Is the Oil Sector a buy now? —Weekly Treasure Hunt #03

Hunting for value in the last lagging commodity

First of all, I’m not an oil expert. This purely comes from a generalist who looks for cheap stuff that might be inflecting. What caught my eye regarding oil is the apparent two-sided narrative: on one hand, we have the overall narrative from analysts that there is an oil surplus; on the other hand, the market, especially oil stocks, are telling a different story.

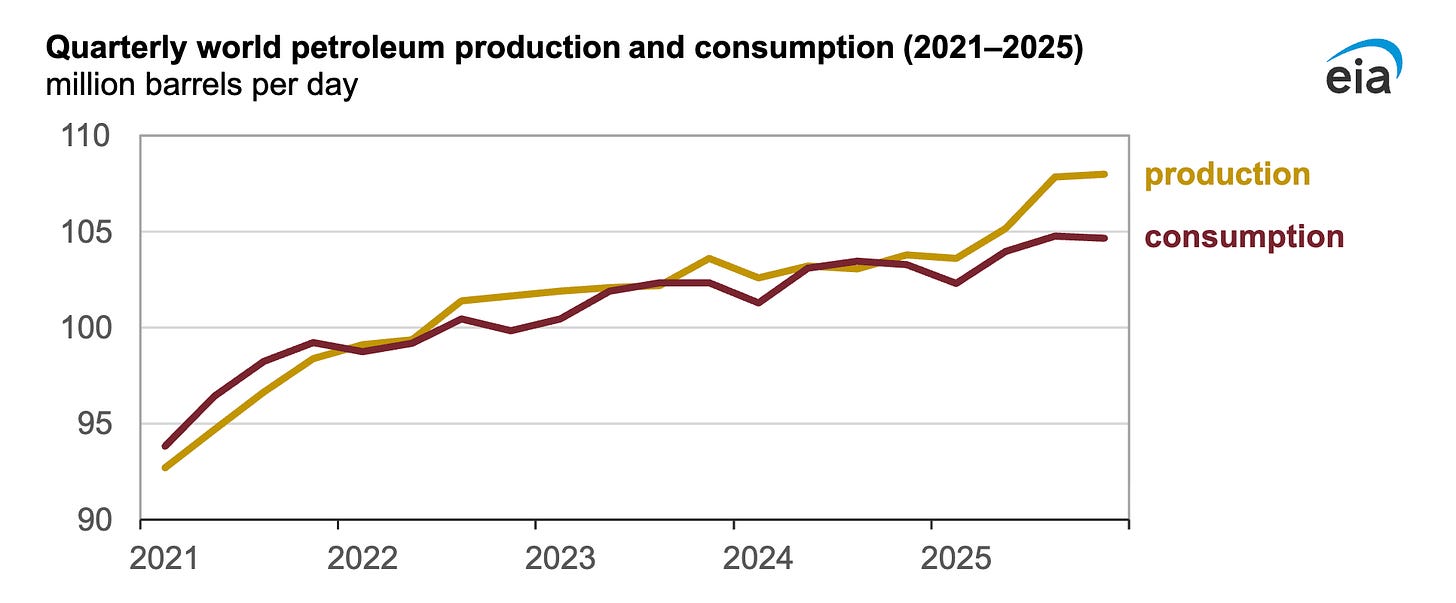

Eia has an outlook for $56 per barrel in 2026, a further decline from 2025. So, no matter which source you look up, most point to a clear oversupply of oil and expect that to continue into 2026.

So the overall outlook looks bearish, neutral at best. However, there is also some good news for oil bulls, like Kazakhstan, which had a supply disruption, and a rise in demand outlook for 2026 stated by The IEA’s January Oil Market Report.

What is interesting though, are a couple of other things.

