Earnings Update: August 2025 (Part 1)

My take on the Q2 earnings from the profiled companies

Disclaimer: This is not investment advice and meant for entertainment purposes only, I hold positions in the discussed companies and therefore may be biased in my opinion.

It has been a busy August, with earnings reports from most of the profiled companies. I provided some initial commentary on the earnings in the subscriber chat, and I will offer a more detailed overview of each company and its results here.

Ascent Industries (ACNT)

As expected, Ascent reported relatively unspectacular results. Revenue decreased by 13%, while gross margins increased further. The increase in gross margin is the result of a continued focus on higher-margin business and lower raw material sourcing costs. The focus on branded products should increase margins further, and it seems that they are also able to secure custom manufacturing jobs with higher margins. This was evidenced by comments made by CEO Bryan Kitchen during the earnings call.

”Q2, we secured over $3.1 million of annualized new revenue at a 29% gross margin, well above historical averages. These wind spend oil and gas HI&I, up and paper and case. All markets where our value proposition continues to resonate. Roughly 1/3 of that growth came from product sales, 2/3 came from high-quality custom manufacturing engagements.”

- Q2 2025 earnings call

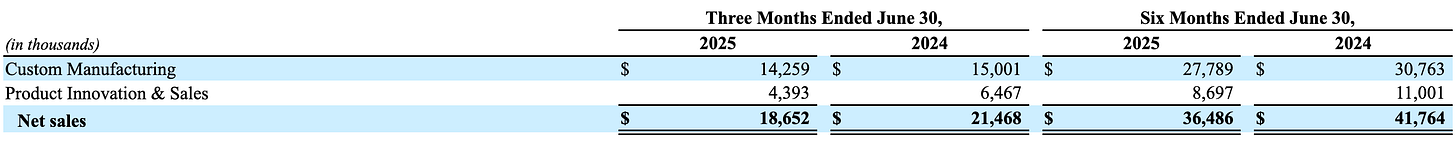

They also began breaking down their sales by custom manufacturing and products. Both categories saw a year-over-year decline in sales.

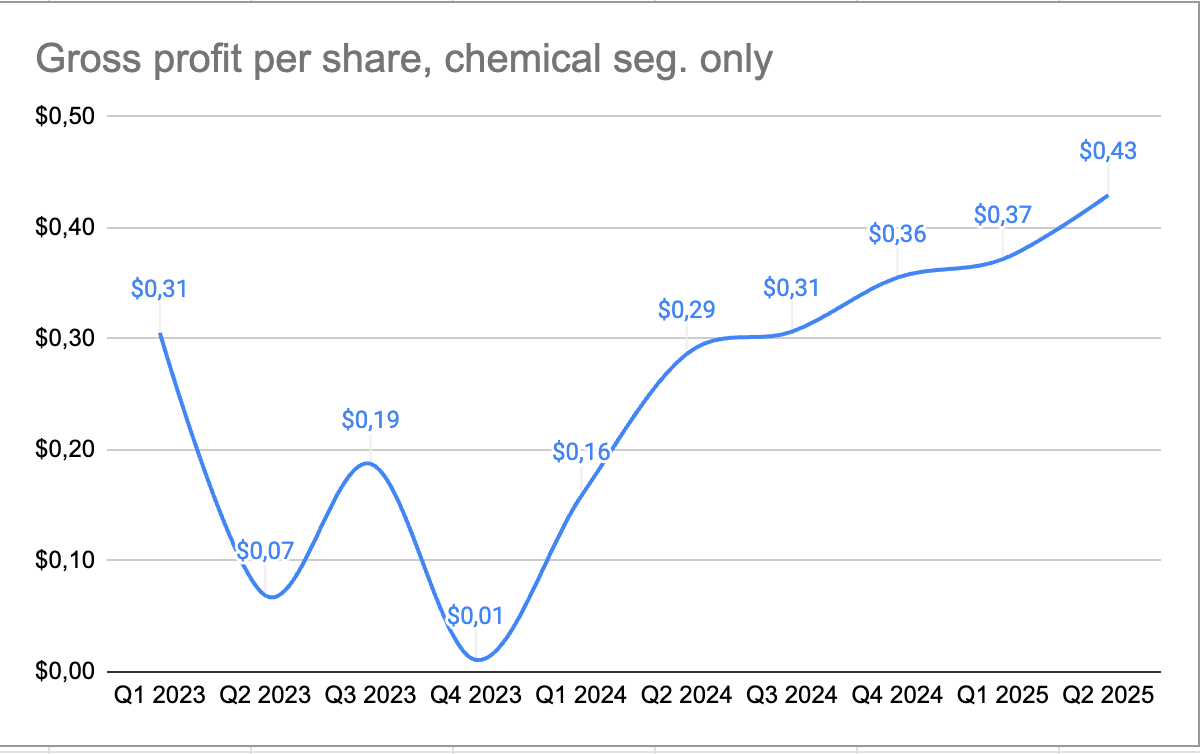

However, revenues increased by 5% sequentially. These revenue levels are not yet sufficient for profitability and may make the stock appear unattractive at first glance. I believe the business's progress is best measured by gross profits per share of the chemical segment. Focused Compounding has discussed this metric in their podcast, and it reminded me of Ascent because I think it is the best evidence of the business's improvements.

For an apples-to-apples comparison, I only considered the gross profits of their chemical segment, and I also took into account their reclassification of expenses in Q2.1 This metric received a boost in Q2 from their repurchase of 644,171 shares, or 6.4% of the shares outstanding.

Looking ahead, I expect the company to resume top-line growth in 2026. This expectation is supported by their growing pipeline of opportunities:

”Underpinned by a $25 million increase in our selling project pipeline, the $3.1 million of new business won in Q2 is expected to grow significantly into 2026. And with no significant new fixed cost burden, each incremental win translates directly to meaningful profit. That's what makes this model powerful is that it's scalable.”

- Earnings call Q2 2025