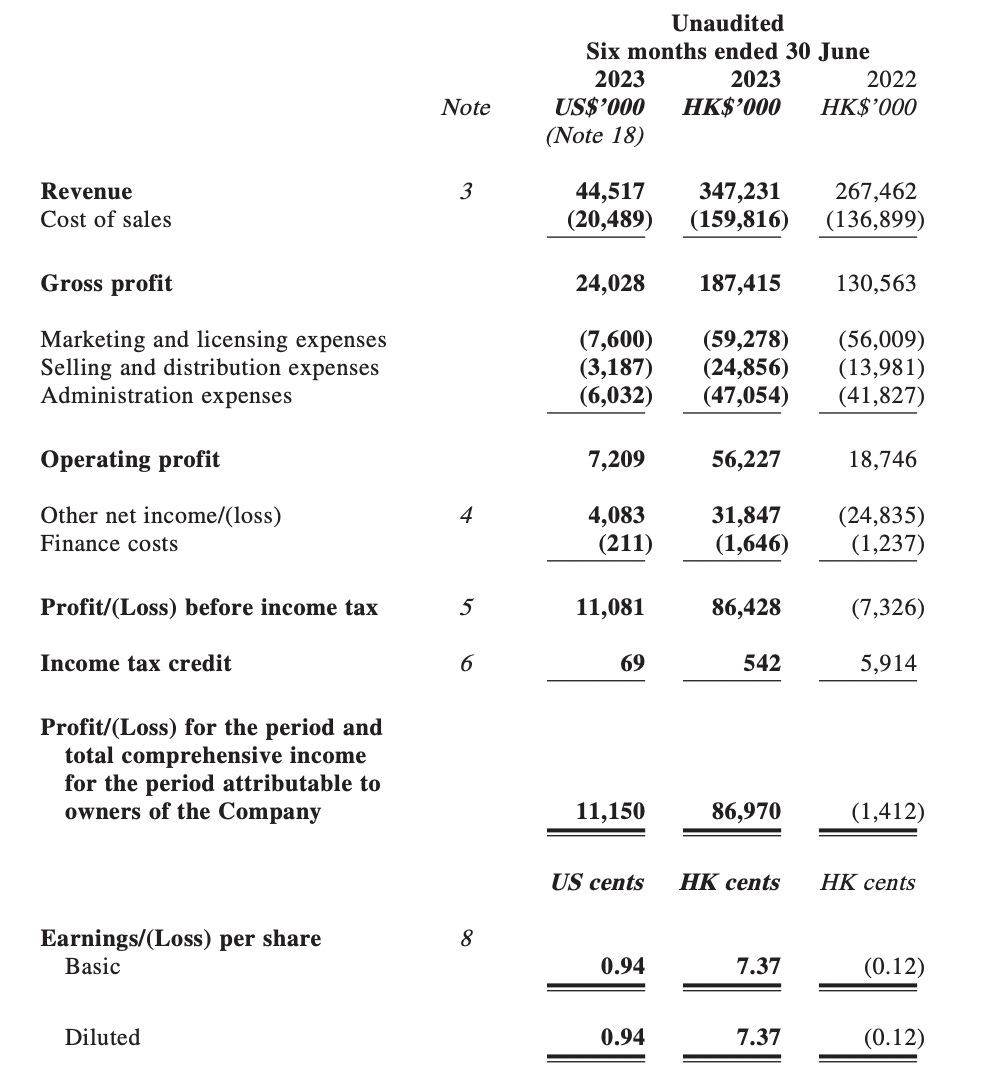

Financials:

Currently, the two major toy lines are: MIRACULOUS: LADYBUG & CAT NOIR and Teenage Mutant Ninja Turtles. TMNT in particular should drive future sales. A new movie will be released in August 2023 - and Playmates will launch its first toy line to coincide with the movie. After the August 2023 movie, there will be a Paramount+ series and a sequel. Also in 2024 will be the 40th anniversary of TMNT. That year also saw the release of MIRACULOUS: LADYBUG & CAT NOIR, THE MOVIE. So compared to the last release of TMNT, the company is more diversified. During the last release in 2013, the revenue peaked at 2.1 billion HK dollars. The higher revenue allowed the company to increase gross margin to around 60% (compared to 45-50% currently) and EBIT margin to 25-30% (compared to 10-15% currently). For H1 2023, the company has already provided good numbers, even though most of the TMNT toys will be released in the second half of 2023. Only "initial shipments1" were part of those numbers. The majority should have been achieved by the MIRACULOUS: LADYBUG & CAT NOIR.

Forecasting Demand:

You can use the BSR (Bestseller Rank) on Amazon to estimate how well a product is selling, so we will use this to estimate their revenue from the new toy line.

