Portfolio Update: New investment style?

Updates and outlooks and the companies in my portfolio

I already said in my last Portfolio update that I don’t view my Portfolio as a portfolio, but rather as a series of investments. Especially in the beginning stages of investing, when your active income is a meaningful amount of your general portfolio value, I think it is very useless to be concerned about diversification and portfolio structure in general, simply because your active income plays a bigger role in your general wealth creating strategy at that point.

Hence, you could even afford to lose all your money and (depending on the ratio) be back at the same wealth level 2,3, or 5 years later. Obviously you don’t want to invest like that, I just wanted to illustrate my point.

For me there is also another reason, why I’d like to view it as a series of investments and the reason is that I just learn every day so much more as an investor, every 10k I read, every conversation I held with (far smarter) investors, pays huge dividends in terms of learning the game. Meaning investments that I did 1 or 2 years ago, I wouldn’t probably do them again now.

So in terms of tracking my progress as an investor, I prefer the view of looking at my latest investments and see how they performed. I believe at this current stage, this is a great indicator of my progress as an investor.

A change in style?

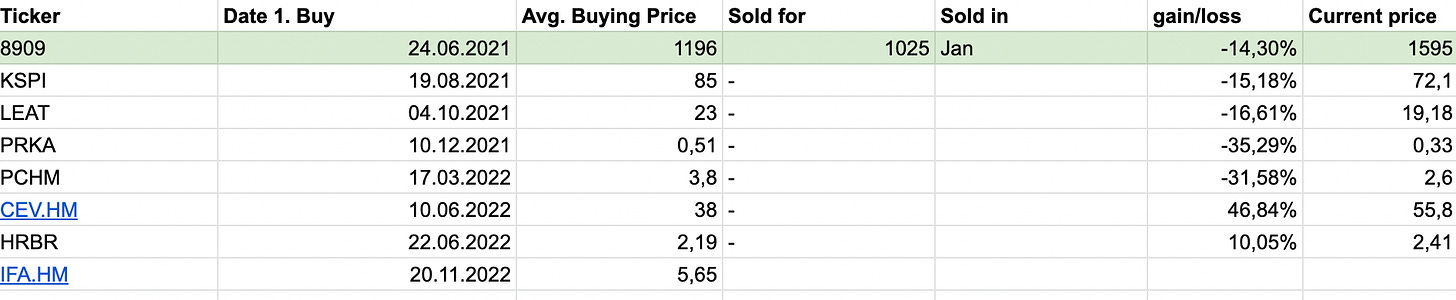

As you can see, basically all I bought in 2021 were "great businesses at a fair price” (maybe expect for Shinoken). However - in 2022 basically every investment would be considered as a “special situation”. Well, I’d say Centrotec and Pharmchem are also good companies at a fair/cheap prices, but especially the last two investments have been made more on a Balance sheet and assets basis, rather than an earnings forecast.

This has two reasons, first I think these situations are easier to understand or to estimate what will happen, since you have a shorter timeframe and a clear catalyst. Second, the downside is often protected (usually even by real assets).

I think it is very, very hard to predict whether a business will grow in the future and at which rate it will grow. Ultimately these two factors determine the value of a company, and the further we look into the future, the harder it gets to predict this.

So I would feel only confident doing so, if I really understand the dynamics of the industry and the business - because this is very rarely the case and since the past 2 years have been very unusual (covid winners, inflation etc).

I find it pretty hard to separate the lucky ones (e.g. covid beneficiaries) and the ones that really improved their business and have sustainable growth for years coming.

In addition, I don’t think that there is a superior style in general, I think it more a question of which style suits your personality best. Something that is barely talked about, but I think I very important to succeed in life and investing.

Some Updates on my holdings

Leatt: I already posted it on Twitter, but in case you missed it, here are my thoughts:

$LEAT reported Q3 numbers:

- 5% Revenue Growth (33% YTD)

- Net income -5% (YTD +26%)

Here is why I believe it was a good quarter in a difficult environment, and why the numbers prove that the thesis is still intact.

