SHW AG: The market has just forgotten about this stock

Special Situation: ∼50% upside in a potential Squeeze-Out

This is not investment advise and meant for entertainment purposes only, I hold a position in the discussed company and therefore may be biased in my opinion.

Edit: This is a closed idea, I no longer own shares in SHW.

SWH AG is a German automotive supplier company, with a market cap of €84million.

They are mainly active in two different segments: the production and sale of hydraulic pumps, powder metallurgy parts, and brake discs.

While Car manufacturers have been seeing great years since covid, the auto supply industry suffered from covid, chip shortages, inflation and partially from the shift to electric vehicles. SWH couldn’t escape those obstacles and are still trying to get back to pre covid levels, facing these headwinds and being in a fairly capital intensive industry, we are not looking at a great business here.

Even though, I do think their brake disk segment is a solid operation.

This thesis evolves purely around a potential squeeze-out, which should result in a ≈50% upside from the current share price.

Why does this opportunity exist?

In 2017 SWH announced for the first time, that Pierer Industy AG is a major shareholder from now own. Back then, Pierer Industry AG acquired about 50% of all shares outstanding. In the next three years, they followed the classic preparations for a potential squeeze out. They delisted the stock in 2021 to the over the counter exchange in Hamburg (at first I wasn’t even sure, that they are still public), basically cut all shareholder communications, only report once a year, and increased their ownership to 92% (89% through the Pankl AG, 3% through the Pierer Industry AG).

A quick background on Pierer Indsutry AG. As you can see, this is a huge company that is constantly acquiring other companies. We may see what the playbook for SWH looks like, if we look at what happened with Pankl.

In this case, they owned 98% of the company, delisted the company and eventually did a squeeze out. At a later point, I will provide a detailed overview about the price that minority shareholders received in this squeeze out.

Back to SWH, apart from the fact that we are talking about a €84 million market cap stock, with a free float of less than €7 million, that trades only on the Hamburg Over the counter Stock exchange, with little to no public information, the years since covid haven’t been that great operational either. Resulting in the fact, that this company trades almost at an all-time low (The all-time low was in October 2022).