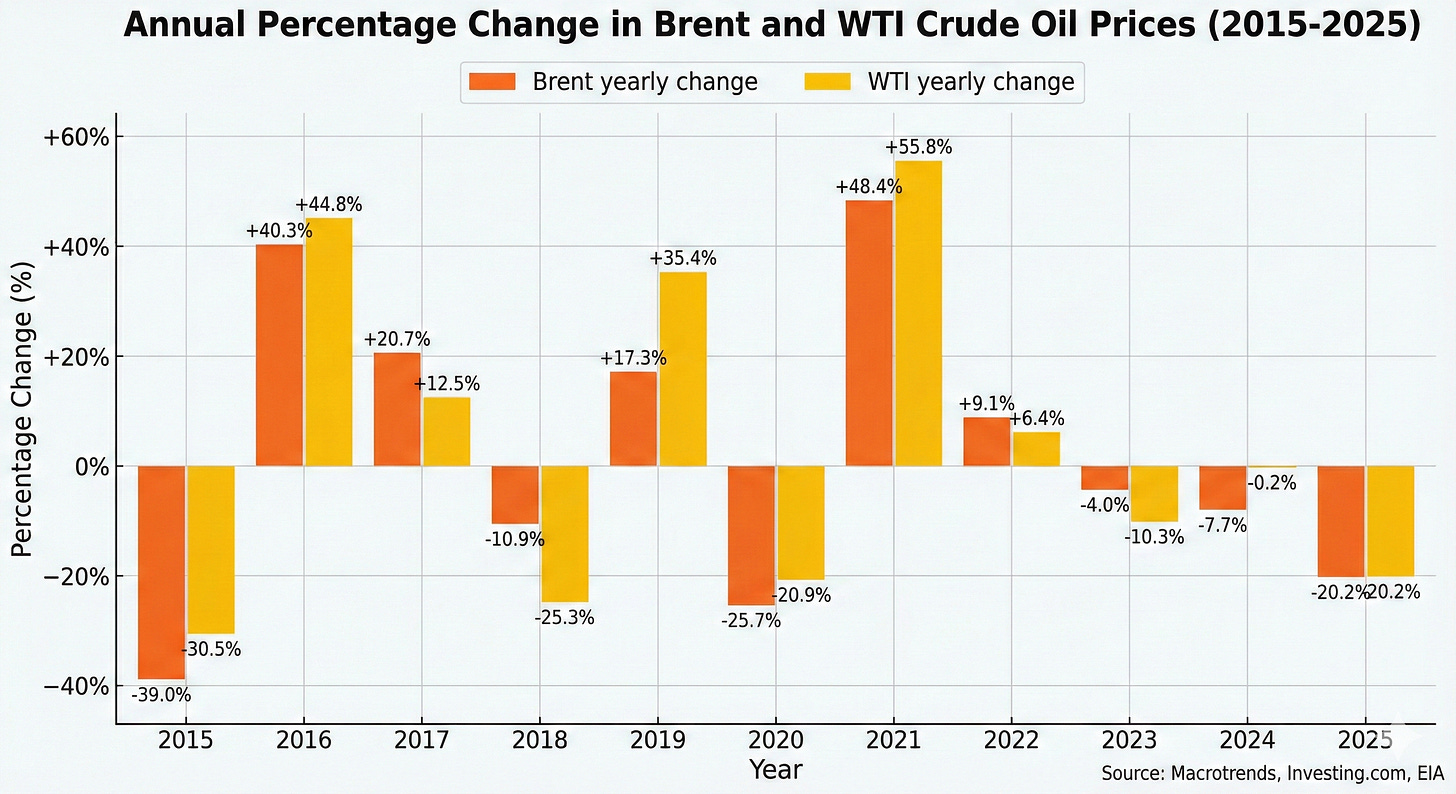

#1: Oil has been going down for three years straight, making this the second longest period of declining oil prices since the 80s (1981-1986). Can it decline for another two years? Yes, for sure. But I'm a fan of simple heuristics, and regression to the mean is one of them. The best cure for low prices is low prices. If prices stay in the current range, investments will naturally decrease, which will solve the oversupply.

