Q3 2025 Portfolio Update: Reflections on -7.3% YTD

Still not a good year

Disclaimer: This is not investment advice and meant for entertainment purposes only, I hold a position in the discussed companies and therefore may be biased in my opinion. Please be aware that this is an illiquid Microcap, please only buy and sell with a limit-order. I also may trade around the mentioned positions.

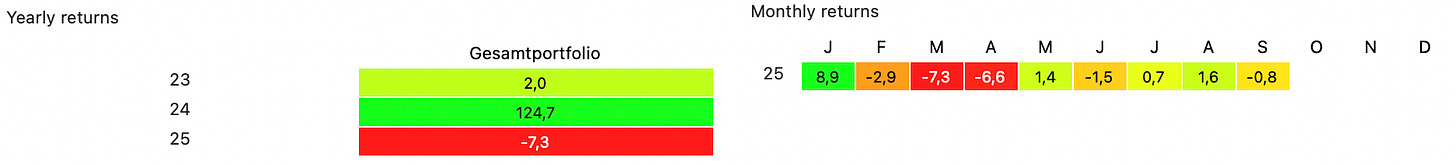

Performance-wise, this year has not been good. I am still down 7.3% year-to-date. Grant me one excuse: I lost roughly 10% on USD depreciation compared to EUR. The dollar is having its weakest year in over 50 years. Compared to the S&P 500 measured in euros, which is basically flat YTD, I lag a lot less than I do compared to it measured in dollars. Since I measure my performance in euros but mainly invest in the U.S. and Canada, it’s important to keep this in mind.

Okay, that’s it with the excuses. The rest is self-inflicted. Looking back on this year, two mistakes stand out to me. I hope to learn from them in the future.

Mistakes

The first mistake is being impatient with a 10% cash position. After a tremendous 2024, I was full of confidence and motivated to find the next great stock. With a relatively large cash position, I felt pressured to invest, so I lowered my hurdle rate and increased my risk tolerance, which I shouldn’t have done. Despite seeing some “red flags,” I bought the stock. The company had substantial debt, and the CEO talked on podcasts about leveraging the stock market for acquisitions.

In other words, he wanted to raise money to make acquisitions. Apart from that, the company was cheap, and the new CEO had also invested his own money to buy shares. Desperate as I was, I overlooked the bad and saw only the opportunity. I bought the illiquid stock without patience and, best of all, dumped it at a loss during the tariff mania in April. Had I held the stock until now, at least I would be break-even, but I never had the conviction to hold it during the downturn.

The second mistake, which proved to be the costliest this year, is also psychological. Never get too attached to a stock. It’s easy to say that in hindsight when your former best idea is down 60% year-to-date (YTD), so we must be aware of this bias when making post-mortem conclusions.

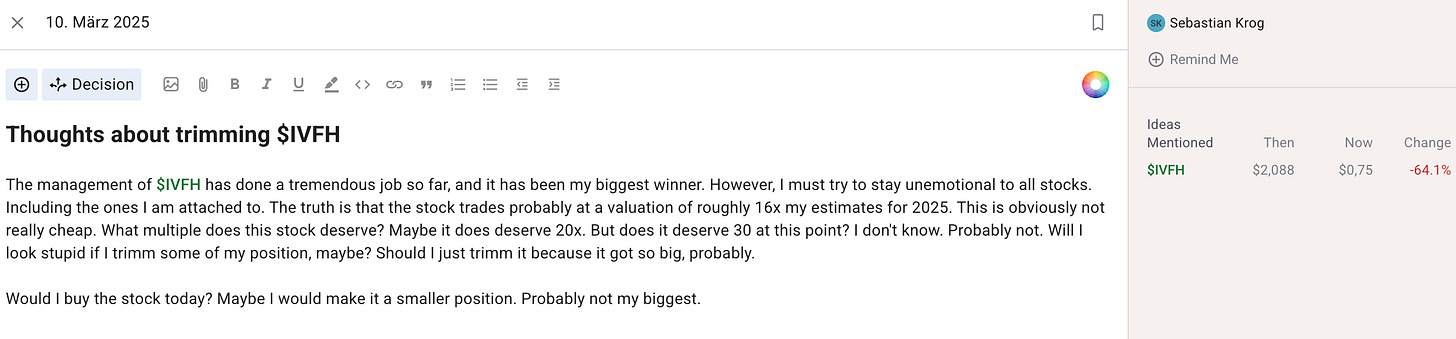

However, I am mad at myself because before any drawdown, I was aware of the business’s overvaluation, even if I spun it in the most bullish case. At best, it was fairly valued. Here is my journal entry from March. The stock has dropped 65% since then.

As a retail investor with a relatively small sum of money, I have one advantage: I can be flexible. I can easily get in and out of positions, so there is no need to “marry” a stock.

The mistake I did with IVFH was not that I bought shares for $0.70 at the end of 2023, it was that I did not even trim a bit when I actually knew it was overvalued at $2. Some context, at this time, the position was roughly 20% of my portfolio, so if I had sold, say half of it, and the stock would be at $3 now, I would still have captured the upside. Yes, maybe I would write then “you should never sell your winners” — but ultimately, rule number one is not to lose money.

The next issue was that I did not even follow the rules, I have outlined in my journal, where I captured I would sell 1/4 if the Q1 results would not reach a certain threshold. However, when the results came in below my threshold, I only sold 16%.

I don’t think the company is a bad bet at $0.70, so I’m happy to hold onto it. It’s not my best idea, but I think there’s a decent chance they’ll turn things around, which isn’t reflected in the current price.

So why didn’t I trim it when I knew I should have? I even had a sell order at around $2, but I canceled it.

Reason #1: My own tendency. I don’t like selling shares. Every investor has different tendencies. Some sell too early because they are always skeptical and want to take profits while they can. I think Christian Schmidt does a very good job at this. It may sound strange, but he may be the best person I know when it comes to the timing of selling shares. We usually judge investors based only on their ability to buy, but selling is equally important. My tendency isn’t necessarily bad, but you have to adapt your stock picking accordingly. Stocks which have a long runway for growth. Unfortunately, this only applies to a very few microcaps. Therefore, selling is a very important part of investing.

Reason #2: Never get too attached to a stock. Again, this is probably just my personal bias. If you imagine a scale where a quant would be the least emotionally invested, then I would be on the opposite end of that scale. I enjoy talking to management teams, interviewing them, and visiting companies when I am the states. If I lived in the US, I would do it regularly. I also enjoy discussing stocks publicly. As you probably know, my pitch of IVFH was well received back then, and it was, in a certain way, the foundation for everything that happened afterward. Many readers found me because of that pitch, and it also connected me with some very smart investors who I am grateful to call friends now. In any case, some people may have seen me as the “IVFH guy,” so accepting that your thesis is no longer attractive is much more difficult when you’re so emotionally invested. You can quickly end up in a state of illusion rather than facts. For this reason, I am happy to discuss stocks only with paid subscribers. At least this way, I am less public about one stock.

Overall, this year was not what I had hoped for. However, it was probably the year I needed. I am now in a better position as a person, as an investor, and with my portfolio than I was at the start of the year—at least, that’s what I like to think.