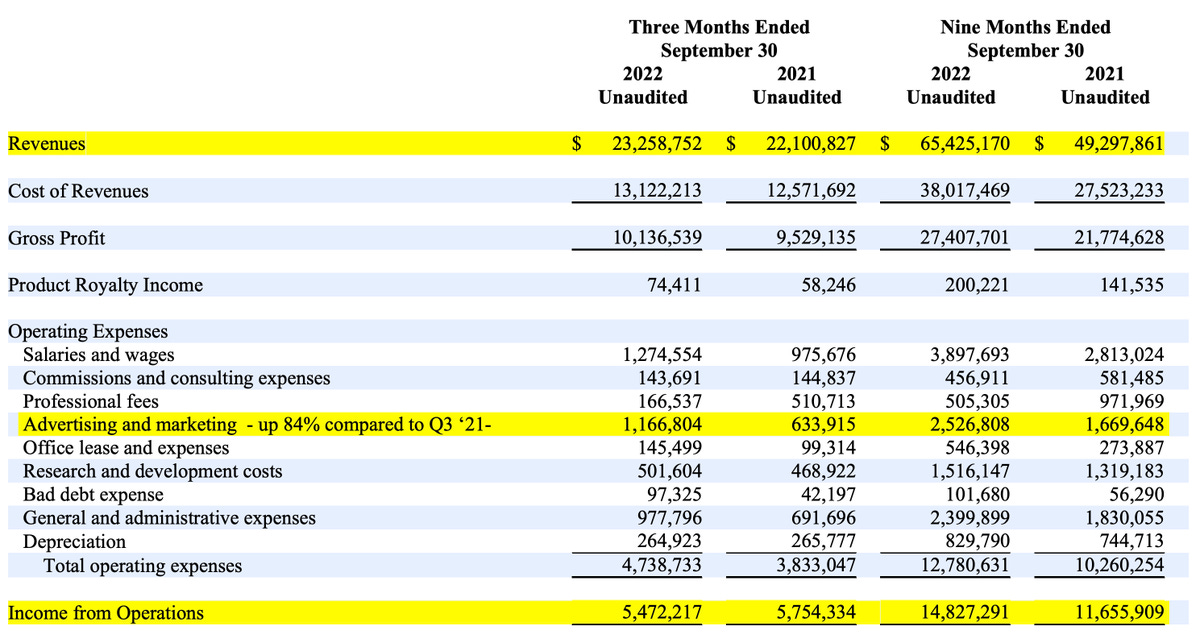

Firstly, we have to remember that the comp. Numbers are very tough, so anything better than negative revenue growth was already a success (compare $MIPS numbers). Despite moderate growth in revenue, they increased their Marketing spend by 84%...

While I gave them credits in the last quarter for their low Marketing spend compared to revenue, I think increasing their Marketing spend is actually a good thing since it should increase brand awareness. Brand awareness is now the most important aspect of the investment case.

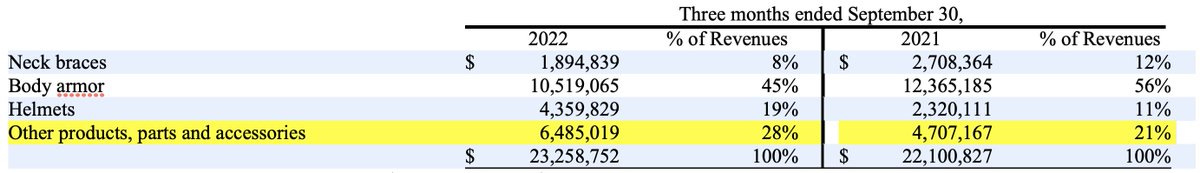

While the investment thesis started as a company that changed from one product to a head-to-toe brand in MTB and MX and expanded their operating margins, now we are betting on the transition from a brand known for safety to a cool brand. And the best number to measure this is to look at their product mix. Neck braces and body armour represent the safety (old) part. Especially other products, parts and accessories, which also includes jerseys, t-shirts etc., are representative for their brand awareness. This segment is up 38% YoY.

Helmets are even up 88%. So all in all, I would say, despite a lower demand in the industry compared to peak-covid and a difficult environment, $LEAT once again showed that it is more than "just a covid winner"

Disc. Long $LEAT, no Investment advice.

Centrotec:

Centrotec sold its main division for 700 million in cash + they receive 300 million worth of stocks of Ariston. The current market cap is 734m, so you get the remaining operating for free and the company basically trades at a negative EV currently. They are also buying back their stock, so I remain long this one until the valuation gap closes further.

Parks! America:

They just announced Lisa Brady as new CEO. She has been on the board till 2021 and has a lot of experience in the entertainment industry. While she earns more than the previous CEO “the Company shall pay Brady a salary at the rate of $175,000.00” - I like the following incentive structure:

“Brady shall receive an annual amount equal to 12.5% of her annual base salary (ie: in the first year of this Agreement 12.5% X $175,000 = $21,875) if the Company achieves the consolidated EBITDA goal that is adopted by the Board in the preceding year and announced in the Company’s annual report on Form 10-K, as filed with the Securities and Exchange Commission.”

”Brady also shall receive an annual amount equal to 12.5% of her annual base salary at the discretion of the Board based upon her meeting objectives established by the Board with respect to achievement of key performance indicators (KPIs) such as increases in the Company’s value as reflected in its stock price. This section of the award incentive plan is separate and will be independently measured.”

Obviously it would be better if she would just own stock instead of this incentive structure, but since the free float is only 29% already and probably none of the insider wanted to sell, it was probably the only solution to tie her income to the business performance.

Thoughts on FY 2022

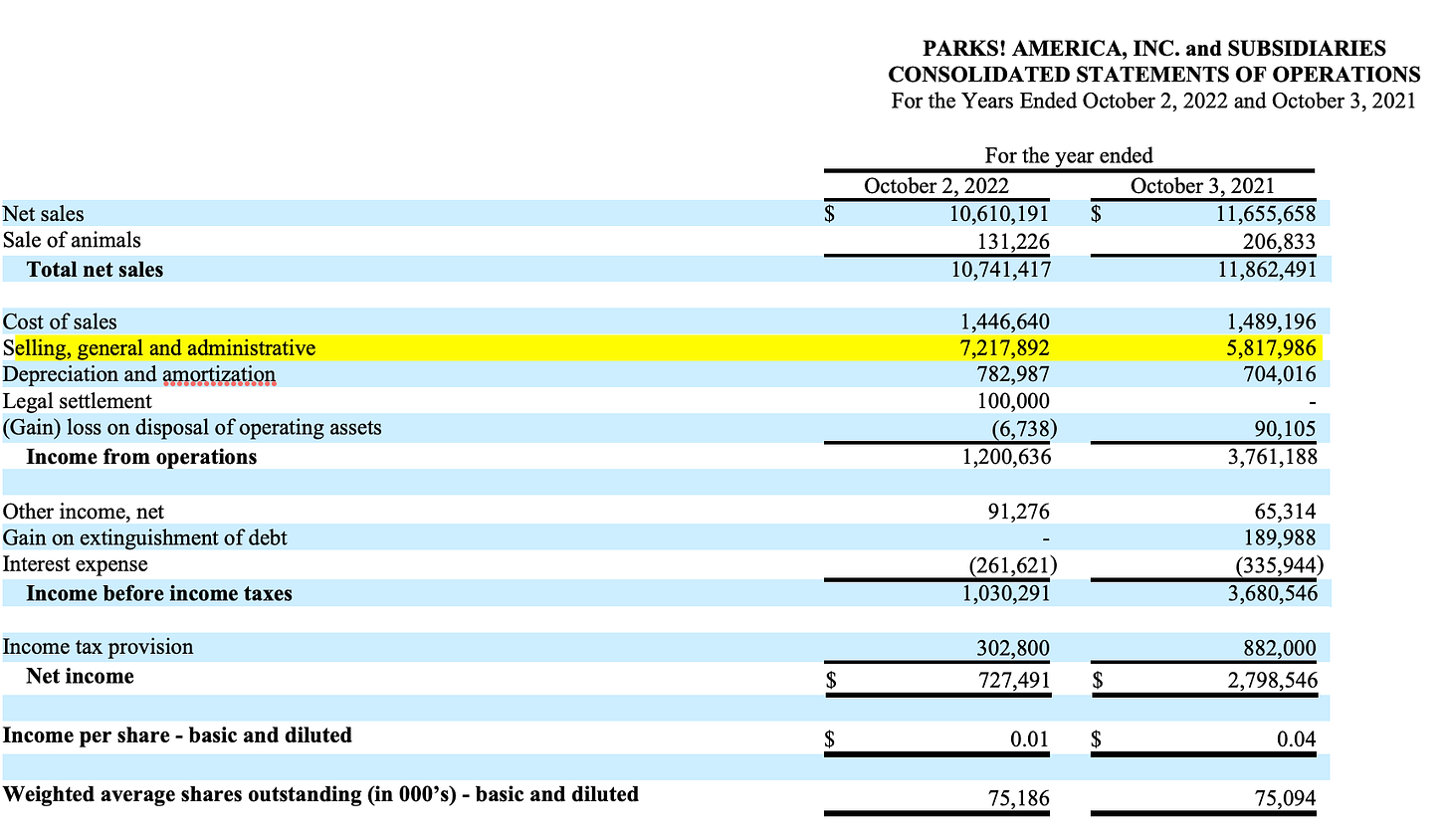

It was known beforehand, that in 2022 they want to invest more into improving the parks and be willing to sacrifice the short term profitability for that.

In theory, this seems like a good idea: use the elevated cashflows from the two covid years and invest them into the business to build long term growth.

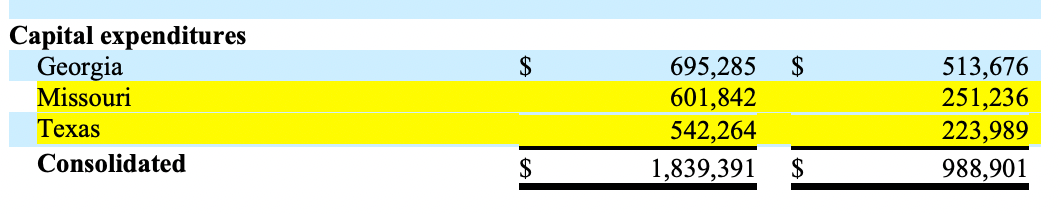