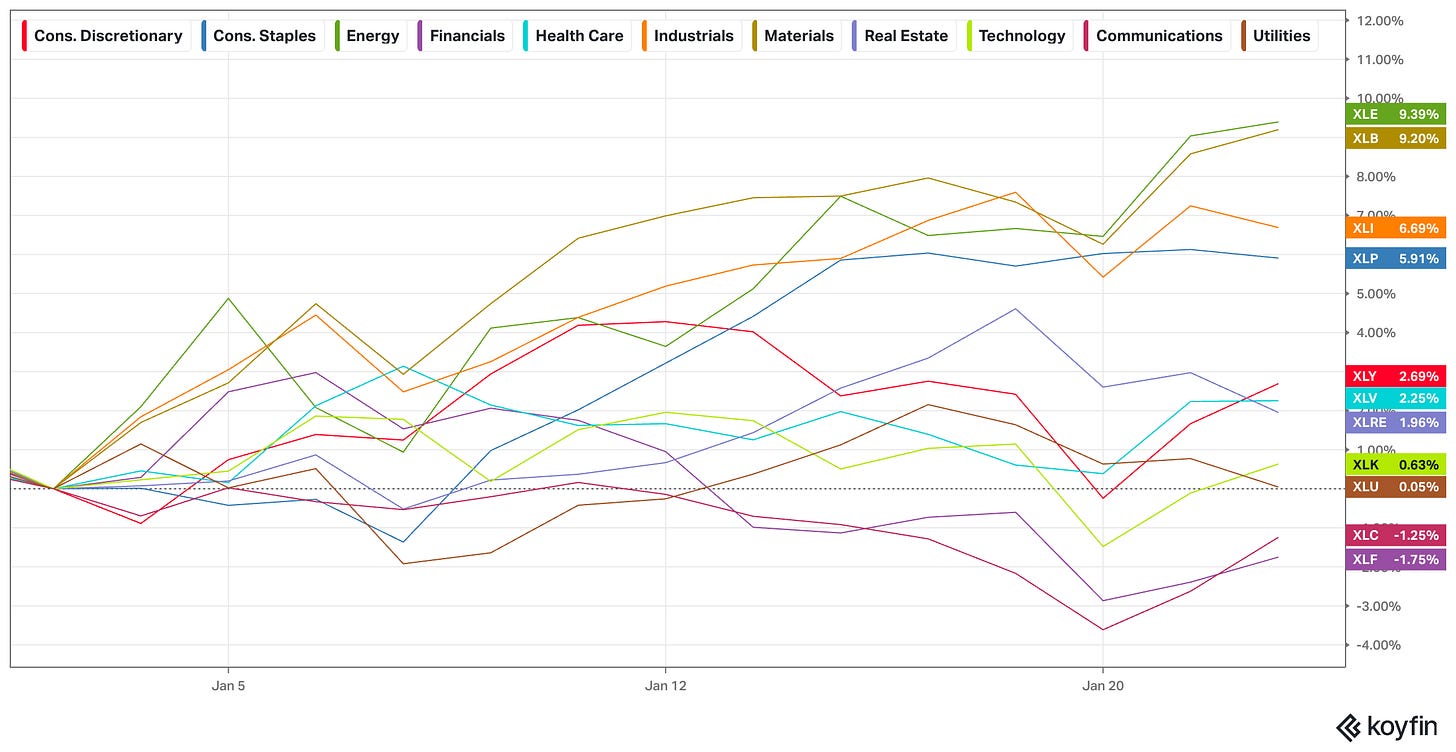

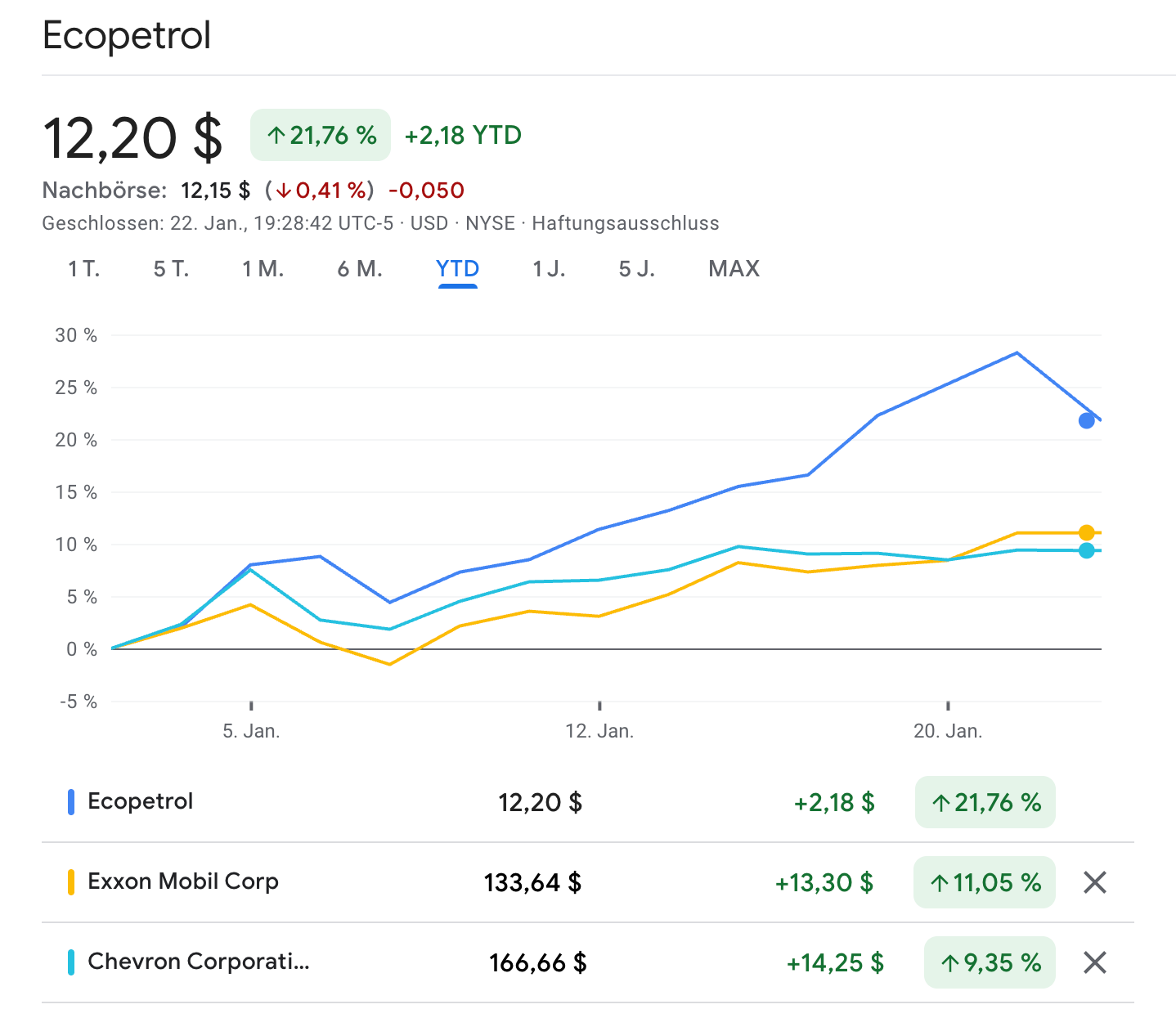

#2: Oil stocks had a strong start to the year and have been outperforming oil prices. However, I would take the XLE with a grain of salt because Chevron and Exxon combined are 40% of the index. Nonetheless, it’s noteworthy.

