5 Microcaps in 5 Minutes — Planet MircoCap Showcase Edition

Highlighting some of the interesting companies that presented in Las Vegas

The Planet MicroCap Showcase is over — and it was awesome. I had a great time, the companies that presented were great, and the investors that attended were even better. It was awesome to finally meet a lot of investor friends and readers of my blog in person. It was also insightful to see the CEOs in person and in a casual social setting instead of the strict Zoom meetings. While I can't share these impressions with you, I can highlight some of the interesting companies that presented.

1. Acorn Energy, Inc. - $ACFN

Acorn Energy sells remote monitoring systems for power generators. Their business model is to sell the hardware upfront, followed by the monitoring software on the back end. Initially, the software monitoring contract is for one year, but renewal rates are 95%, providing the company with a steady stream of cash flow. The goal is to grow 20% per year on average, but this will likely be lumpy, as large hardware sales like the recent one1 can create a lumpy bump.

The thesis is that the company can continue to grow from here - and eventually become an attractive acquisition target.

2. FitLife Brands, Inc. - $FTLF

The most visited conference was that of Fitlife Brands. Investors love the story and have loved it for a while. A consumer products company run by an activist investor turned CEO who acquires companies without diluting shareholders. Just what investors like. Here is how much investors liked the story:

The model is relatively simple, they acquire general health or fitness supplement brands for 3x EBITDA and are able to increase margins and grow significantly by improving their online sales. The CEO owns 56% so he is well aligned with the shareholders.

The thesis is that after a period of no acquisitions, they will be able to pull another one out of the hat.

3. BuildDirect.com Technologies Inc. - $BILD.V

BuildDirect, a roll-up of flooring companies. Acquiring them for 1x EBITDA, yes, not a typo. How is that possible? Most flooring companies are mom-and-pop shops. The owners want to retire. In most cases, they own the real estate of the flooring business they sell to BuildDirect, and BuildDirect enters into a lease agreement with them. Providing them with money from the sale and rental income stream.

They are in an interesting position where tariffs could help them as more flooring companies struggle, making them cheaper to acquire.

Trading at 22x EV/EBITDA, the company is not cheap. As a thinly traded stock, mostly held by insiders, it may never trade cheaply.

