5 Microcaps in 5 Minutes (#3)

A quick introduction of 5 interesting Microcaps

As discussed in my 2024 Outlook, I am (re)introducing a new format where I share companies that I have come across and found interesting. I'll give a brief overview of each company, but won't go into much detail.

1. Thermal Energy International - $TMG.V

Market Cap: $49.03m CA

Enterprise Value: $49.60m CA

P/E LTM: 35 (about 12x NTM Earnings)

Thermal Energy International is a global provider of industrial energy efficiency solutions. The company is not a manufacturer, but a service provider. Its team helps install turnkey carbon-saving solutions and other products at its customers' sites. It is an asset-light company with no major capital expenditures. Most of their costs are part of their SG&A.

Covid hit them hard because they were not allowed to travel to their customers' sites. After Covid, they are enjoying an all-time high backlog of orders. Most of them from existing customers. Revenues are generated by orders won, so growth can be sloppy. In summary, we have an asset-light company enjoying massive tailwinds in its industry, trading somewhere around 10-12x NTM earnings. If you think these are not peak earnings, but just the starting point of a long-term run that can unlock operating leverage, you should take a closer look.

2. Tandy Leather Factory TLF 0.00%↑

Market Cap: $40m

Enterprise Value: $41m

P/E LTM: 17

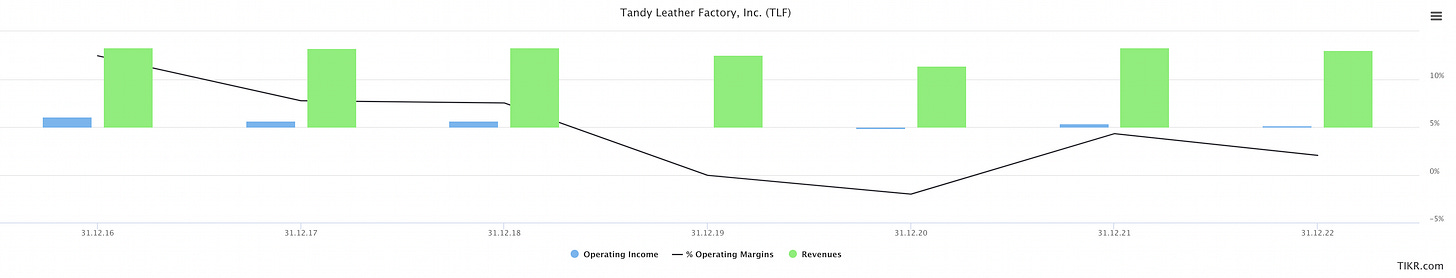

Tandy Leather Factory seems to be one of those eternal value stocks, trading below book value and in bad times below net current asset value. I don't think their business model is attractive (retail) - moreover, EBIT has declined from $10.5 million in 2015 to just $1.9 million in 2022 (about $3 million LTM).

The board is probably one of the best you'll find in a microcap:

Jeff Gramm is a well-known deep value investor and activist, he is also the author of the book "Dear Chairman" - the same goes for Pappas. Still, operationally, the company has not flourished in the past. And even if we assume 2021 earnings of $3.55 million as normalized earnings, we are still looking at 11x earnings. However, in December, the company announced:

“(…) to explore a potential sale of the Company’s headquarters/distribution facility and flagship store in Fort Worth, TX (…)” - Source: Form 8-K1

A quick search led me to a presentation where they said their real estate was worth at least $10 million. So this could be an interesting development.

3. Premier Health of America - $PHA.V

Market Cap: $24m CA

Enterprise Value: $50m CA

P/E LTM: - (Around 8x my estimates for '24)

Premier Health of America is a staffing company focused on the medical sector. They pursue a Roll-Up strategy, buying staffing companies, usually below 4x EBITDA. In 2023 they announced their biggest acquisition so far. Buying Solutions Staffing for CAD 21-27 million (depending on potential bonus payments in the future). Solution Staffing did 6.7m EBITDA in 2022. Add this to the 7.8 Premier Health did in their FY 2023, and we arrive at 14.5m EBITDA for 2024. That puts the stock at about 4.5x EV/EBITDA. However, the recent acquisition was financed with debt, a portion of their debt was financed at around 13% interest! Furthermore, in the Quebec region, the new law called Bill-10 could have a negative impact on their business. On the one hand, it should reduce the gross margin from 26% to 20%, on the other hand, the company expects higher sales to compensate for the lower gross margin.

In any case, management is working to reduce its penetration in the Quebec area (including through the acquisition of Solutions Staffing).

4. The Platform Group - $TPG.DE

Edit (5th of April): 5 Microcaps in 5 Minutes is not a format in which I publish stocks I am bullish on, but rather stocks I found to be interesting. However, I want to disclose that I sold my shares in the Platform Group last year and my opinion has changed on this name. I don’t think the business model nor the management team is great.