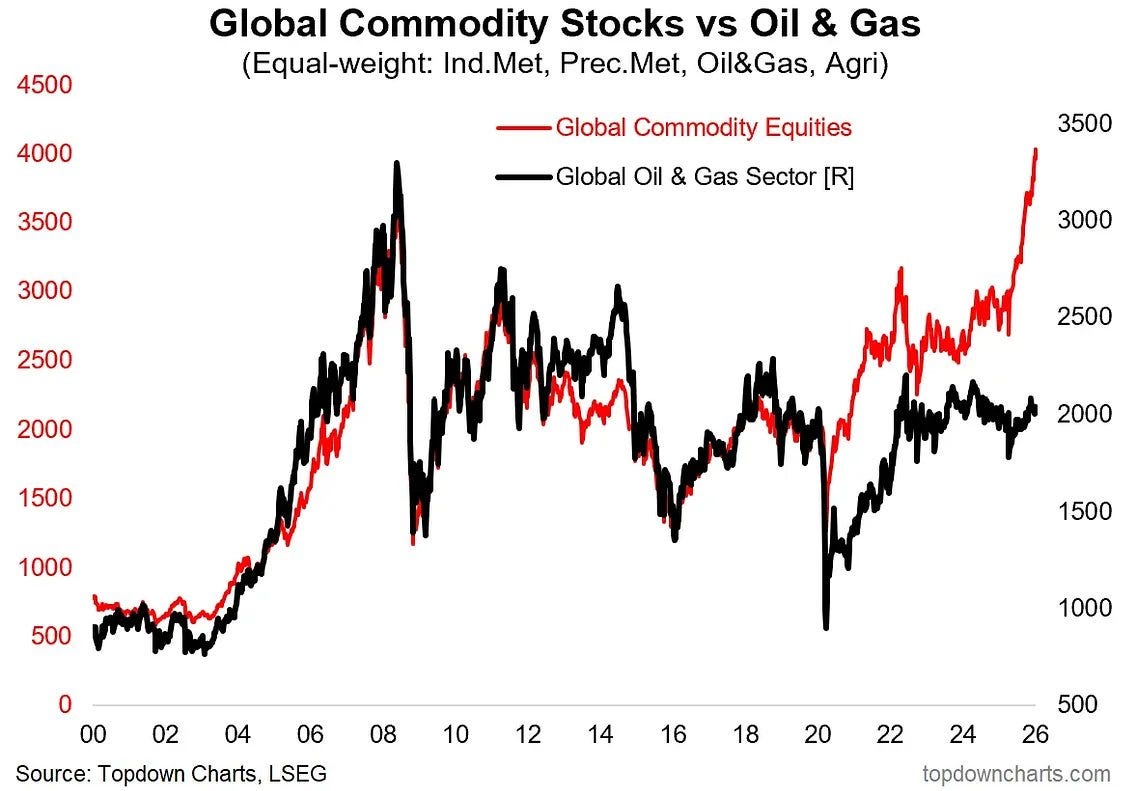

#3: Lagging behind other commodities. While basically all commodities have been going straight up since 2025, oil has actually declined. As this chart indicates, this is somewhat of a divergence from past behavior.

In my opinion, it’s impossible to predict oil prices, you can spin every narrative the way you like. That being said, I do think oil at $65/bbl is not expensive. Can it go lower? Yes, but the lower it goes, the higher the likelihood of higher prices in the future becomes.

Three Ways to play it

The safe way to play oil is through the service providers. They depend on the capex of the oil companies instead of the oil price in general. On the flip side, the “torque” is also lower if oil prices really go higher. Further they usually lack behind. First prices rise and Oil producer make and then they increase their capex.

Here are two cheap names:

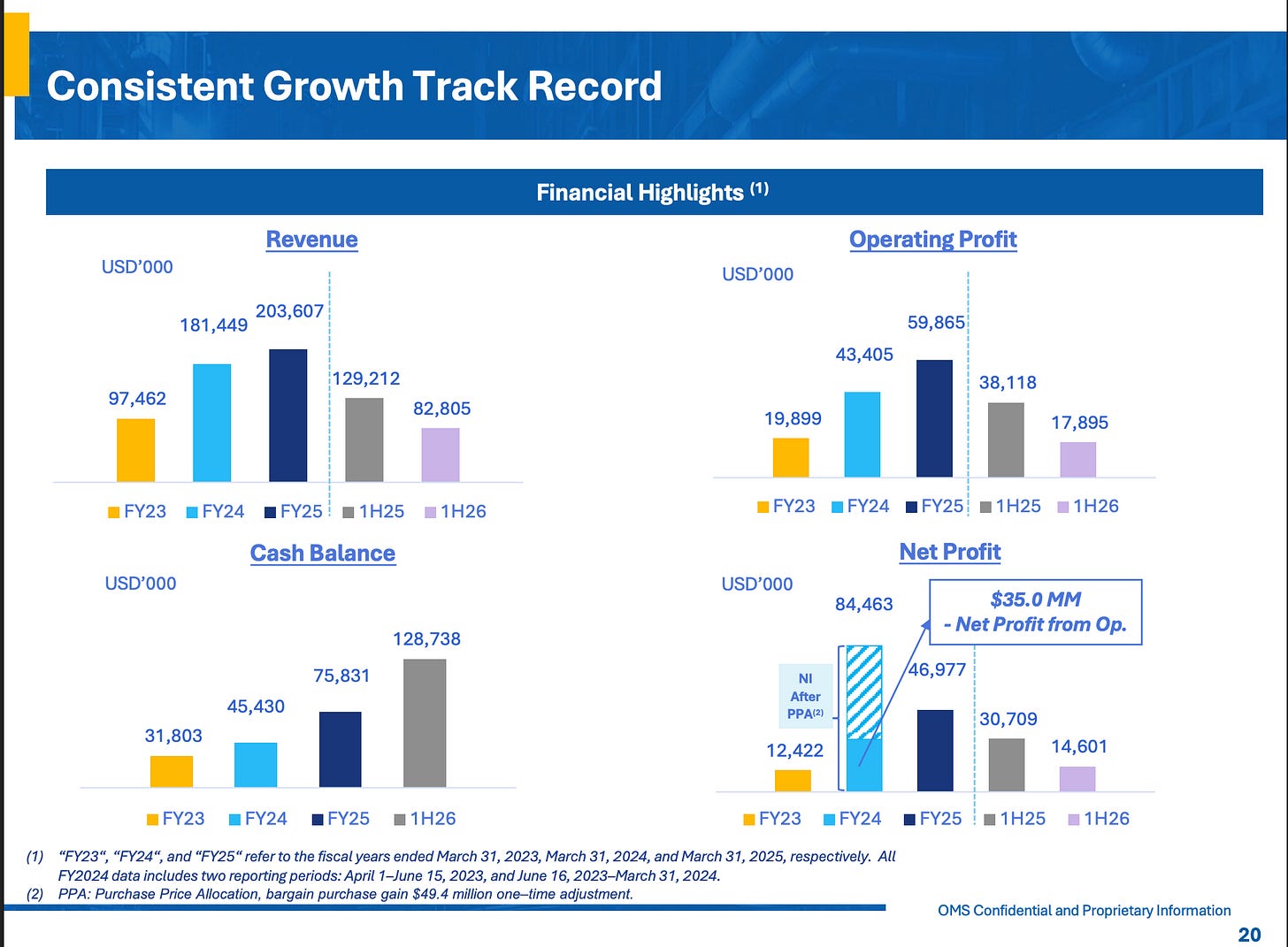

OMS Energy Technologie (OMSE)

It’s an oil service provider specializing in surface wellhead systems and oil country tubular goods for the oil and gas industry. The company came public as a spin-off. It trades very cheaply at 4.5x (FY’25) earnings. They also have more than half of their market cap in net cash, so on an EV/EBIT basis, shares are even cheaper. However, I'm not sure about their earnings power. Based on LTM numbers, shares are trading at 6.5x earnings, and their last quarter was not necessarily strong.

Reasons it’s so cheap: Saudi Aramco contributes 67% of their revenue, the company’s jurisdiction is the Cayman Islands, and there’s a majority shareholder. It gave me more than enough reasons to pass, despite it being cheap.