“Our 2023 fiscal year capital investment plan remains elevated versus historical levels, however, is lower than the $1.84 million record level of capital spending during our 2022 fiscal year. Our 2023 capital plan targets substantial guest-facing enhancements at all three of our parks, delivering a marketable attraction at each property and setting the stage for longer-term master planning and optimization at every park. Our plan to open a significant new giraffe exhibit at our Georgia Park during our 2022 fiscal year experienced delays due to a highly inflationary period for building materials and a challenging labor market.” - 10k Annual Report 2022

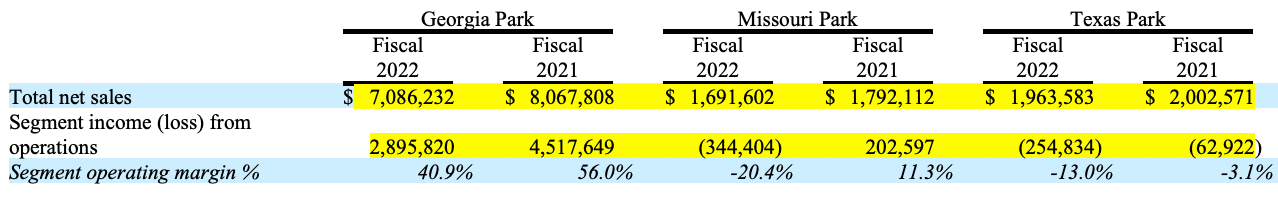

The main question for me remains, whether they are able to turn the Missouri Park around and generate profits with both, the Texas Park and the Missouri Park.

Despite increased Capex in those two Parks, the numbers in 2022, didn’t show returns on the increased Capex.

If we look back, at my thesis, when I bought the stock, it revolved around the fact, that I believe they are able to make at least the Texas park profitable and maintain the Missouri at slight profits.

I am willing to wait, how 2023 will play out for the three Parks and whether they are able to turn the investments into Cashflow. The new, young CEO might be the right change for that. We will see. I remain long.

Peak earnings?

Overall Parks! America, PharChem and Leatt have been beneficiary of COVID, the question is whether these business can grow in a post Covid environment. Since the market is skeptic about that, these stocks remain to trade far below their Covid highs.

LS Invest, however, didn’t profit from Covid and should bounce back with to pre Covid levels in 2022.

If you are interested in my write-up about LS Invest ($IFA.HM), you can read it here.

Disclaimer: Do not interpret anything above as financial advice. I do hold a position in the discussed companies and therefore may be biased. The article was written for entertainment & educational purposes only.

Thanks on sharing your thoughts on parks and leatt, I really liked them