I know from their annual reports that about 60% of their revenue is generated in the US. Unfortunately, they don't disclose how much revenue Amazon accounts for. After contacting management, they said it was in line with other toy companies. Which should be around 10% (JAKK: 10,5%2, Hasbro: 10%3). The three big customers mentioned in their annual report should be Target, Walmart and Amazon. I think it should be in that order. So about 13% of all sales should be on Amazon for Playmates Toys.

To keep it simple and short, I will only highlight two products, one from the Miraculous line and the bestseller from the TMNT line. I chose these two to check a) if the demand for Miraculous is stable and b) how much demand there is for the TMNT line. From this, we can get a pretty good estimate of H2 2023 earnings. Keep in mind that demand and price fluctuate, so this may look different in two weeks. This is just to illustrate how demand is moving.

MIRACULOUS: LADYBUG & CAT NOIR

First of all, all of their toys have excellent reviews. But let's look at the demand: the lower the BSR, the better. It means that it is the X most sold item in the Toys category on Amazon.com. Remember, the lower, the better, so the lower, the green line gets, the more sales they make.

We see that the current BSR is 5252, which means that it is the 5252nd best-selling item in the "Toys" category on amazon.com - more importantly, we see that demand seems to be quite stable. We can also see a small increase in sales in August, when the movie was released.

TEENAGE MUTANT NINJA TURTLES: MUTANT MAYHEM

As always, great reviews. Now the demand:

It is through the roof! It is currently the 28th best-selling toy on amazon.com.

For reference, that should equal about 28,000 unit sold per month4.

I just picked two products from each line to demonstrate the demand for them. Obviously, demand fluctuates, but I've been tracking their demand closely and so far it's been pretty stable. There are many more products for the TMNT release, almost all of which are enjoying great reviews and high sales. They even won the Toy of the year award. See here. Also for 2024 they plan to release more toys for TMNT and the Miraculous Cat Ladybug: See here

The demand for Miraculous toys is stable and even increasing compared to H1 because of the movie release and the nature that toys are sold more before the holiday season. TMNT demand is obviously very strong. I did the work to track all their products on amazon.com and arrived at my estimate that they should earn close to 1B HKD in revenue, on a 56% gross margin and 20% EBIT margin, which would equal around 200m HKD and put the stock at ca. 4x MC/EBIT.

What it means for the stock

With the last movie release, the stock jumped to 4HK dollars. I think the stock will most likely react positively to the 2023 and 2024 numbers as well. I don't know how long the demand for their toys will stay high, and I don't assume that they will earn what they earned in the last peak. But Playmates Toys is in a better position than it was in 2014, with its entire market cap in cash and significant revenues from the other toy line as well. Perhaps the large cash position allows them to pay out more than 30% of their earnings in dividends (as they did last time). Maybe they can even secure another Tier 1 contract, I don't think it will happen, and it's not necessary to make money. But it would be a potential upside.

Risks:

Playmates Toys is not the only company that has the right to sell toys for the TMNT brand. Funrise has also secured the rights and is competing for the same audience. According to my research, Playmates has about 60% of the market, while Funrise has about 30%.

The new stock incentive plan allows them to exercise their options and increase their share count by up to 5%.

No dividends. I think it is unlikely that they would not pay out earnings via dividend. First, they already paid out 0.02HKD per share in H1, second, they have a longer history of paying out earnings via dividend. Furthermore, if they were to accumulate all the cash from the next "cycle" on their balance sheet, they would have about twice their current market cap in cash. I believe that even in this scenario, the stock should at least not experience multiple compression.

Conclusion:

I think Playmates Toys offers a great opportunity for the shorter term. Maybe, if the management executes well, secures others deals with well known brands, this could even turn out into a good long term holding. However, I think this is the more unlikely scenario.

Disc: I am long Playmates Toys.

Useful Information: Check Asian Century Stocks article about the toy industry.

Disclaimer: This is not investment advice and meant for entertainment purposes only, I hold a position in the discussed company and therefore may be biased in my opinion. Please be aware that this is an illiquid microcap, please only buy and sell with a limit-order.

From their interim Report 2023: https://doc.irasia.com/listco/hk/playmatestoys/interim/ir288690-e23081863_playmatetoys_ir.pdf

From JAKK‘s latest Report: https://www.sec.gov/ix?doc=/Archives/edgar/data/1009829/000118518523001194/jakkspacif20230930_10q.htm

From this BSR calculator: https://www.junglescout.com/estimator/

Looked at the net-net company w/ a minus EV in the weekend. But still have some margin of safety concerns.

#1 Performance highly related with performance at the box office, which is not predictable.

#2 There was a consecutive 3yrs loss from FY18-20, which made dividends pended with stock price plummeted by 90%.

#3 YoY growth of FY24 would probably at LSD-LDD, with a possibility of negative growth. With a rigid administration expense, bottom line drops morr significantly to sales.

At HK market, a certain stock could be wipe out by 50% or more market capitalization within one day.

Just wonder do you see any solid catalysts for FY24H2?

Hi Sebastian, have you done any work on the listed parent Playmates Holdings (635 HK)?