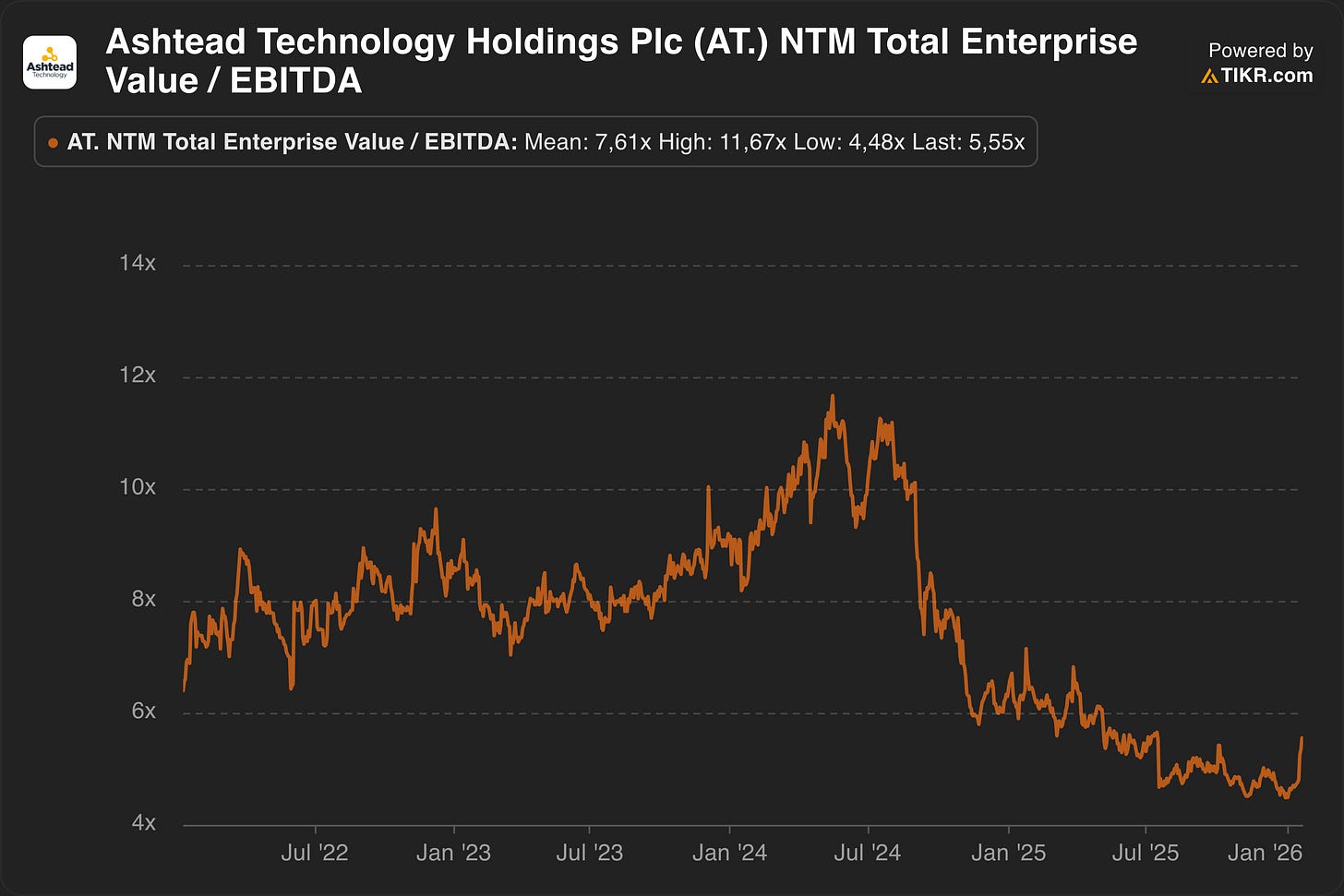

Ashtead Technology Holdings Plc (AT.L)

A service provider for the subsea space. They mainly make their revenues from rental equipment. The decline in offshore wind made the stock tumble to new lows. The other reason might be because it's a UK-listed company and they just go down (just kidding). However, they did uplist from the AIM to the LSE; ironically, this caused some AIM-focused funds to sell out. Shares have recovered from their lows in the summer of last year but remain at historically low(er) valuations:

Here is a good thread from Adam:

It’s added to my watchlist, but I just have a natural aversion to UK-listed companies.

Oil exposure with a politcal kicker

Speaking of the outperformance of Chevron and Exxon, this has been nothing compared to the YTD performance of Colombian state-owned, major oil producer Ecopetrol.

I wrote about the upcoming election in Colombia in the last Treasure Hunting weekly, so I won’t repeat myself here. But obviously, Colombian oil stocks trade not only on oil prices but on politics as well.

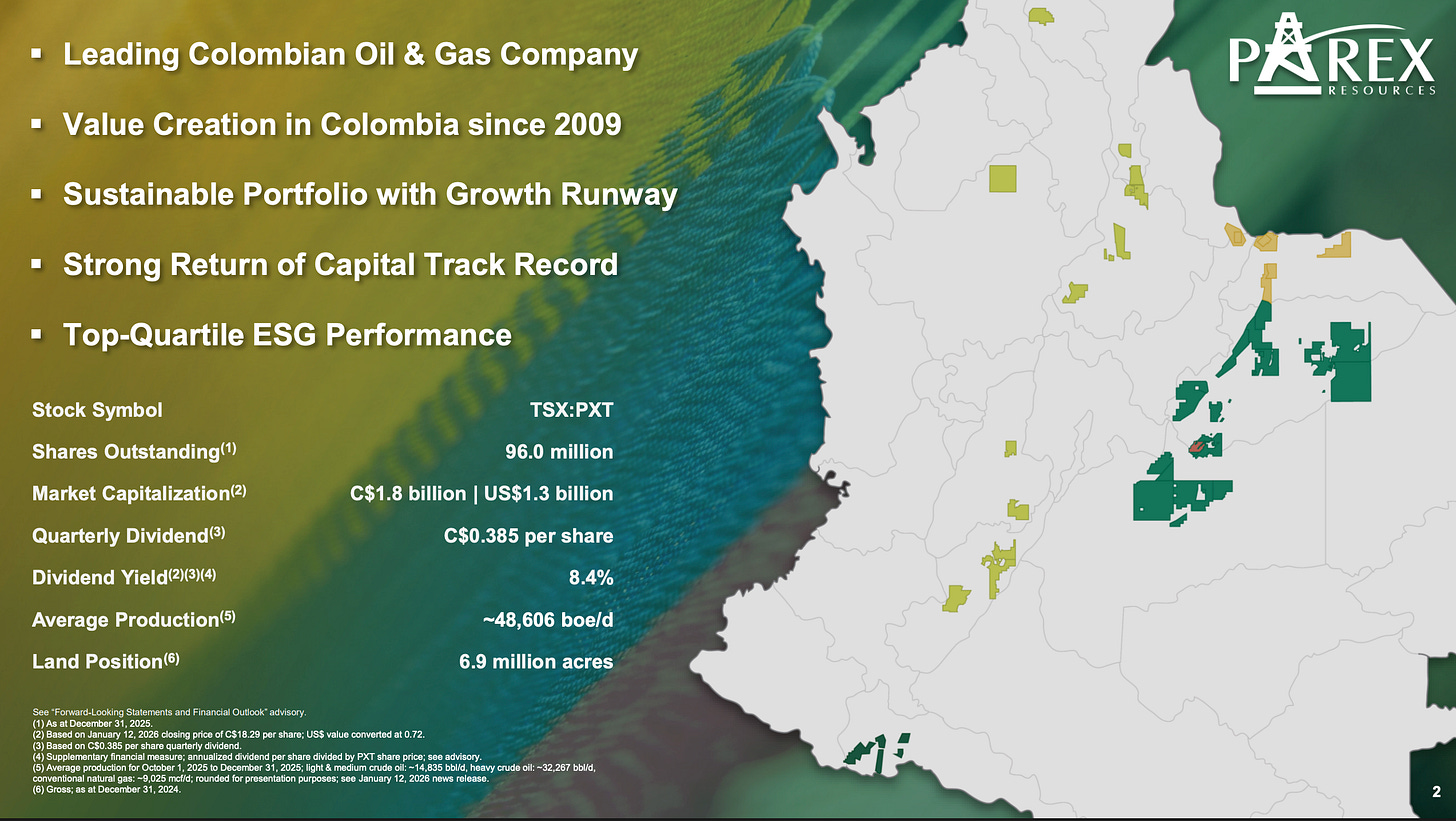

If you want to look one row behind Ecopetrol, Parex Resources (PXT.TO) is the largest 100% privately owned oil producer with 100% Colombian exposure. The market cap is roughly US$1 billion, and they trade at the typical Colombian discount of 2.5x EV/EBITDA for a debt-free oil producer that has returned money to shareholders through buybacks and dividends (current yield is 8%).

The issue with Colombian E&P firms is the relatively low reserve life and the low oil quality, meaning the oil is usually sold at a discount. So, the 2.5x EV/EBITDA multiple is not as cheap as it seems, and regardless of the country-specific risk, these companies deserve to trade at a discount. However, a lift of the current exploration ban—something that right-wing candidate de la Espriella is advocating for—would increase current reserve lives, albeit at the expense of some serious capex. Therefore, a player like Parex with a debt-free balance sheet can probably take advantage of that.

For me, I don’t see any meaningful catalyst for Parex, apart from the upcoming election and higher oil prices. That’s why I opted to buy this special situation instead, where the election and oil prices just serve as an additional kicker for the upside but are not thesis-dependent:

Summary

I’m watching the oil sector closely, and I’m also learning more about the sector as a whole. I think it makes more sense to learn about oil when it’s at $65/bbl than when it’s at $100. At the same time, I’m monitoring the situation in Colombia. The currency and the stock market are betting on a right-wing president, while the bond market seems still skeptical. If you have any interesting names, feel free to comment your favorites.

As you may have seen, I just launched a new project with Maj Soueidan called “The Small Cap Earnings Monitor. Your fast track to micro-cap and small-cap earnings (under $2B Market Cap) insights. You can learn more about it here (click here).

Disclaimer: I don’t own any of the mentioned companies. This is not financial advice—for entertainment purposes only.

Any thoughts about Equinor?

Ensign Energy Services is another interesting business. ESI.TO