Cornerstone FS: A multibagger in the making?

Tiny Currency Exchange company hits inflection point

Usually I am not someone who is hunting for “multibagger” - I prefer to keep my investment thesis simple and predict the next year rather than the next decade. But every once in a while you come across a company that you think has a chance to be a 5x or even a 10x. What does it take to find such a multibagger? A business with competitive advantages? An outstanding management team? High return on capital? Great capital allocation? Sure, these are all attributes that make it more likely, but the only thing that matters to become a multibagger is this. Steady EPS growth without dilution.

With this in mind, let me introduce you Cornerstone FS:

Overview

A foreign exchange and payments company providing multi-currency accounts to businesses and high net worth individuals. Currently, they are offering 58+ currencies to 150+ countries. They are an Electronic Money Institution, which allows them to operate an IBAN for their customers. In the past, the company sold it's platform as a white label service to other FX companies. Under this model, the company was able to grow revenues, but only while increasing losses.

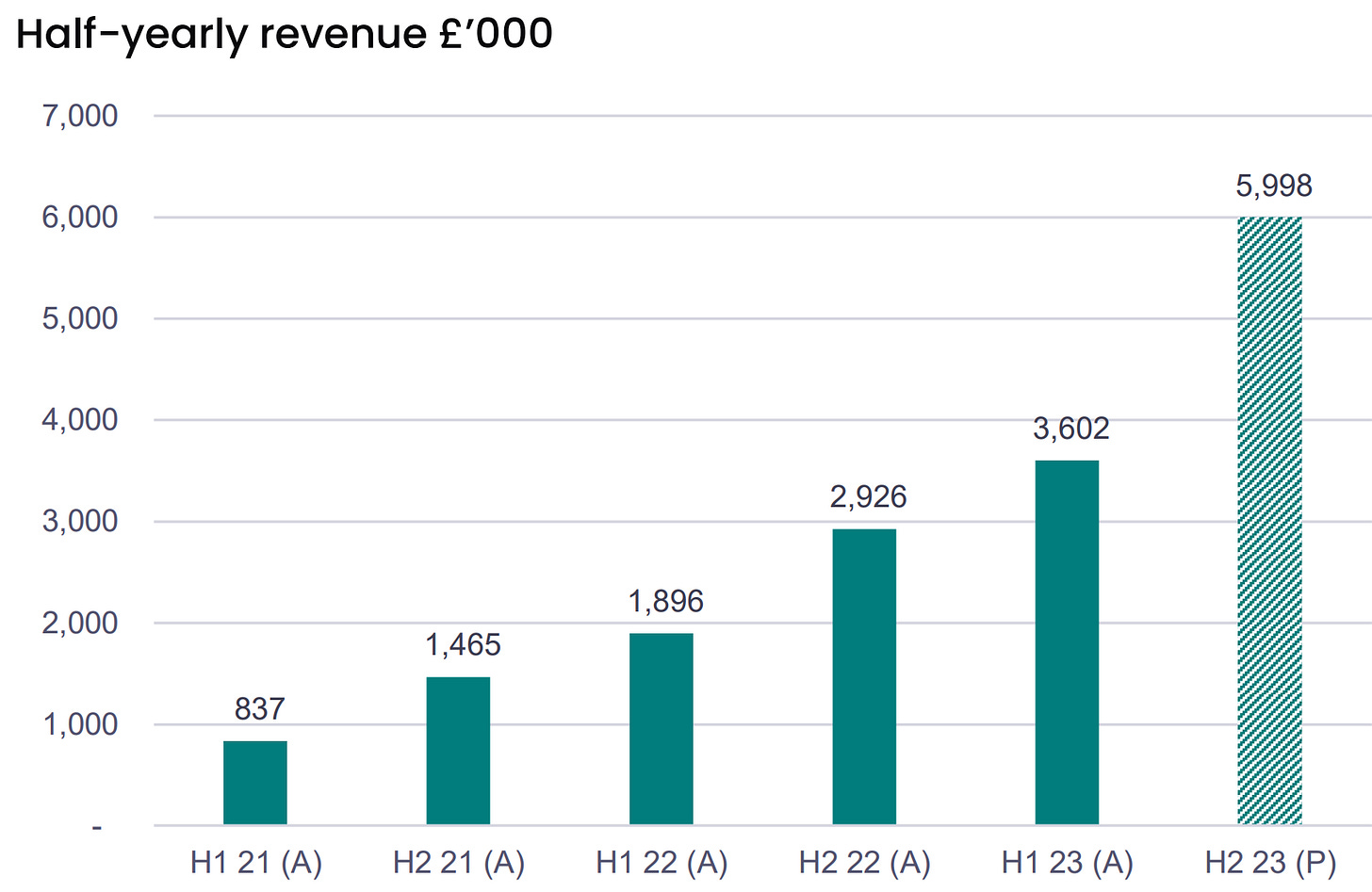

In 2022, James Hickman was appointed as the new CEO. He transformed the business model. Turned the company profitable while doubling revenue within a year.

All this while increasing EBITDA by 6x.

