Portfolio Update Q1 2023

Reflection and updates on the companies I own

Thoughts about Portfolio construction

Advice without context is very difficult. That is the problem with reading only books about a certain topic, the advice in the book might be correct in general but not correct for your specific situation. A good example for that is the topic of portfolio construction, whether one should diversify or not, whether one should take a coffee-can-approach or aim for a higher portfolio turnover. Every strategy has its pros and cons, but ultimately it comes down to you specifically, your personality and your overall financial situation. At the end, those two, your personality and your overall financial situation play a big role, probably the biggest in building your wealth. In the last two portfolio updates, I already stretched the point, that I don’t view my portfolio as a portfolio, and this time I want to show exactly why I think the whole thought of having a portfolio applies only if your portfolio is way bigger than your projected income in the next 10 years. As long as this is not the case, meaning as long as you are in your 20 or 30’s (and still have a relatively high income compared to your net worth), you should not think that you have a portfolio. Here is an illustration why, as of March 2023, my portfolio looked like this

14,5% of it lays in cash, which I have already set aside to invest in the next weeks or months. While my biggest position is around 21%. However, If I take “projected” cash for 2023. Meaning cash, that I will be very likely to be able to invest this year, the portfolio would look like this:

“Projected cash for 2023” is around 31% of the portfolio. Obviously it is not 100% sure, I will be able to invest this sum, but it is very likely. Also, my current position will hopefully grow in value in this year. But the point I am trying to make is, it is useless to think about my current portfolio as a portfolio and I should make bigger bets, because they get “offset” by increasing cash. A 5% position today probably barely matters in 12 months from now. Enough about portfolio construction, let’s take a look at what has happened so far in 2023.

New Buys:

As you can see, I continue my trend of only making money in German stocks.

The only new company I bought in Q1 2023 was SHW AG. I already wrote about it here in detail. In short, the company trades currently at x0,66 BV, the major shareholder owns more than 90% and could therefore do a squeeze-out. In a squeeze-out, I believe the company should be worth at least book value (50% upside).

Some comments on recent news from my holdings:

Centrotec:

The most interesting development came from Centrotec. First, they published their annual report as a PDF on their website, which was odd because last year it was only available as a physical copy for shareholders, second the results have been weaker than anybody expected. But -as usual-the CEO and major shareholder had a clear plan, after those on first sight disappointing results (weak EPS and the sale of their Climate Segment has not been reported on their balance sheet), the share price went down to 49€. The next morning, a share repurchase program for 57,20€ per share was announced. Given these developments, a squeeze-out this year seems to be possible, if Guide Krass is able to get to at least 90% of ownership. Luckily, I have increased my position in January, and it still remains the company with the best risk/rewards in my opinion.

LS Invest:

LS Invest remains some kind of black box. The local press reported that they have sold their hotels in Germany and probably in Austria too. Probably they will use this cash to invest further in Spain and the Dominican Republic. It remains unclear to me whether this increased the likelihood of a squeeze-out, or decreased it. Nonetheless, the book value should now be significantly higher than before.

SHW:

Reported earnings for FY 2022 were inline with what I’ve predicted. The bad is, they increased their debt further and EBITDA was positively impacted by one time effects.

They announced that they opened a new facility in China to produce brake discs.

The outlook was very positive, so I remain confident in my position and still think the stock is undervalued. A question, however, is whether the current mess with LEONI affects a potential squeeze-out (more info here).