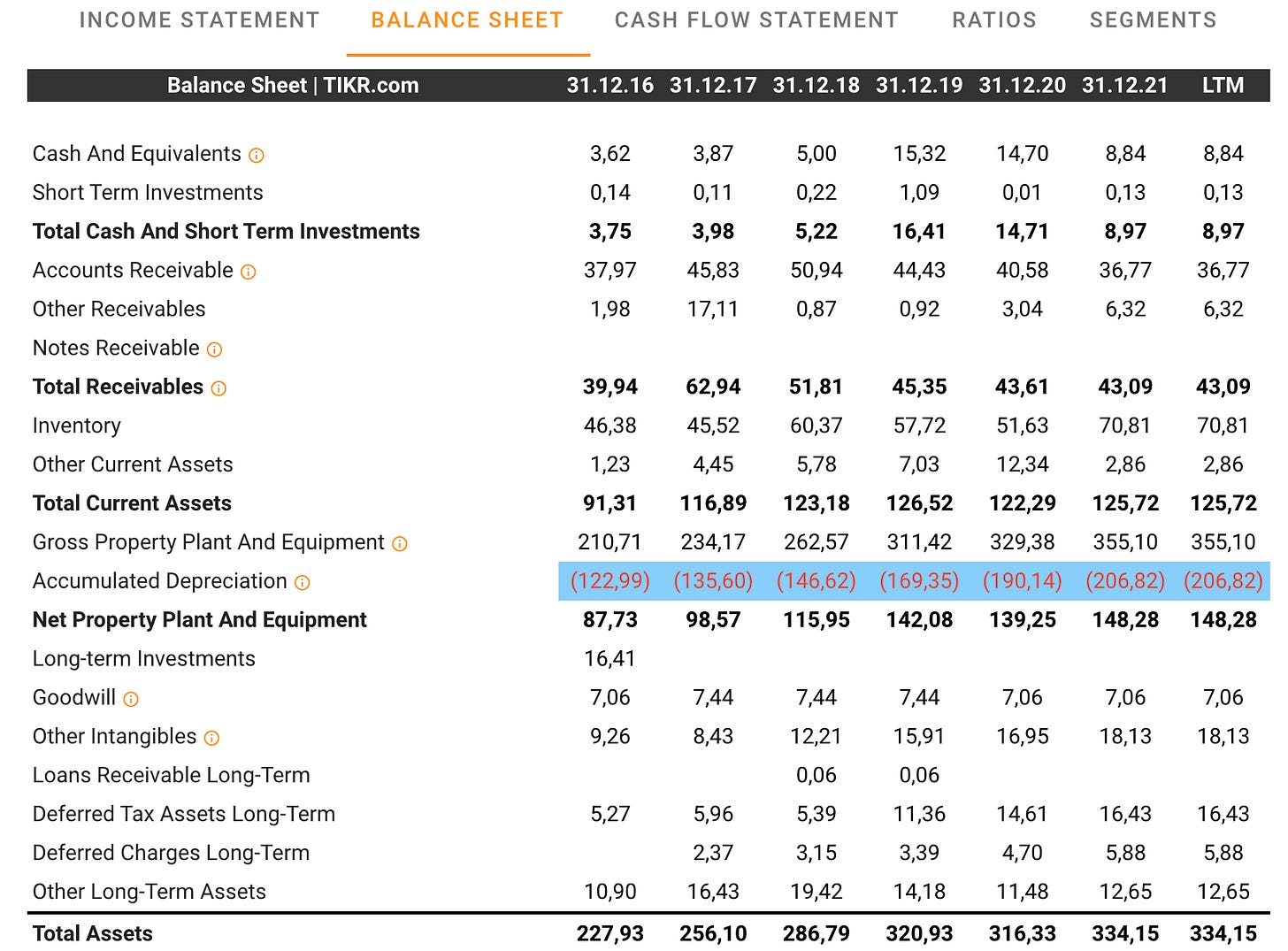

And if we look at the numbers of the last years, they don’t that appealing, either. Revenue increased by 5,5% from 2016 to 2021. Gross Profit increased by around 8%, EBITDA and book value stayed basically flat in these years.

Why I believe the company is worth more

The company doesn’t publish quarterly or semi-annual results, but Pierer Industry does, and therefore we can take a look what 2022 will probably look like.

“Sales in the Brake Discs business unit also developed well, increasing significantly by 24% to €79 million. (…) At €152 million, sales in the Pumps and Engine Components business were only slightly below the previous year (-8%).”

- Half year Report from Pierer Indusrty (available here, in German)

Basically, the development from the last years seems to be continued.

The brake disc segments posting decent number, with growth rates of around 24%. Also, if you look at BREMBO, a premium brand of brake disks, you can see that the brake disc industry seem to be doing very well. However, the Pump segment is still struggling, with a slight decline in revenue for the first half of 2022.

Guidance from SWH management for 2022 was an increase in revenue for the Pump segment, so maybe they can recover in the second half of 2022.

Overall, I calculate, for 2022 an EBITDA of almost €40m.

Valuation:

Book value has been more or less flat in the last years (€124-127m), EBITDA range is around €30-40m. So at the current share price of 13€, we are looking at a €84m Market Cap, hence: 2 -2,8x EBITDA and 0,7x Book value.