Market Cap: €116m

Enterprise Value: €166m

P/E LTM: - (Around 11x my estimates for ‘23)

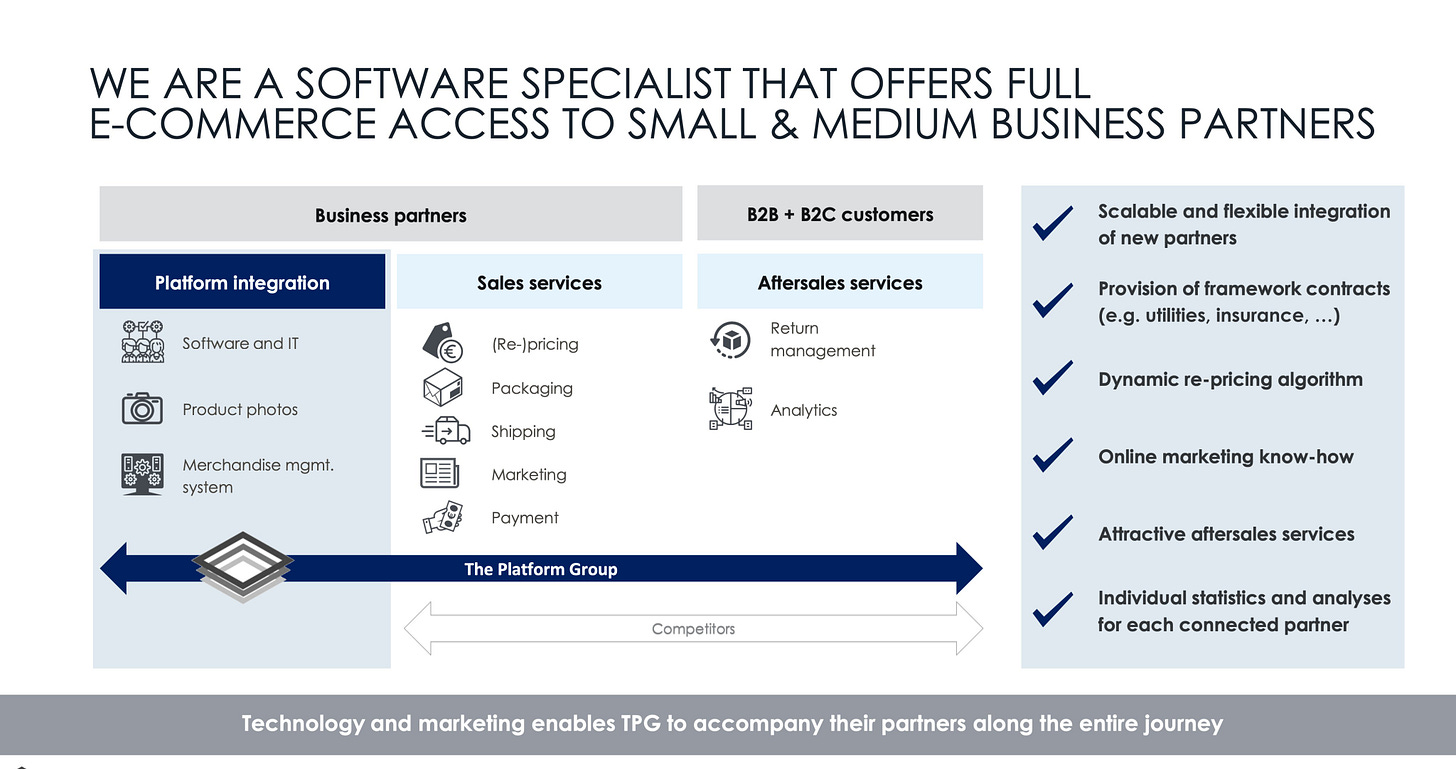

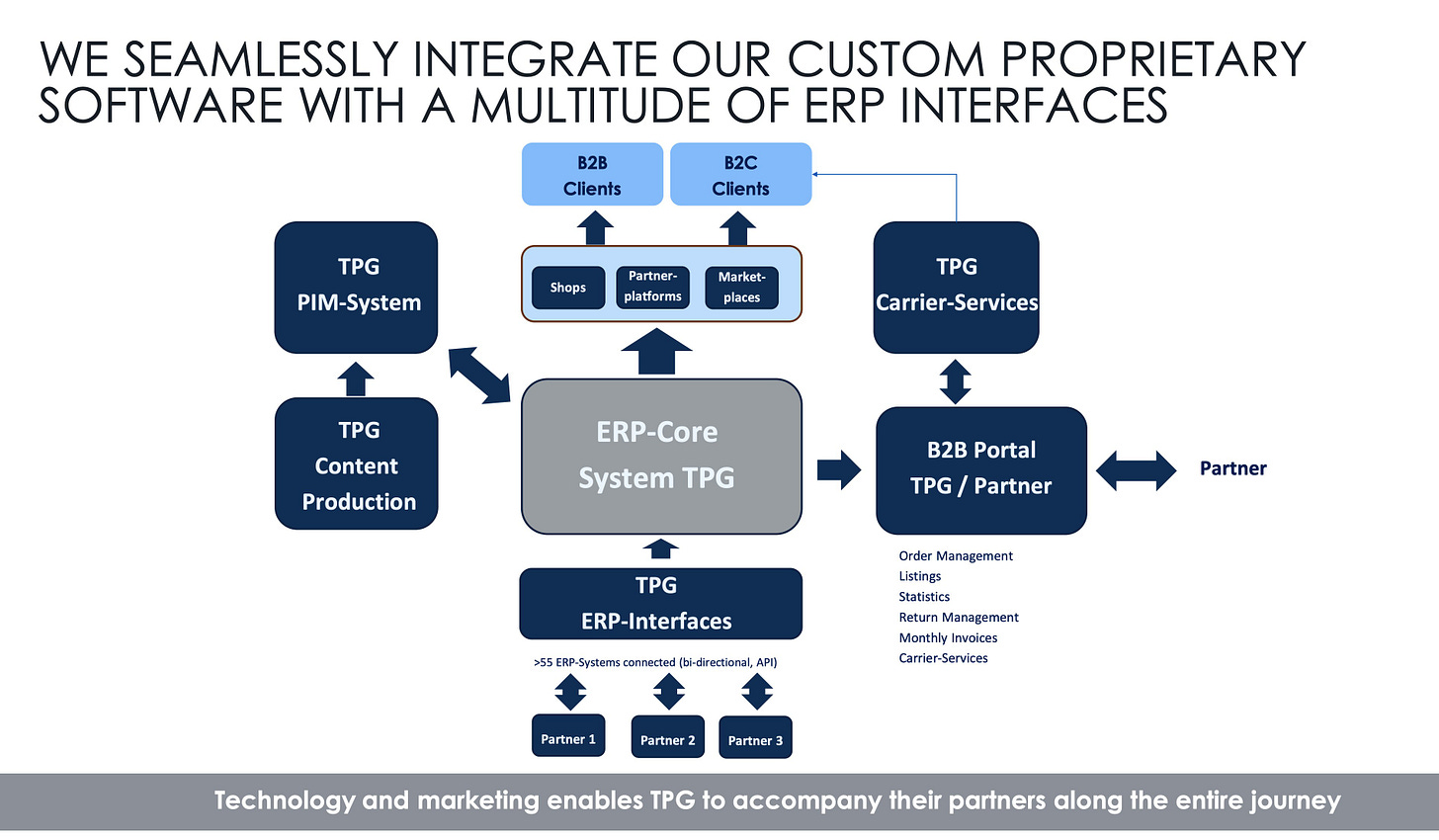

The Platform Group went public in 2023 through a reverse merger with Fashionette. Prior to that, The Platform Group's management had acquired a stake in Fashionette in 2022 and took control of its management in early 2023. While Fashionette was a normal online retailer, The Platform Group is a platform business that works with different partners (B2B & B2C) and provides an end-to-end solution that allows partners to sell their products online without any knowledge.

This business model not only reduces the risks of e-commerce (inventory management, cyclical demand, competition) - I believe it should be a very sticky business that benefits from high switching costs.

Prior to the IPO, the company had been growing at approximately 30% p.a., both organically and through acquisitions. They aim to make 3-8 acquisitions per year. Most are either smaller e-commerce businesses or partial ownership stakes in related businesses. The CEO owns about 70% of all outstanding shares. For 2023, they guide to 20 million in EBITDA, which puts them at 7.5x EV/EBITDA. Time will tell if the roll-up strategy is value creating or value destroying.

5. Sow Good - $SOWG

Market Cap: $45m

Enterprise Value: $52m

P/E LTM: N/A

Have you ever heard of freeze-dried candy? Well, I haven't, but apparently this kind of candy is all the rage in the U.S. right now - and Sow Good suddenly came up with a business selling this kind of candy.