Rubbing my nose in my own mistakes

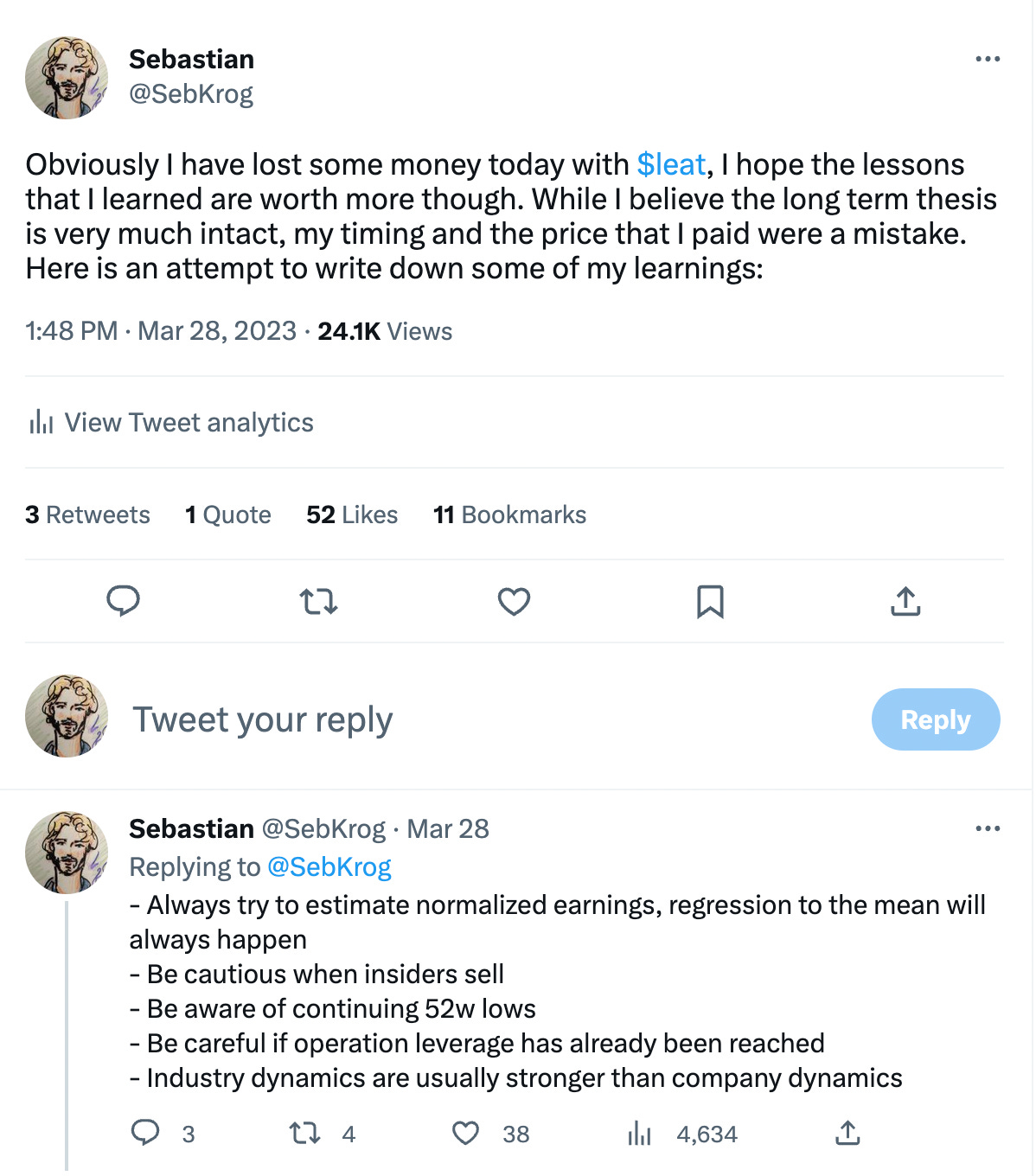

While the above-mentioned stocks continue as expected, Leatt‘s results have been a big disappointment and the market reacted accordingly by plumping the stock 35% down in a single day. To be honest, this obviously hurt me financially and emotionally. I already tweeted some of my learnings from this experience.

Now I want to provide some thoughts on these results and the company in general.

The Good:

Leatt will enter new markets starting from the second half of 2022:

“The second half of the year will also see Leatt's expansion into new areas in the global MTB and MOTO marketplace with well differentiated product categories that showcase innovation and our dedication to consumer adventure. We believe that this continued expansion will appeal to very large total addressable markets”

- Leatt Press release

On the earnings call, Sean MacDonald gave more insights into this:

“These are much larger markets that we are looking at entering. So we've had a strategy of -- on the MTB side specifically of moving down the mountain. So at the top of the mountain, you kind of the 1%, which is the gravity rider and then you move down into Enduro and all mountain and trail and then at the bottom, you get into the Endurance Marathon cross-country area, which is really where the bulk of riders are (…) I think presents a great opportunity for growth in the future.”

- Leatt Earnings Call

The Bad:

Q4 2022 numbers:

Revenue: $10,9m (-53% YoY)

Gross Margin: 34,1% (-61% YoY)

EBIT: $-1,8m (compared to $4,9m in Q4 2021 and $2,31m in Q4 2020)

Weaker demand led to an oversupply of inventory for their customers, which needs to be digested first. Especially bad is that even newer categories such as helmets (-51%) or others (-51%) have been down significantly.

The ugly:

While some of these numbers have been effected by one time expenses, such as inventory write down and higher stock based compensation, the general lower demand will probably continue until the end of 2023. Especially comparing to tough comps for Leatt, I don’t expect a positive development (and reaction from the market) until Q4 2023.

All in All, did I do a mistake by buying Leatt at this price and timing? Yes.

Did I underestimate industry dynamics for the sector? Yes.

But did this quarter kill my thesis? No.

In 2021, I wrote “Leatt is an emerging brand, entering new markets in the MTB industry and it‘s the best days are yet to come.” This is certainly still the case.

Therefore, I didn‘t sell any shares, but bought some after the downturn.

Some cool stuff I’ve found this quarter:

Book recommendations:

I am currently listening to “When genius failed”. An interesting story about a hedge fund that had one of the most intelligent people and a mathematical certainty of success, and yet still failed.

Tool recommendation:

Tiny Stock Ninja shared https://journalytic.com - a journal about keeping track of your investing thoughts about companies and the market in general. I absolutely love it and I think my decision-making process will improve from it.

Just after Q1, I bought my second stock this year. A deep-value German microcap, trading at 2,5x normalized EV/EBITDA. Make sure to subscribe now, so you won’t miss this write-up - and by doing that, you will also help me to reach 1000 subscribers.

Disclaimer: Do not interpret anything above as financial advice. I do hold a position in the discussed companies and therefore may be biased. The article was written for entertainment & educational purposes only.