Reflecting on a -0.9% Year: Lessons from 2025

A year of two extremes, the Chinese Farmer, and what I'm changing for 2026

Disclaimer: This is not investment advice and meant for entertainment purposes only, I hold a position in the discussed companies and therefore may be biased in my opinion. Please be aware that this is an illiquid Microcap, please only buy and sell with a limit-order. I also may trade around the mentioned positions.

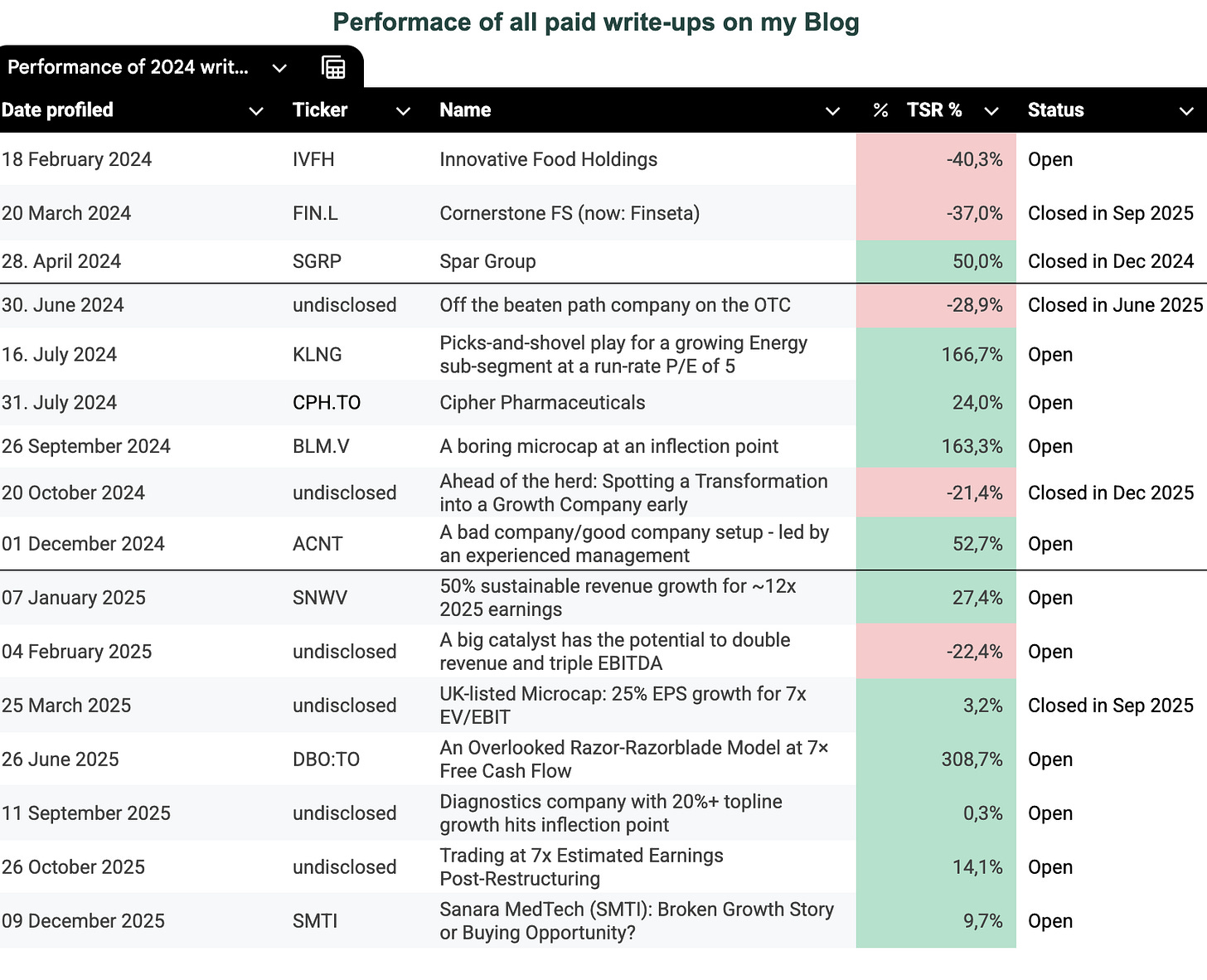

2025 was a year of extremes. My biggest winner from an IRR perspective was D-BOX Technologies (DBO.TO), up almost 300% since I bought and profiled it in June. At the same time, my largest position heading into the year is down 78% YTD.

This perfectly illustrates why microcaps are such a fertile yet volatile hunting ground. The chances that a Microcap is fairly valued at any given time are way lower than for a megacap. It’s almost more common that a Microcap is either over or undervalued.

This naturally leads to a strategy with higher turnover and a lower batting average than you'd see with large caps, but if executed correctly, a much higher slugging average. For a concentrated approach with Microcaps, that means results can and most certainly will be volatile, and a handful of big winners will account for most of your gains.