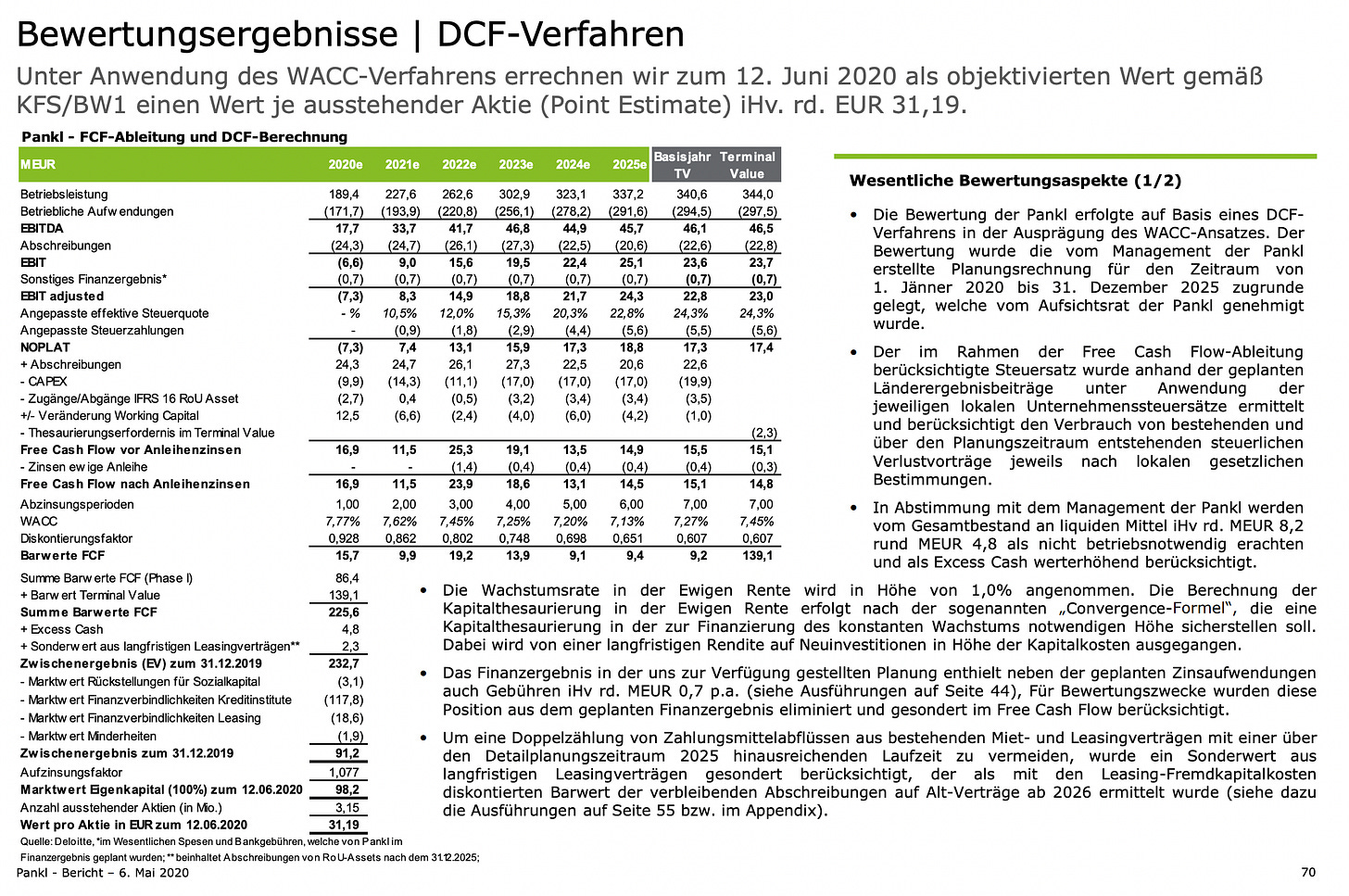

At this point, it gets interesting, we can take a look at PANKL AG, to see what this business was valued in the squeeze out. Here are the numbers from the Audit, you can find the full audit here (Sorry, again only in German):

Pankl may not be a perfect comparison since the company is more focused on supplying the racing industry rather than normal cars and also growth rates and EBTIDA margin are a little higher than SWH‘s numbers.

From the third party auditor, the company was valued at book value or around 3x EBITDA, leading to 31,19€ per share. But I believe in a “Spruchwertverfahren”, there would be a chance to increase this valuation, since they used a pretty high WACC of 7,7% to calculate the DCF.

Eventually Pierer AG and the minority shareholders agreed on 42,18€ per share, 35% more than the squeeze out estimated. This was also the same price, Pierer offered in a voluntary offer at the delisting.

If we apply these multiples to SHW, we get the following valuation range:

During the delisting, the Pierer Indsutry AG offered €19 per share, as a voluntary offer. In my opinion, the valuation range of 19-20 € per share (or 1x book value), seems to be the base case in a squeeze-out. Especially because all their assets have been depreciated quite a lot on their balance sheet, they own property once worth €77m, which is currently carrying for around €51m on the balance sheet. Even if you adjust the book value of €124m in 2021 for €-7m in Goodwill and €-18m in intangible assets, but add back the €∼25m for the depreciation of their properties, you come to: €124m in adjusted book value, or 19,25€ per share.

Risks:

There are two potential main risk, I see:

a) A squeeze out never happens, and the valuation stays low, may be gets even lower, if the operational results don’t improve.

b) The major shareholder dilutes the minor shareholder, to increase his stake to do a squeeze out.

Overall:

I believe SHW offers a great risk/reward at the current share price of ∼13€.

If the Squeeze-Out will happen in the next 24 months at 1x book value (€19,25 per share), we are looking at an IRR of at least 20%.

Generally, I agree with you, however in this case - I think EV is misleading because they have most of their assets in PP&E - which is certainly worth something in a squeeze-out, but wouldn't be included in their EV.

If you talk EBITDA, you should compare it to EV, not MarketCap.