Business model

It is important to understand the difference in their business model compared to other currency exchange platforms. First, they cut out the white label part. Now in 2024, they have completed the transformation and have zero white label customers left. This allowed them to increase their gross margins from 38% to 64%. It has also allowed them to double their revenue, primarily by increasing the average order transaction size from a customer.

Cornerstone FS gets all of its clients through Introducers, which can be lawyers, real estate agents, tax advisors or similar types of businesses whose clients are high net worth individuals. These Introducers are typically global firms. They recommend that their clients use Cornerstone for their foreign exchange transactions. Some introducers (such as real estate agents) receive a commission for the referrals, others (such as lawyers) do it to provide their clients with a trustworthy way to exchange their currency. I believe this introducer model has a number of advantages that could be the key to continued profitable growth for Cornerstone.

They have no marketing expenses. While this is great to lower their costs, it also removes them from competition with other currency exchanges. Being in a marketing treadmill can really hurt your margins. Not only because you have higher marketing expenses, but also because you may have to lower your prices to attract more customers, which also results in lower gross margins. A race to the bottom. Cornerstone avoids it.

They benefit from compounding of their network. Say an introducer gets them 10 clients. If they get a new introducer, their client base grows, therefore by 10x the time of people they originally acquired. This might seem obvious and neglectable at first, but if you think it through, every introducer might spread the word to other real-estate agents, every end client might spread the word to other potential clients. One new introducer can really give them a lot of new business and opportunities.

You operate on trust. If your lawyer recommends a service, you use it because you trust your lawyer. Cornerstone uses the trust that these introducers have with their clients.

The next very important part of their business model is that most of their transactions are done over the phone. This again emphasizes that their business is all about building trust with customers and serving them well. This is not just a platform where anyone can exchange their currency for their next vacation.

Competition

As a result, their main competition today is not other currency exchange platforms, but banks. Previously, most of their customers would have done the transaction with their bank. However, banks tend to be slow, have poor customer support, and are more expansive. By focusing on this specific niche and the specific needs for these larger transactions, Cornerstone is able to provide a faster, cheaper and more customized experience for their customers.

Growth

As I mentioned earlier, the primary growth driver behind the doubling of their revenue was higher transaction value per customer.

This is underlined by their strategy updates and growth plans for 2024. They will offer a Mastercard1 to their customers, which should further increase revenue per customer. They are also opening offices in Dubai and Canada in 2024 and Hong Kong in 2025. These offices will give them a better presence at those locations, making it easier to get more introducers and in some cases assist the clients face-to-face.

Since the company started as a white-label currency exchange platform used by other currency exchanges, they already have the backend to scale further. There is no need to increase operational spending to serve more clients. They will mainly spend money on growing their sales team to get more introducers. Since they are also cash flow positive and have a net cash position, there is also no need to raise money. Which brings me back to the beginning of the article, this could be a company that is able to grow earnings per share without dilution over a long period of time. The question is, what is this company worth, and how much are we paying now?

Valuation

If we look at the results of the past, what stands out is the ridiculously high share-based compensation. This is important to understand.

“£1.9m increase in share-based (non-cash) compensation to £4.3m (2021: £2.3m), which predominantly relates to share- based incentivisation for the Asia team and the General Manager APAC and Middle East” (…) “Accordingly, there is no further share-based compensation to be recognised in future periods in respect of Mr. O’Brien and the Asia team.”

- From their annual report 20222

The next important thing to understand is cash generation. We don't want to pay for EBITDA, we want to pay for cash earnings. As I explained, their biggest "growth" expansion is sales people, so as they grow the business, they will grow it by investing in their SG&A. I think that should yield high returns. That leaves us with very high cash conversion from EBITDA. The trading update for 2023 results reads as follows:

H1 results to demonstrate adjustment of EBITDA

Which brings me roughly to this assumption for their 2023 and what the annualized H2 2023 would look like.

Some notes: I took the adj EBITDA, which subtracted "other operating income", which is the interest they earn on customer money. This number was equal to the interest they paid on their debt, so I left both out. Maintenance capex is investment in their own software. They have NOLs, so they don't pay taxes. I am not sure about the SBC in H2 of 2023, but if we see the cash conversion from their press release, I believe that my assumptions overall are more on the conservative side. I think buying this company for less than 10x free cash flow annualized H2 earnings is not a bad deal.

Verdict

Overall, I think Cornerstone FS is an interesting little company. James Hickmann has done a great job so far in making the company profitable and growing. I like their business model and think the referral strategy could be the cornerstone (ha ha...) for future growth. I would not bet the farm on this company just yet, but I see potential and as execution continues I could see myself adding to my position.

Edit: If you read this after April 2024, the company will change its name to Finseta.

Disclaimer: This is not investment advice and meant for entertainment purposes only, I hold a position in the discussed company and therefore may be biased in my opinion. Please be aware that this is an illiquid microcap, please only buy and sell with a limit-order.

In every multi-bagger story, a moat is an essential aspect of the thesis. What's the moat of this business exactly? The introducer model does not feel like one to me.

If the introducer model is so good and scalable, why would other maybe even larger FX players in the space not be able to replicate the same model? I could imagine a race to the bottom in terms of compensation for introducers.

Anyways elaboration around this topic would be very helpful.

Nice write-up, thanks. How similar to Argentex are they?