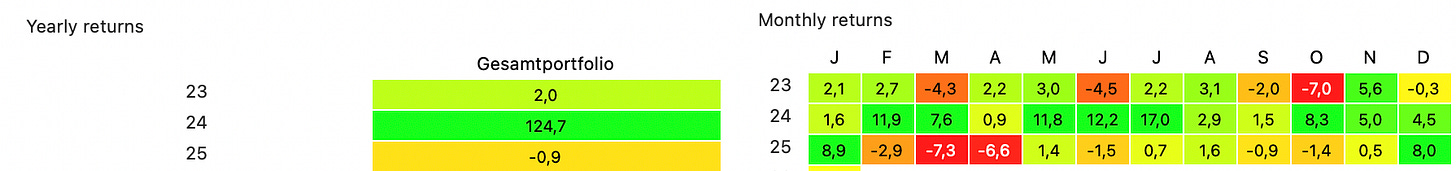

Since I started tracking my performance in 2023, my overall return has been 127% (31.4% CAGR) — but ~70% of that came from just three companies: Cipher Pharmaceuticals, D-BOX Technologies, and Koil Energy.

This year tells the other side of that story. My return has been -0.9%, lagging the S&P 500 which was up 16.3% in USD (or 4.77% in EUR, the currency I track my returns in).

Learnings

In soccer they say, the best matches to learn from are those where you played badly but still managed a draw. That pretty much sums up my year. There is no way I am satisfied with my own performance this year, but thankfully, I didn’t lose much money, just time. However, this year was a valuable learning lesson. It's easy to coast when everything's working, and impossible to think clearly when everything's falling apart. But you are forced to learn if you underperform.

While I have made several investments that did not work out, most of them have not hurt me much because they were either smaller positions and/or losses were cut shortly after the thesis broke. Finseta would be an example where my thesis was wrong and I moved on. I’ve barely spent any thought on that company after I sold my shares. It’s part of the game to be wrong.

The issue is if we don’t accept being wrong, if our ego takes over. I wrote about that at length here — and it is my biggest learning for this year. I hope it’s engraved into my skin now. It also shows that the biggest advantage of retail investors is not that they can buy illiquid companies, but that they can actually sell them once the thesis cracks, and let’s be honest, most will crack eventually.

The longer you invest in microcaps, the more of them you see round-tripping, and the less seriously you’ll take a “breakout” quarter. Recently, I read an older quarterly letter of mine where I explained my investing style in “inflection points” — while the overall theme is still true, I have seen too many of those “inflection points” just round trip shortly after.

My favorite story is the Parable of the Chinese Farmer. Whenever something ‘good’ or ‘bad’ happens to the farmer and everyone either starts to congratulates him or pities him, he simply responds with ‘Maybe.’ It’s a reminder not to judge events too quickly because you never know how things will actually turn out.

This applies perfectly to microcaps. As an example ETCC and ACFN both won big contracts. Is this good or bad? Certainly good, right? Well, it depends. It was in both cases good for the stock price in the short run, but in the medium term, it raised the expectations of investors that these new record earnings were sustainable. Once the revenue from the contract rolled off, shares plummeted. The “good news” became bad news. Maybe.

My own investment strategy has naturally evolved over the years. In 2023 I was very heavily focused on not losing money, mostly buying stocks that were backed by hard assets. My portfolio consisted of companies like LS Invest (large discount to book value), Centrotec (below net cash), and HRBR (below liquidation value). This has shifted completely over the following years to companies that are growing their earnings or where I think they can do that in the future. However, this approach can also make you take bigger risks than you actually realize.

The downside in most cases is bigger than we like to think. IVFH demonstrated that perfectly. And downside was something I was not as focused on as I should have been in the past two years. You can get downside protection either from the business quality itself, which increases the odds that the business can continue to grow (and deserve a higher multiple), or by buying it so cheap that even if you are wrong you won’t lose much. While both are nothing new to value investors, if you apply that to microcaps you’ll find how rare both are.

Most microcaps are not high quality businesses. They depend on the execution of management to a very high degree. They have no real competitive advantage. Therefore, naturally the downside is very rarely protected, and yes, your microcaps can also trade below net cash if the cash is not used properly. Even worse, having a large cash position only serves as downside protection if management does something smart with it. Best examples are Cipher Pharmaceuticals and Ascent Industries. Both bought back shares aggressively with their cash position and didn’t burn any with bad M&A. So even something like having half of your market cap in cash, is it good or bad? Maybe it‘s good, maybe bad.

2025 for the Blog and an outlook for 2026

In 2025 I profiled 7 companies in total. The good news first: the highest-performing write-up I’ve ever published came out this year in June. Overall, I am not satisfied with my own returns or with the published ideas in 2025. However, I do feel that the second half of the year was better than the first, both in my investing results and for the profiled ideas.

For 2026 I already have some good ideas on how to make the blog more valuable without adding noise. The easiest way to make more money on Substack is to just issue a write-up every week, but I will not do this and also don’t want to attract the people who want a new write-up every week. That being said, I will make sure to keep the quality high and still deliver frequent write-ups next year.

Additionally, I will introduce a new format so you can get a better understanding of the work that happens behind the scenes, what companies I look at, and my thoughts on current positions. Make sure to check your inbox in January for the first issue.

Portfolio update

At the end of every year, I go through my portfolio with a simple question: “Can this stock double from here within the next 12-18 months?” Some years I’ve had more success with this exercise than others. In 2025, for example, I obviously failed quite badly at it. Nonetheless, I think if done honestly, this exercise forces you to think about whether you’d actually buy these positions today at current prices.

After a particularly bad year like this one, I felt the urge to almost start with a blank sheet — keeping only the stocks I would buy again today. Unfortunately, actually executing that would be stupid for tax reasons, and some positions are illiquid enough that it would take time to exit anyway. But the mental exercise itself was valuable, and the end result was basically as follows: