My current best idea: Innovation Food Holdings (IVFH)

5x EV/EBITDA for an asset-light business after restructuring

Disclaimer: This is not investment advice and meant for entertainment purposes only, I hold a position in the discussed company and therefore may be biased in my opinion. Please be aware that this is an illiquid microcap, please only buy and sell with a limit-order.

We currently have the opportunity to invest in a business that trades at 5x EV/EBITDA (normalized). Once the restructuring is complete, what is left is an asset-light platform business with minimal capex, led by an excellent management team and an experienced and aligned board of well-known value investors.

Overview

Experienced value investors may have seen Innovation Food Holdings (IVFH) as a value destroying company in the past.

But that is a story of the past. Since March 2023, the new CEO has taken over and replaced the entire management team within the next 12 months. But before I go into detail about the new management team, here is a brief overview of what Innovation Food Holdings does: Innovation Food Holdings distributes specialty foods such as origin-specific seafood, domestic and imported meats, exotic game and poultry, artisanal cheeses, and many more to restaurants, casinos, country clubs, national chain accounts, casinos, hospitals, and catering companies in the United States through a combination of their network of distributors and their warehouse. They also have an e-commerce part where they offer food direct to consumers through their website. In short, we have two businesses.

The Good Business:

The B2B Business (Specialty foodservice) in which they serve professional chefs, restaurants with specialty food. This is basically a platform business where they connect regional small food suppliers with different restaurants. Why would a restaurant use such a service? The advantages are ease of use, a restaurant now has only one contact (IVFH) for all their needs instead of dealing with dozens of different small food vendors. IVFH also offers fast delivery and price stability.

Here is what the new CEO says about the B2B Business:

“The comment on asset light, I love. It's -- if you look at how we run this business, the majority of our specialty food service business, we don't even own the inventory, right? It's -- the value we add is in connecting hundreds of small vendors who would otherwise not be doing business with a big distributor. We connect them into a single pipeline of product and inventory and item information to these distributors so that the distributors don't have to deal with 500 different vendors, right? There is -- that's a valuable service that we provide. And it means that as we add customers and as we add sales to the food service business, it scales almost indefinitely without additional assets. Really, the only expenses that get added as we grow those businesses are in salespeople and customer service, but those scale very nicely compared to the margins that we make on the food service side of the business.” - Earning Call Q2 2023, Transcript1

It is also important to understand, the difference between their focus on specialty food and a normal food distributor like US Foods or Sysco. It does not make sense for a normal, broadline foodservice distributor to focus on lower turnover, specialty foods. It is a very small part of the overall food market, that would require high quality customer service.

In fact, US Food (a broadline foodservice distributor) is their largest customer (about 50% of revenue), showing that they are not really competing with the "big guys". In summary, the B2B Business is an asset-light, platform-like business focused on a small niche segment - so the question is, why has this business not been able to generate shareholder value over the last 10 years?

The bad business:

The second part of the business was their direct-to-consumer business. This has been an unmitigated disaster since the old management got into this business in 2018. If we strip out the acquisition of "The fresh diet" (discontinued operations) from 2014-2016, we get a sense of the profitability of the B2B business, and also a sense of the unprofitability of the D2C business and the horrible capital allocation of the old management.

Fortunately, this was quickly recognized by the new management team and also confirmed that the B2B business has indeed remained profitable throughout. Here is an expert from the Q3 earnings call:

“As I dug into our historical financials, I found that our e-commerce business has been the primary driver of losses for the company. Over the past five years since we purchased our ecommerce businesses, we have lost in excess of $12M on those businesses, more than our entire debt outstanding. During this time, the Professional Chef side of our busines remained nicely profitable, but the overall company lost money for most of those five years..” - Earning Call Q3 2023, Transcript2

In January 2024, we got confirmation that they will shut down the e-commerce part of the business and also sell the related real estate, which would result in about $10 million net cash (after paying down their debt). (See here)

The Management

Bill Bennett spent 3 years at Walmart and later Kroger where he served as Vice President / Head of E-Commerce. However, despite less than a year in the CEO role, my assessment of Bill is not just based on words or his (over)qualified background. It is based on the impressive actions he has taken in less than a year as CEO. In May 2023, he appointed Brady Smallwood as Chief Operating Officer. Not only is Brady probably overqualified to be the COO of a $35 million market cap company (his resume: https://www.linkedin.com/in/bradysmallwood/), also Bill and him have worked together in the past and Brady is also incentivized to increase EPS (see his stock option plan: See here)

In addition, he has already been able to increase margins by raising prices and cutting marketing spending in the loss-making e-commerce business.

In January this year, Gary Schubert was appointed as CFO. I can basically copy & paste the part of Brady. Highly capable, worked with Bill at Walmart in the past, incentivized to increase stock price. (See here). Later in January, the company confirmed its plans to shut down its money-losing e-commerce business. (See here)

The Incentives:

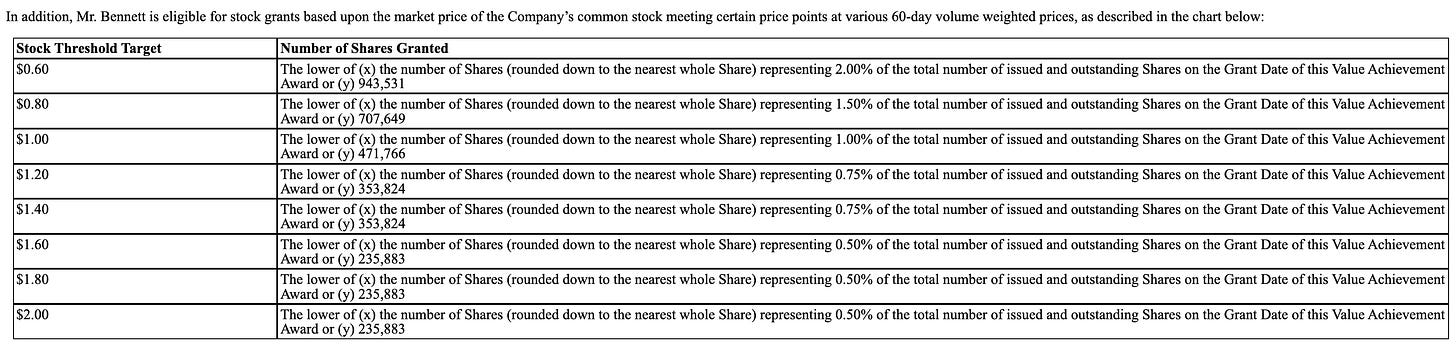

Why would a guy like Bill leave Kroger to join a (at the time) $13 million market cap company? Sure, it's a nice challenge, but I think he also wants to make some decent money, and the opportunity to walk away with say $10 million in the next 3–5 years is there. Look at his stock option plan. If the stock hits $2.00, he would own about 6% of a company with a market cap of about $100 million.3

Eventually, I could see this business being bought by a broadline food distributor. This is just speculation, of course, but I think it is a possible scenario. Aside from the fact that he is obviously convinced of the opportunity that IVFH represents, he has also convinced two of his old employees to join as well. The later they joined, the higher their stock options go. Probably another sign of confidence. As if that were not enough, the board of directors is also known to value investors and well aligned with shareholders. Pappas owns 17.3% of all shares and Jeff Gramm owns 7.4%.

Valuation

The current fully diluted market cap is approximately $40 million. As of this writing, they have already sold one warehouse related to the e-commerce segment for $1.9 million net of fees and mortgage4. The other warehouse in Pennsylvania is also for sale. It has an appraised value of $18 million and a mortgage of $8.8 million. This means that after selling the Pennsylvania warehouse as well, they should add somewhere between $8-12 million in net cash. Currently, they have $3.7 million in cash. Thus, the enterprise value should be around $23-28 million (not including further cash generation). As we have seen, the B2B business has historically generated an EBITDA margin of 10%. After the real estate sale, the company is debt-free and still has NOLs. As mentioned above, there is almost no investment in inventory or capex, so EBITDA is a good proxy for free cash flow. The runway revenue of the Professional Chef business was $60 million - which would imply an EBITDA of $6 million. Therefore, I believe the company is currently trading at less than 5x normalized EV/EBITDA. It is important to note that 10% was the margin under the old management; given the track record, I would not be surprised if the new management is able to increase their margin (with scale). Also, the professional chef business was basically neglected by the old management, and yet it doubled in revenue. This was also pointed out by Bill:

“Our hope is to reinvest into our Professional Chef business. A decade ago, we bought a specialty food distributor in Chicago called Artisan Specialty Food. It has essentially doubled in size since our purchase, and does a nice, profitable business for us in specialty food distribution in Chicagoland, but is limited by the size of its small 17K square foot warehouse.” - Earning Call Q3 2023, Transcript

Bill outlined his plan of becoming a $1 billion revenue company someday. His first milestone is increasing the revenue to $100 million and EBITDA to $10 million without any incremental debt or capital raises. I highly recommend to read/listen to the Earning Calls from Q2 and Q3, they will give a great impression, how Bill thinks and what his plan is. While it's not necessary for my initial thesis, I would not bet against him achieving his midterm goal of growing the business to $100 million in revenue and $10 million in EBITDA. Once this company becomes screenable, I believe it should be worth at least 10x EBITDA. If you look at some of the comps, 10x EBITDA is on the cheaper side of things.

Risks

Over 50% of sales are generated with one customer, US Food. While this relationship is healthy and has been for 5 years and the current management wants to diversify its customer base. This is still a risk. The way I see it: I think it is unlikely that the relationship would end, but the odds are not zero, it could happen, but I think that even if it did happen and revenues and profits got cut in half, I would still like to own the stock at 10x EBITDA. It would eliminate the upside of a re-rating, but not the upside of EPS growth.

Disclaimer: I bought the stock at an average price of $0.70 per share and may be biased in my opinion. This is not investment advice and meant for entertainment purposes only

Thank you for the great idea!

I'm curious about how you buy their capital-light story. It seems their current solution is serving the pan-Chicago area with their own logistics, while serving nationwide customers on US Food's network, so they don't have to do much incremental capex. But as they grow their business further, as they hinted the capacity of existing warehouse does have hampered the growth of the B2B business, would they achieve it by leveraging broadliners? Maybe that will make them even more rely on a couple of key customers. CHEF seems to have built their own logistics, that model makes more sense IMO.

the 16% drop in foodservices sales is concerning