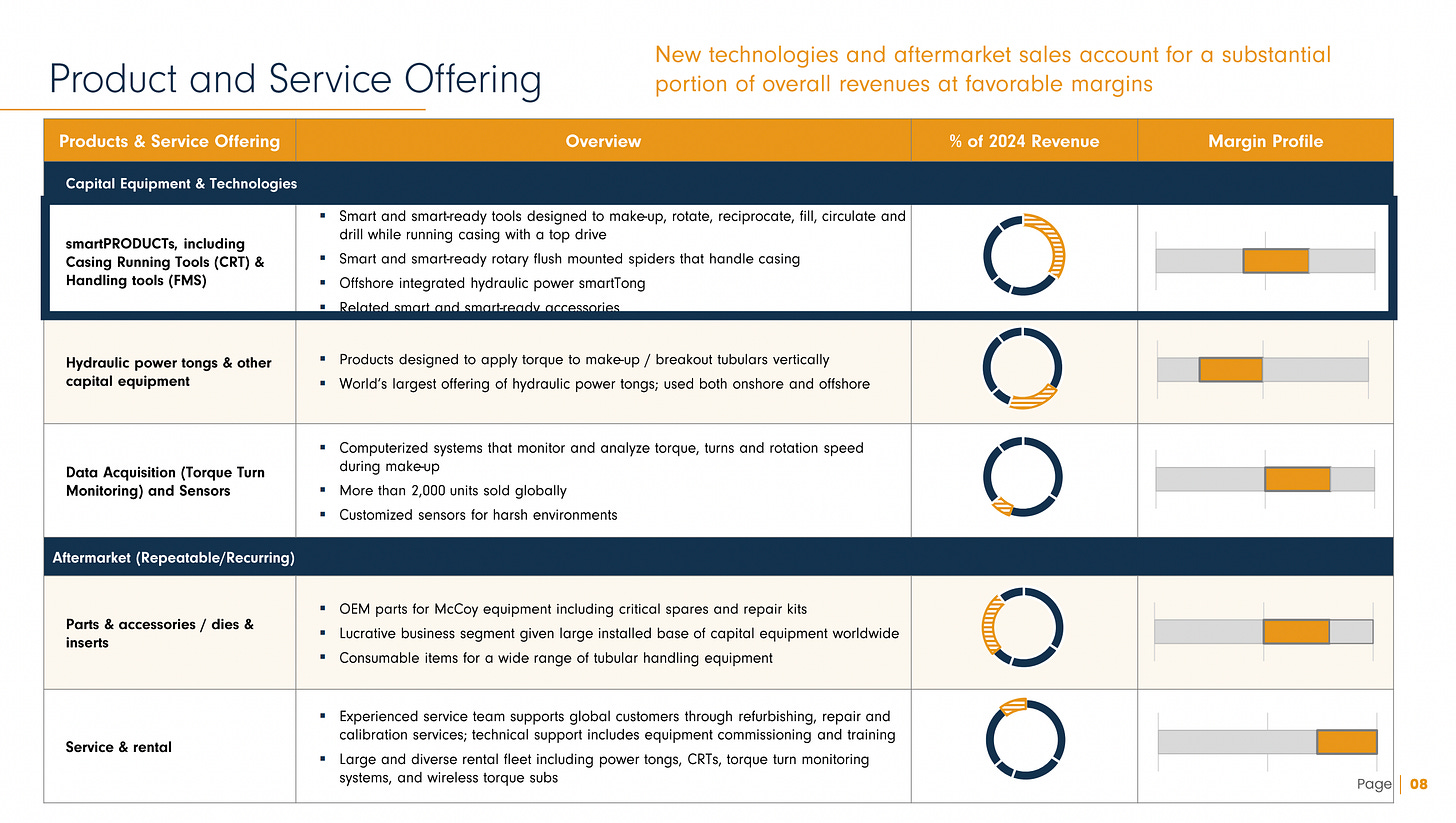

4. McCoy Global Inc. - $MCB.TO

McCoy Global sells drilling equipment to oil service companies. In recent years, they have shifted their product line to more smart technology products. As a result, they are increasing the value proposition and pricing of their products.

Even more impressive was their recent press release2 announcing their first SAAS contract - on the backend of a TSR smartTR order. They are one of the first and only companies to sell a SAAS contract to an oil service company.

This company's business is perceived to be as cyclical as the O&G space, but they have been able to grow revenues despite lower rig counts in the US. This shows their ability to upsell their customers to their higher value products. They also do a good amount of higher margin after market work.

Overall, I came away with the impression that this is a much higher quality company than I first thought. Their shift to technology products and even SAAS should continue to increase their margin and give them room to grow. If the stock drops back to CA$2. (maybe on a lumpy, bad quarter) I could see myself as a buyer.

5. Sanara MedTech Inc. - $SMTI

Sanara offers a wide range of surgical, skin, and wound care products. The company has grown its revenue at a CAGR of 57% since 2018, and when you add in gross margins of 90%, you have a compelling compounder story.

This growth is being driven by their surgical segment, which generated $4.1 million in EBITDA in Q4 2024, up from $1.5 million in Q4 2023. At a market cap of $284 million, this looks pretty cheap for a company with 90% gross margins and 30%+ growth. So why has the stock gone nowhere over the past four years?

Because their CEO decided to put all their money back into building their Tissue Health Plus segment, which is still burning money - and set to get its first pilot in Q2 of this year.

The market does not appreciate reinvesting in a long-term project with an uncertain outcome. The bull thesis at the moment is: Either the CEO will succeed in what he is trying to do — or the Health Plus segment would be spun off, in which case the stock would probably rally as the surgical business is worth more than the current market reflects. Needless to say, the bear thesis is that it won't be as successful as hoped, nor will it be spun off, which will weigh on the stock's multiple for years to come.

Disclaimer: This is not investment advice and meant for entertainment purposes only, I do not hold a position in the discussed companies but may initiate a position in the future. The mentioned names are highly illiquid, please use a Limit-order when buying.

https://acornenergy.com/wp-content/uploads/2024/06/ACFN-Telecom-Customer-PR-6-5-24.pdf

https://money.tmx.com/quote/MCB/news/5083400198778786/MCCOY_GLOBAL_ANNOUNCES_SUCCESSFUL_COMMERCIALIZATION_OF_smarTRTM_AND_SIGNIFICANT_CONTRACT_AWARD

Another interesting addition. Thanks!

Will you do a deep dive in any of these? potentially make a position ?