2023 Review and Outlook for 2024

What has worked in 2023 and an outlook for the blog and my investing

2023 was not a good year for me personally in terms of returns. I made a lot of mistakes in my first 2 years that I am still suffering from. As Jason Hirschmann said in the last episode of the Planet MicroCap Podcast, your return in 2023 is more a consequence of the decisions you made in 2021 and 2022 than the investments you made in 2023. While my portfolio did only +2% in 2023, all the "legacy" investments I initially bought before 2023 did even worse (-14%), while all the new initial investments from 2023 did quite well (+34%). While a one-year period is too short to judge, I feel that I have learned quite a bit as an investor. I have no background in finance or investing. I am 100% self-taught, and it probably took me two years to really understand the relationship between the income statement, balance sheet and cash flow statement. While I am proud of this progress and still have confidence in my ability to outperform the market in the future (at least I will keep trying for the next few years), I also have to admit that I probably suffered from some sunk cost fallacy in my investments that I made in 2021 and 2022. It's not that they're bad, it's just that I wouldn't buy some of them with my current knowledge. So my first lesson is to constantly evaluate my current portfolio. Holding a position is as much a decision as buying or selling.

Was has worked in 2023

Cipher Pharmaceuticals ($CPH.TO) +56%

My biggest winner of the year was Cipher Pharmaceuticals ($CPH.TO). I bought the stock in July for 3.55 CAD. As of this writing, the price is 5.55 CAD. What drove the price was the announcement of a tender offer to use some of their absurdly huge cash pile to buy back shares and surprisingly good results from their legacy drugs. The stock remains cheap at 4x EV/FCF. Looking ahead, we have a second NCIB and potential M&A as the main use of cash. Very likely MOB-15 launch in 2025, but also increased competition from Sun for Epuris in Canada. Overall, I think it would be stupid to sell before the release of MOB-15.

Deufol (DE1.HM) +36% (incl. Dividend)

When I bought Deufol at €1.1 per share, they had just announced the legal settlement, which meant they would receive €11 million over the next 3 years. When I bought the stock, the market cap was €47 million. It was trading below liquidation value (which should be around €85m / €2 per share) and at a P/E of 7. At a current price of around €1.5 and assuming €0.16 per share in earnings, the stock is trading at 8x my conservative earnings for 2023.

Was has not worked

Leatt ($LEAT) - 40%

In hindsight, Leatt was a huge mistake, but it was also my biggest lesson. First, it is funny how two people can have completely different returns investing in the same stock. Even though the company has not changed much. I think this is especially true in microcaps, where illiquidity works in your favor on the way up, but against you on the way down. My mistake was not to buy Leatt in the first place, it was to double down while the numbers continued to be bad. I thought I was smarter than the market. I thought it was just one bad quarter, maybe two. Usually, a bad quarter is followed by at least one other bad quarter. The Leatt case is actually interesting to study because for some it was a 10-bagger, while for others (like me) it was the biggest loss so far.

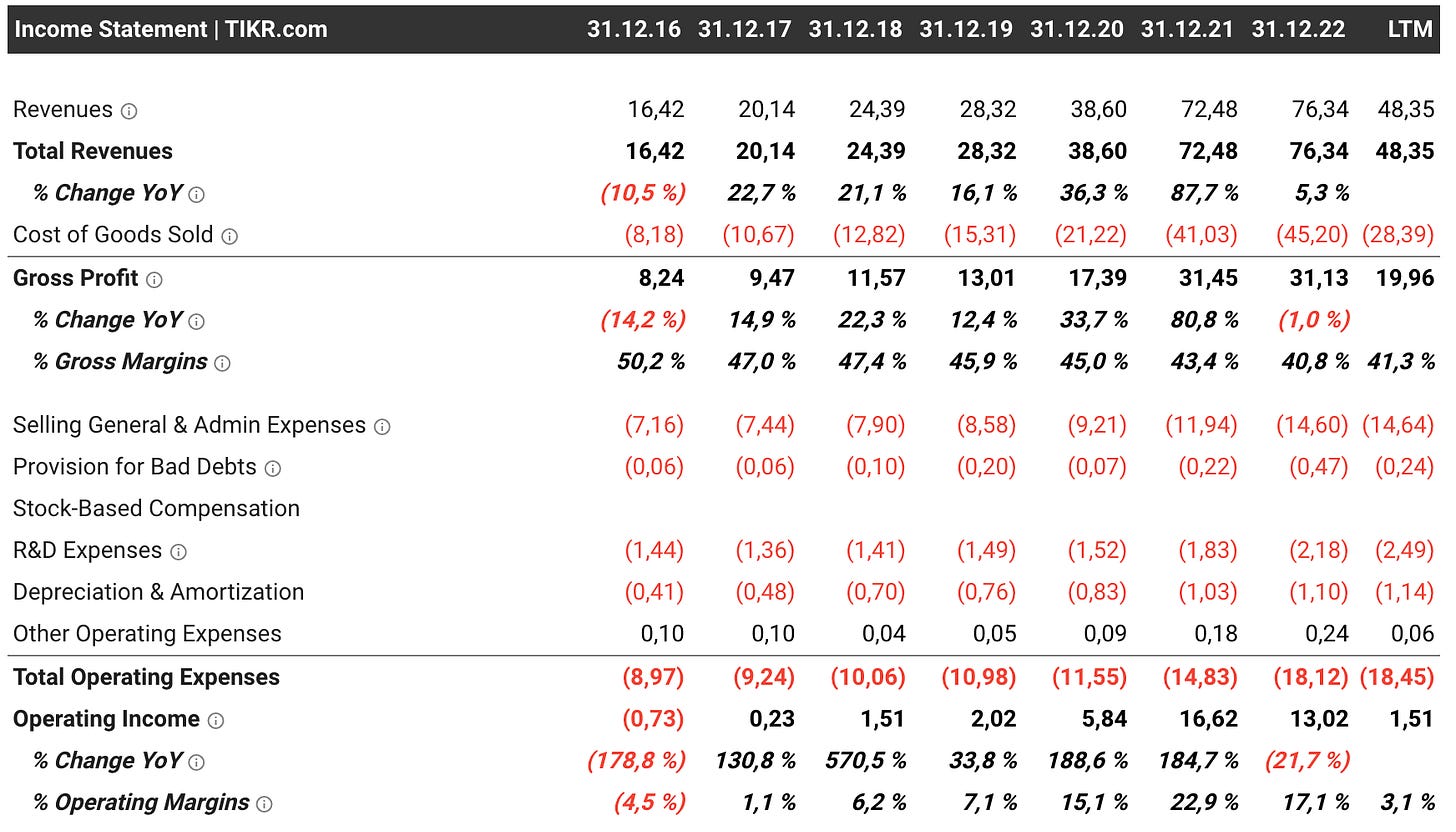

It would have been interesting to see how the story would have played out without Covid. In 2019, you were looking at a company that had grown revenue by 20% over the past few years, but operating income grew by 10 times from 2017 to 2019.

Covid was an unforeseen catalyst, but I am sure that without Covid the company would have continued to grow as it did before. During that time, it traded at an EV/EBIT of 7.

Outlook for 2024

I already posted on X/Twitter that the biggest change in terms of investing will be to focus more on the idea generation process itself. Here is what it will look like for me:

Idea Sourcing: Going through Press releases on Sedar and Otcmarkets looking for either change (new Management) or growth in earnings releases. Furthermore, checking Microcapclub and newest VIC entries.

Initial Screen: All ideas will go through my initial framework, which boils down to: I want to by cheap, asset light businesses run by great management at an inflection point. Cheap is the most important factor, meaning the cheaper a business is, the less important are the other factors.

Qualitative Research: If a stock checks all the points, the real work will start.

Outlook for the Blog

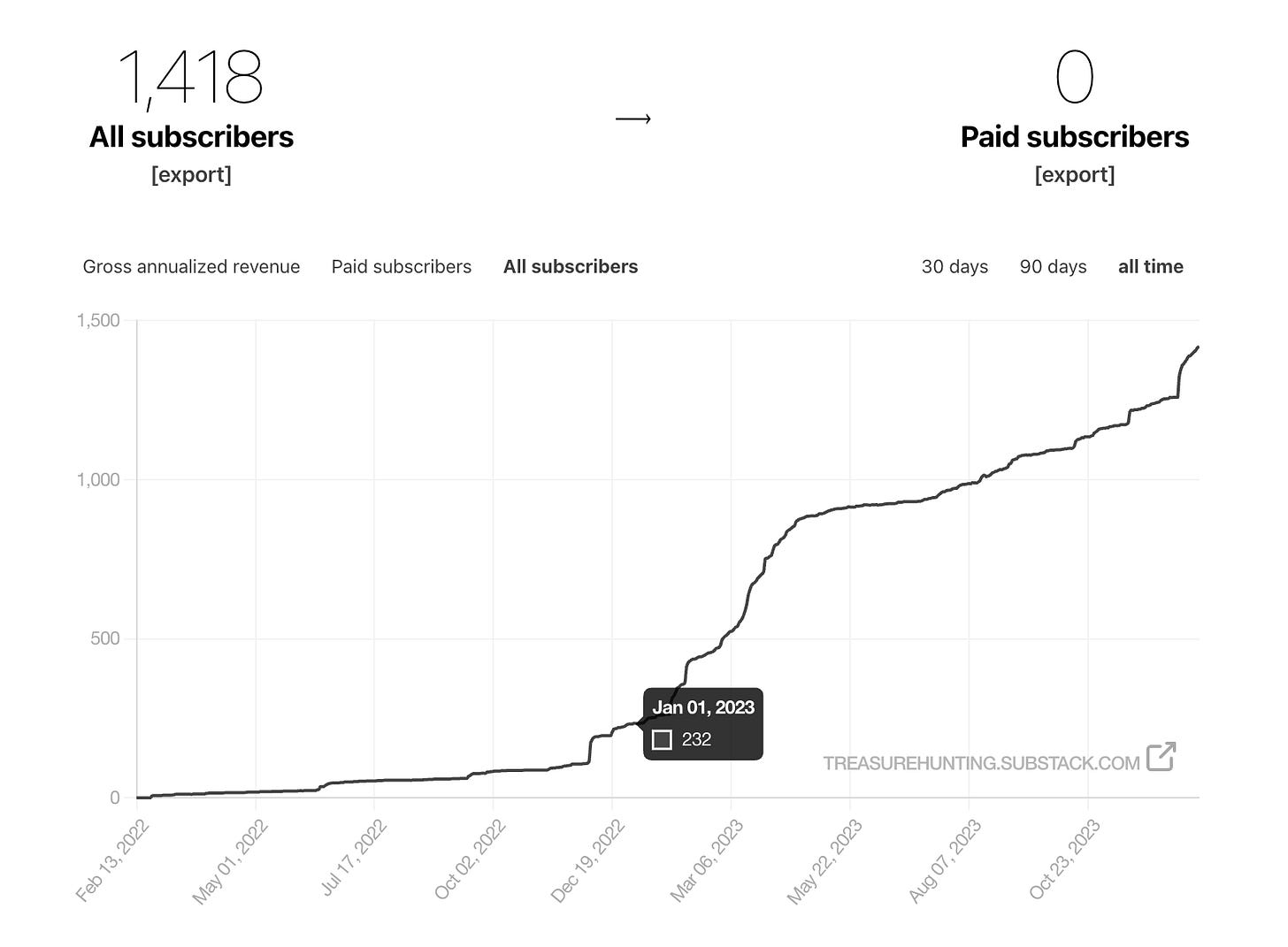

First, thank you, in 2023 this blog grew from 232 subscribers to over 1400.

I really appreciate the outpouring of support from readers, and especially everyone who has shared my work over the past few years. I've only posted 10 articles this year, and yet the growth and feedback has been remarkable. That's why I've decided to introduce new formats to help me post more frequently. More than say 4-6 deep dives a year is simply not possible, and that is already a lot. So my current plan is to post twice a month with a combination of Deep Dives, Short Pitches, Earning Comments and Company Updates. Especially during the earning season there will be a lot of commentary and during the slower season the focus will be on introducing new companies.

Fun fact, after three trading days in 2024, my portfolio is already up more than my entire 2023 performance. Totally irrelevant, but it still feels good. Anyway, here's hoping for a good year. See you in two weeks with a short stock pitch!

Disclaimer: This is not investment advice and meant for entertainment purposes only, I hold a position in the discussed companies and therefore may be biased in my opinion. Please be aware that this is an illiquid microcap, please only buy and sell with a limit-order.

Hey Sebastian, keep it up with the great work! Always looking forward to your posts and articles. :)

Hi! Don't you think that having strict screen criteria such as EV/NOPAT less than 15 or ROCE greater than 15% is too restrictive? I know that the point is to kill ideas quickly, but I think looking at quarterly releases is better. By looking at quarterly releases you can quickly see if there was any great change from one quarter to another.