Saga Furs: A net-net and soon monopolistic Business

Trading at 0.75x NCAV with a clear catalyst in 2025.

Disclaimer: This is not investment advice and meant for entertainment purposes only, I hold a position in the discussed company and therefore may be biased in my opinion. Please be aware that this is an illiquid microcap, please only buy and sell with a limit-order.

Overview:

Saga Furs is an auction house that sells furs. While fur may not be in vogue and its price has been on the decline in recent years, an auction house itself is a very asset-light business model, benefiting from network effects and potential operating leverage. But more importantly, with the largest auction house set to liquidate in 2025, Saga Furs offers us the opportunity to buy a business at 0.75x NCAV and with a clear catalyst that should boost EPS. Saga Furs makes money by charging commission to farmers and buyers at their auctions. The buyer's commission is always around 8.5%. The farmer's commission decreases as the volume increases. Another source of income for Saga Furs is the interest income they receive from buyers who choose to pay for the fur after 30 days have passed. Think of it as a BNPL type thing. There are usually 3-4 auctions a year. 80% of the market for fur auctions is split between Saga Furs and Kopenhagen Fur.

Past Earnings

As you can see, Saga Furs' earnings have been negative most of the time in the past. Low fur prices combined with a largely fixed cost base are the main reasons for this. The potential operating leverage that can be unlocked with higher sales hurts at lower sales (below €45 million). Anything above that goes almost 100% to the bottom line. But with fur prices so low, it is almost impossible for them to reach <€45m in revenues.

Here you can see the correlation with Saga Furs' profit. For 2023, the average price of mink remains low due to overstocking after covid. Predicting future commodity prices is difficult. However, it is not profitable for farmers to produce furs at these levels. As a result, production fell to an all-time low of less than 8 million in the western world in 2023. To put this in context, more than 20 million pelts were sold in 2023. Prices should theoretically rise in 2024.

Catalyst:

Kopenhagen Fur, the self-proclaimed market leader, announced in 2020 that they would liquidate their business in the following years. So far they are still active, but management confirmed to me that they will liquidate their business in 2025. While they claimed to have a 60% market share in 2019 (25 million pelts sold), my research shows that they only offered 12.1 million pelts in 2023. Saga Furs, on the other hand, offered 15.5 million pelts in 2023, the most they have ever offered in the recent past. Kopenhagen Fur and Saga Furs are the biggest players in the industry, with only a few smaller companies in between. The question is, how much of Kopenhagen Fur's market share can Saga Fur take?

Obviously I have no idea, how much market share they will gain and how mink prices will devolve, but it is reasonable to assume that Saga Furs should be able to take most of the market share from Kopenhagen Furs, since it has been the second-largest player in the industry and is apparently already taking market share in 2023.

2023 Auctions

There were three auctions again this year, and although Saga Furs sold the most furs in the last 10 years, the price remained very low. The result is likely to be a lower income than in the past, with lower auction sales but higher prices. Assuming an overall take rate of 13%, I arrive at the following revenues:

Management has said it expects a 5-10% margin for 2023. If we take the lower end, we would have €2.25m in net income or €0.63 in EPS. This puts the stock at 13.5x earnings. Historically, they have paid out a significant portion of earnings in dividends. I wouldn't be surprised to see €0.5 per share (5.8% yield) in dividends for 2023.

Valuation:

Asset Valuation

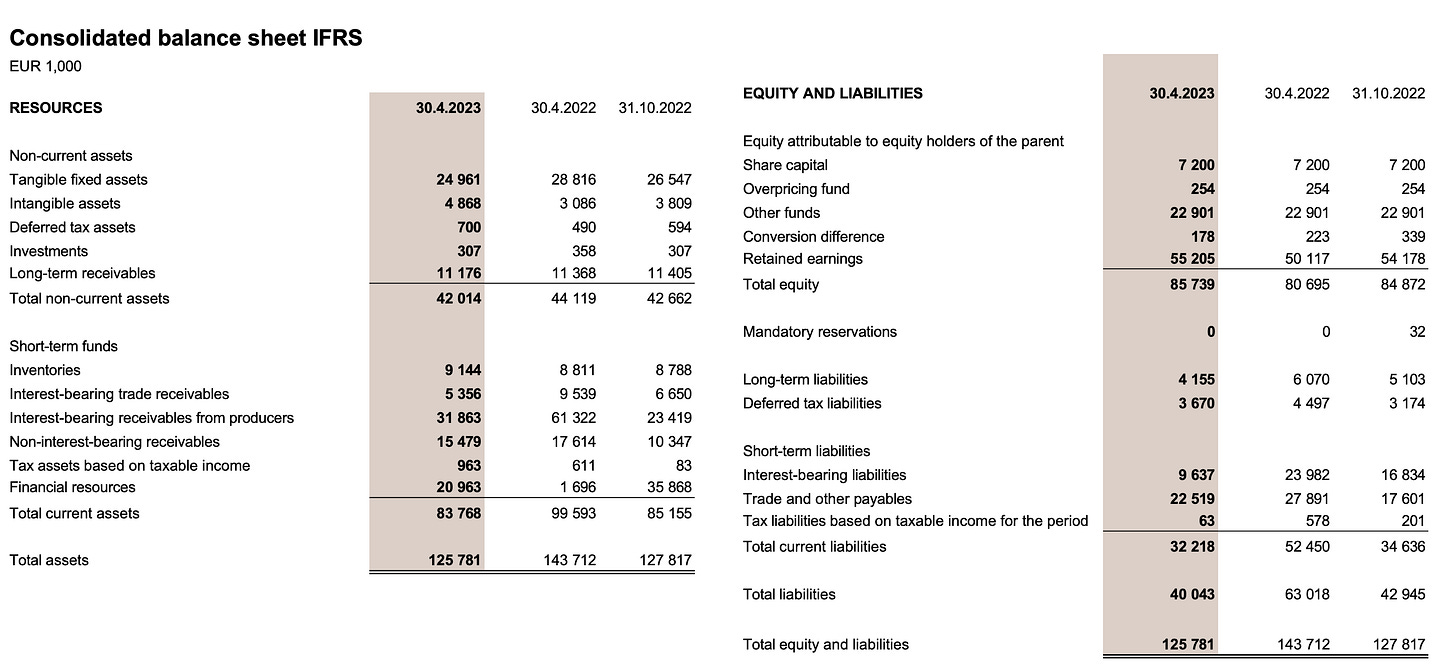

Saga Furs has a clean balance sheet, with plenty of cash and very little debt. The NCAV is €43m, compared to a current market cap of €33m (x0.75NCAV).

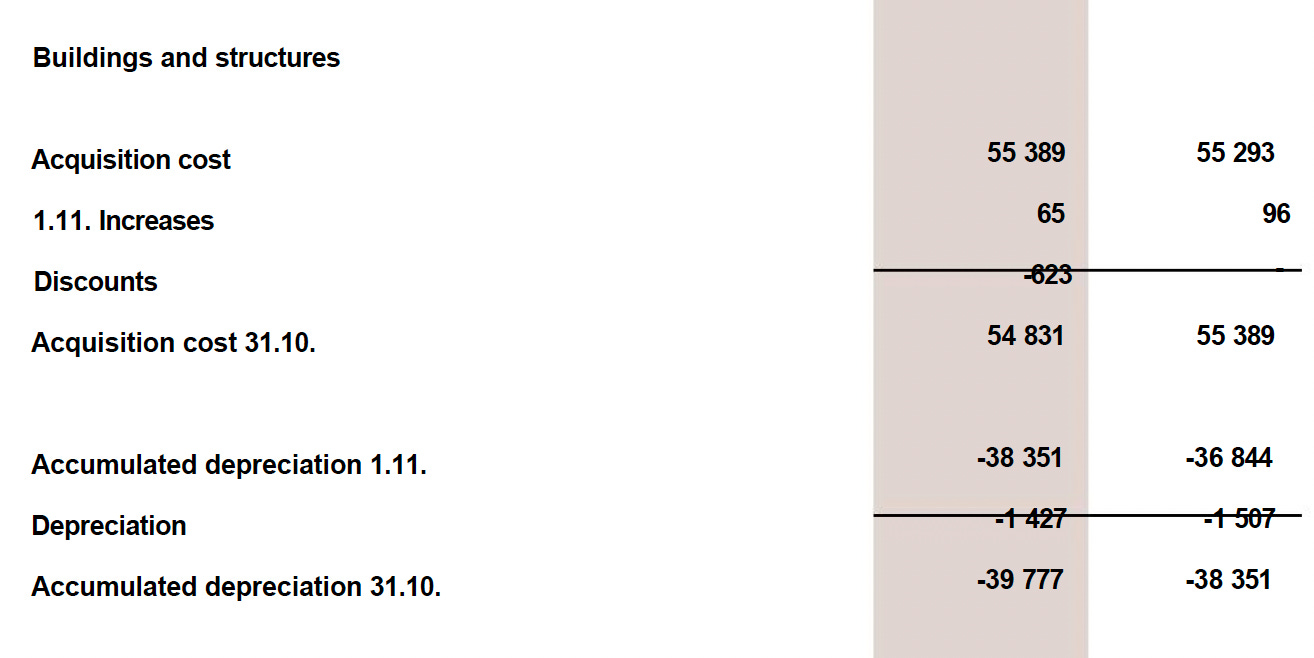

In addition, they probably also have around €60m in real estate.

In 2022 they did the sale-lease-back transaction in which they sold the real estate for 2.7m. The PP&E amount decreased by 0.6m.

Earnings valuation:

As mentioned above, it is difficult to estimate future earnings as they depend on the price of mink, which I obviously cannot predict. However, depending on how much market share they are able to gain from Copenhagen Furs, my estimates range from €2m to €10m in net profit. Management seems confident that they will have a 90% market share after the liquidation of Kopehagen Furs. Whether it is 90% or 70%, the probability that they will have a monopolistic position is quite high. In theory this should also give them pricing power, perhaps they can increase their commission rates.

Conclusion:

This is a case of high uncertainty but very low risk. I cannot give a price target for the stock, nor can I predict future earnings with any accuracy. However, I do know that the liquidation of the largest competitor should have a positive impact on the future of Saga Furs, and with production levels of furs so low, prices should theoretically rise. It would not be crazy to make an argument that the next few years can be quite good for Saga Furs and that they can make a net profit of more than €10 million. I am not sure about that, but I do know that I am buying a company well below liquidation value, with diminishing competition and an asset-light business model. I think the odds should be in my favour to make money.

Disclaimer: I bought the stock at an average price of 8,50€ per share and may be biased in my opinion. This is not investment advice and meant for entertainment purposes only

Recently a public discussion began (again) in Finland to ban the fur animal farming due to the bird flu that the animals were infected with. I don't know how large percentage of furs Saga sources from its homemarket, but I would consider this as a major political risk.

Here's a list of news that are covering the topic in Finnish. They might be behind a paywall.

https://www.hs.fi/haku/?query=lintuinfluenssa&category=kaikki&period=whenever&order=new

What are the reasons Kopenhagen Fur closing shop? Guessing they aren't making money and last couple years have been tough and industry outlook doesn't look encouraging. But would love to hear what you learned on this point. Thanks for the idea!