CEO and co-founder Claudia Goldfarb is a serial entrepreneur who sold her company in the pet industry. She is joined on the board by the former CEO of Yum Brands. So there seem to be capable people involved, and currently the business is growing like crazy, enjoying the first mover advantages in a trendy topic. Last quarter, they did about $9.5 million in sales. Management seems confident that freeze-dried candy is not a fad, but here to stay, by ramping up production capacity. I don't know if that's the case.

If you have any insights on the freeze-dried candy industry or any of the stocks mentioned, feel free to leave a comment or email me at Sebastiankrog@me.com.

Disclaimer: This is not investment advice and meant for entertainment purposes only, I currently hold a position in The Platform Group and my initiate a position in the other discussed companies in the future as well and therefore may be biased in my opinion. Please be aware that this is an illiquid microcap, please only buy and sell with a limit-order.

https://www.sec.gov/ix?doc=/Archives/edgar/data/909724/000114036123056715/ef20016330_8k.htm

Noticed Mars is now selling freeze-dried Skittles themselves and remembered this post. Looks like I was both right about the brands getting in (this stock is down about 65% from this post) and missed out on a three-bagger in less than three months. Lol.

Re: Freeze-dried candy, my vote is fad. I've tried it and don't get it. Seems like there are about a million sellers of these things, which an Amazon search confirms, and none of them have brand power. They all take existing brands like Skittles and Starburst, freeze-dry them, and hope the consumer can still recognize the brand from the window in the bag, because they can't use the brand name on their packaging. If it is more than a passing fad, these brands will freeze-dry their own stuff at a much lower cost and put all these guys out of business anyway.