Sanara MedTech (SMTI): Broken Growth Story or Buying Opportunity?

90%+ gross margin business trading at historical lows

Note: I usually reserve deep dives like this for paid subscribers. I’m making this one free as an exception to show the work I normally do behind the paywall.

Short thesis

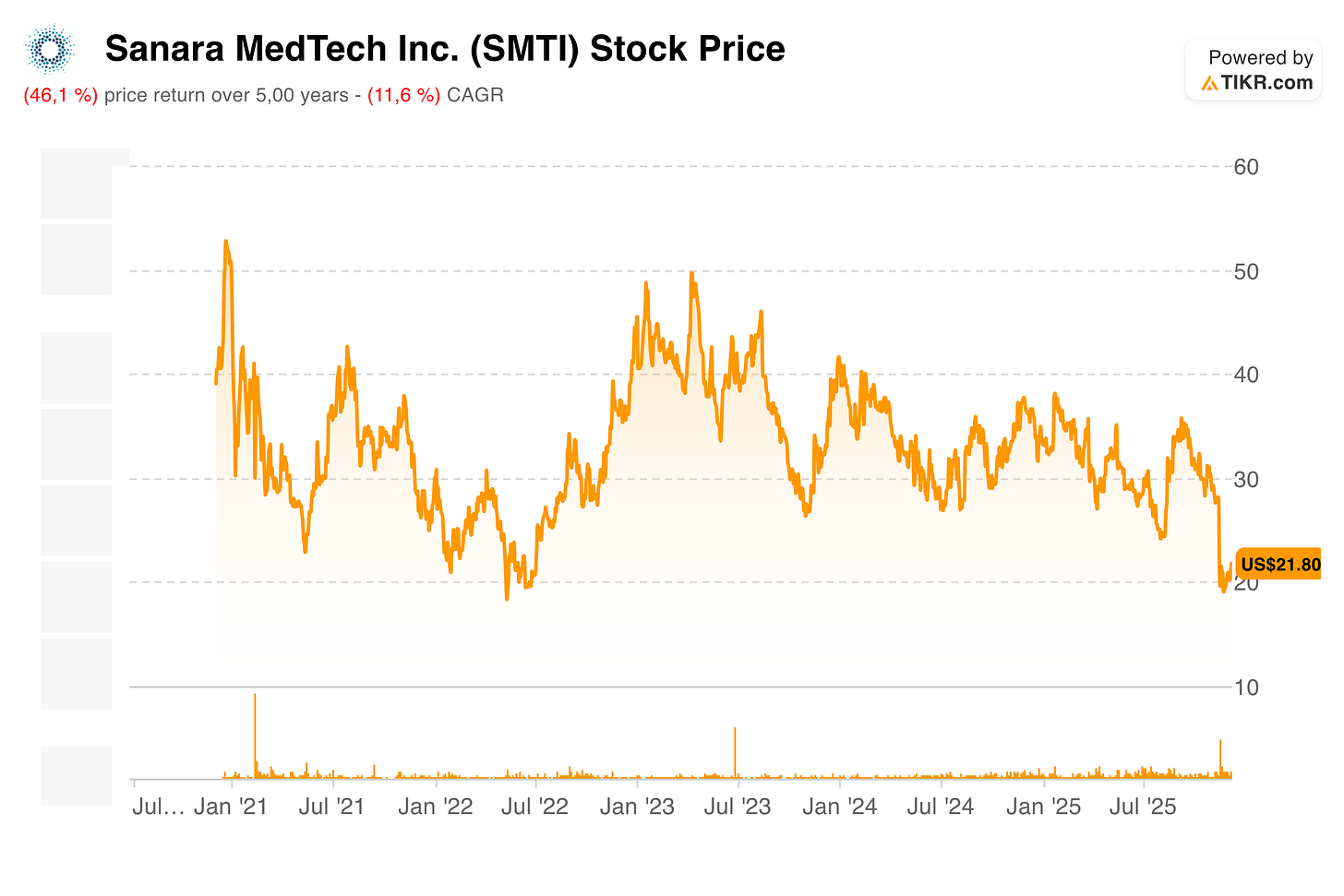

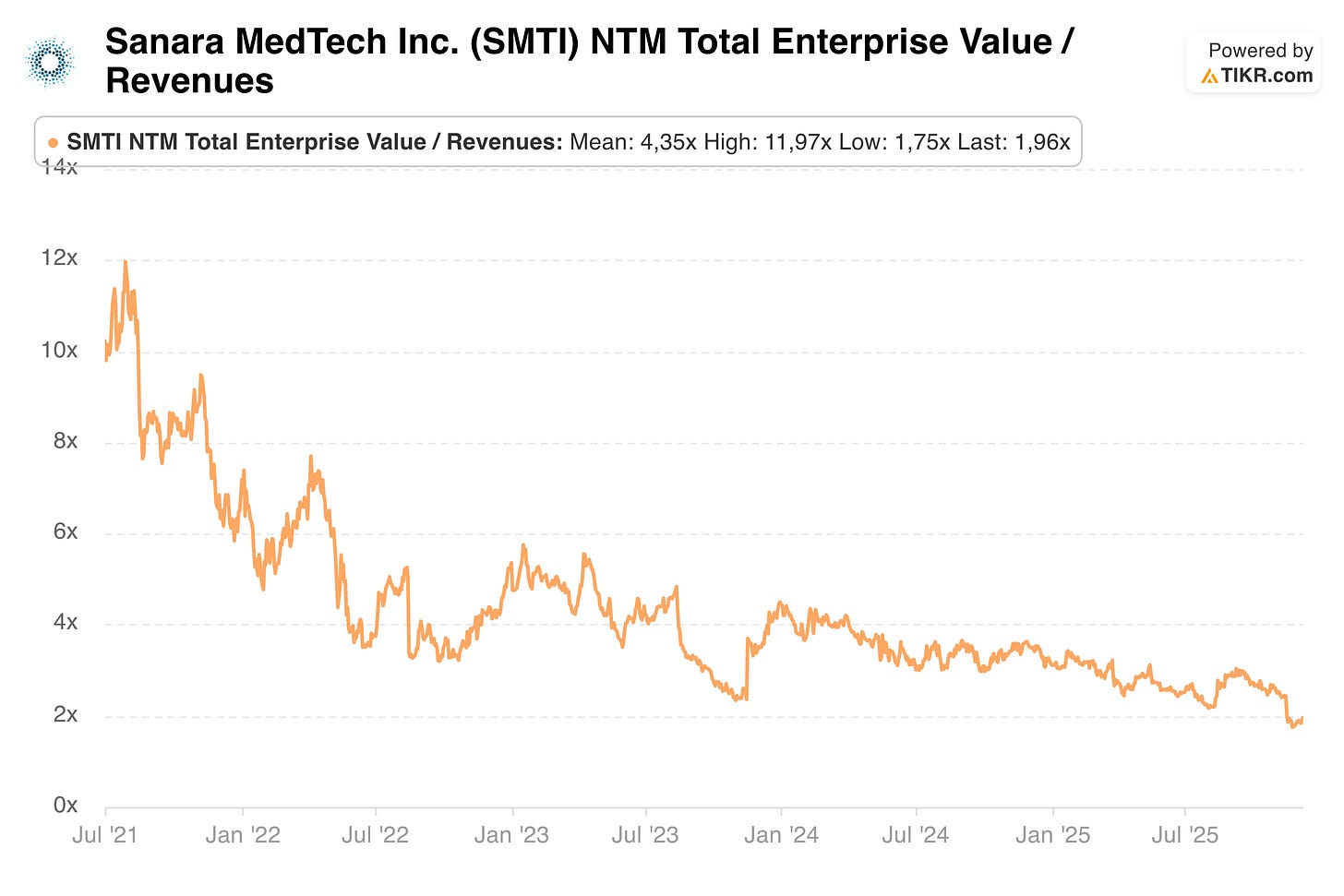

Currently, Sanara MedTech (SMTI) trades at less than 2x EV/Sales, its lowest valuation since going public, while its mean historical valuation (and those of peers) offers 100% upside from re-rating alone. The market discounts SMTI so heavily for two reasons: Years of disappointing shareholder returns from investing their profitable surgical business into their “moonshot” project THP have eroded trust and capital. Now that these ventures are discontinued, Sanara issued weak Q4 guidance, making SMTI the ideal tax-loss selling candidate for an already frustrated shareholder base.

I argue that: SMTI should no longer be punished for past capital allocation mistakes, and the growth story isn’t broken. They’re just facing tougher comps for Q4. Even if growth decelerates to 15%, you’re still buying shares in a high-quality category leader in hydrolyzed collagen, with two potential category leaders in their pipeline, inflecting EBITDA margins and 90%+ gross margins. All of this at its lowest valuation in history and much lower than any private transaction of its peers in the past.

Overview

Name: Sanara MedTech

Ticker: SMTI

Price: $21.76

Market Cap: $193 million

Enterprise value: $223 millionSanara MedTech markets soft tissue repair and bone fusion products. While they sell multiple products, the bulk of its revenue (~80%) comes from its star product CellerateRX, a hydrolyzed collagen. Apart from CellerateRX (soft tissue repair), they offer five more products on the soft tissue front. BIASURGE, which launched in 2023, is the only one of those that could eventually become a significant part of revenue as well. Bone fusion contributes roughly 12% of revenue but has been flat in recent years. They have one more potential star product in the pipeline with OsStic.

The business model of Sanara is extremely asset-light. They acquire the rights to certain products that have been developed by other companies and distribute them into hospitals. In some cases, they pay the manufacturer a royalty as part of the licensing agreement (BIASURGE and OsStic). For CellerateRX, they acquired the assets directly from the original owner in August 2023, allowing them to eventually stop paying royalties. Most deals are structured as “related party transactions” because their Chairman and majority owner Ron Nixon has a stake in some of these companies. I view this as one of the competitive advantages of SMTI.

Their distribution model is also unique. They currently have 40 regional sales managers (RSMs) who manage relationships with the underlying distributors. A distributor is an external company that employs 1099 reps. They can vary in size from one-man operations to hundreds of 1099 reps within one distributor. The distributor earns a commission.

Their product portfolio

Sanara’s product portfolio includes CellerateRX (hydrolyzed collagen powder), BIASURGE (no-rinse irrigation solution), FORTIFY TRG (tissue repair graft), FORTIFY FLOWABLE (flowable extracellular matrix), TEXAGEN (amniotic membrane allograft), and a bone fusion segment consisting of ALLOCYTE (cellular bone matrix), BiFORM (synthetic scaffold), and ACTIGEN (demineralized bone matrix).

CellerateRX is the most important product of the company and is mainly responsible for the growth from less than $9 million revenue in 2018 to $100 million in 2026. BIASURGE, which launched in 2023, has the potential to become a significant revenue contributor, while OsStic (expected to launch in Q1 2027) could become another star product. The rest are largely irrelevant for this thesis: Fortify and Texagen are commoditized “bag fillers” for sales reps. The bone fusion portfolio contributes roughly 12% of revenue but has been flat. Those products are standard “me-too” offerings in a market dominated by giants like Medtronic and Stryker, lacking the competitive moat of CellerateRX, BIASURGE and OsStic.

Therfore I will focus on three products: CellerateRX as it‘s the majoriry of the business, BIASURGE and OsStic as these two have compelling value propositions and can become significant driver of future revenue.

Understanding the success of CellerateRx

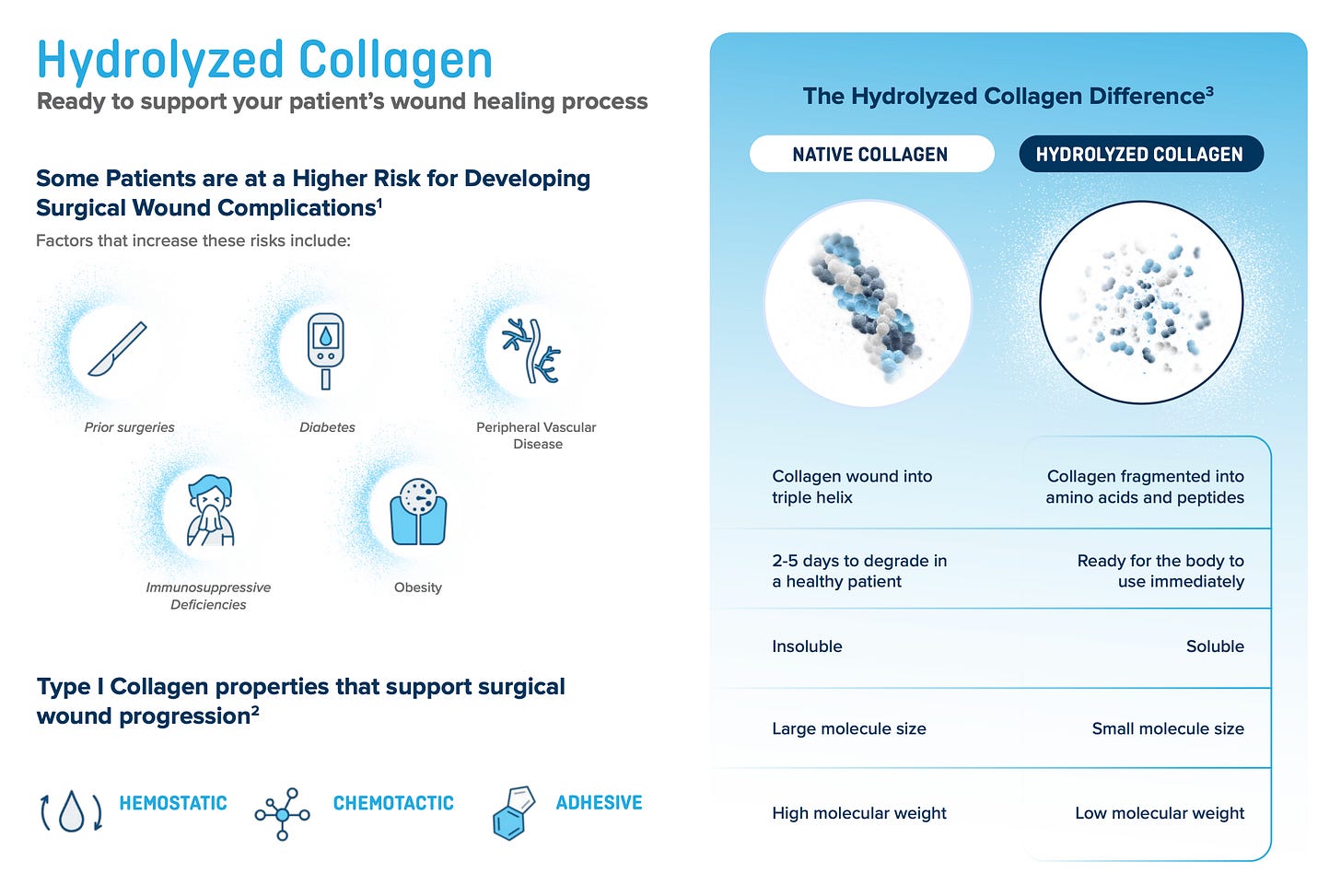

CellerateRX is the only activated hydrolyzed collagen type 1 on the market. It is applied mainly in orthopedic and spinal surgeries for high-risk patients to prevent wound infections. A study claimed that CellerateRX can decrease surgical site infections (SSI) by 59% compared to native collagen1. The value proposition is simple and compelling: A surgery costs $50,000-$100,000. The risk of SSI is higher for high-risk patients, and applying CellerateRX decreases thar risk materially. If a patient gets an infection in the wound, it means reopening it. The cost is another operation worth ~$50,000 or more. So the value proposition is similar to that of insurance: Pay ~$700 (price of CellerateRX) to prevent the potential cost of ~$50,000.

CellerateRX does not have a separate reimbursement code. It’s bundled into the overall surgical payment, meaning it’s a direct cost for the hospital. But given the potential savings from avoiding complications, hospitals usually see the value. The value proposition is strongest in high-risk, high-cost procedures like spine fusion and joint arthroplasty. The company is also expanding into vascular and plastic/reconstructive surgery.

Competition

CellerateRX created this category and still owns it. The alternatives are native collagen products. The main advantage of hydrolyzed collagen compared to native collagen is higher bioavailability, which increases the speed at which the wound closes. The body can work much faster with hydrolyzed collagen than with native collagen. This is extremely valuable for patients that have a high chance of wound complications.

The average selling price (ASP) for CellerateRX is roughly $700-800. Native collagen is way cheaper with an estimated cost of $50-$200. Apart from a bunch of commoditized native collagen products, one of their competitors is MicroMatrix, a porcine urinary bladder matrix originally from ACell that got acquired by Integra for roughly 4x EV/Sales. MicroMatrix comes as a powder or sheet and represents an intact extracellular matrix rather than hydrolyzed collagen. Same issue here as with native collagen: the bioavailability is much lower than hydrolyzed collagen.

Now you probably ask yourself, why doesn’t someone come up with hydrolyzed collagen themselves? The answer is it wouldn’t be that easy. Sanara’s particular formulation is protected by patents and proprietary know-how. Best case is someone would spend $50 million+ and a decade to develop something that doesn’t violate Sanara’s IP and has the same effect. Add on top of that the work to get approvals by hopsitals and built your distribution network and you are looking at an pointless task for competitors to try to beat CellerateRX at its own game.

The rising star: BIASURGE

Sanara MedTech never had the ambition to be a one-product company, although they have been exactly that for the majority of their time on the stock market. This, however, could look a little bit different in the future. While CellerateRX will stay the dominant force thanks to its strong market position and headstart against their other products, the next one in line is BIASURGE. Launched in November 2023, Sanara pays a 2-4% royalty on net sales to Rochal Industries under the BIAKŌS license.

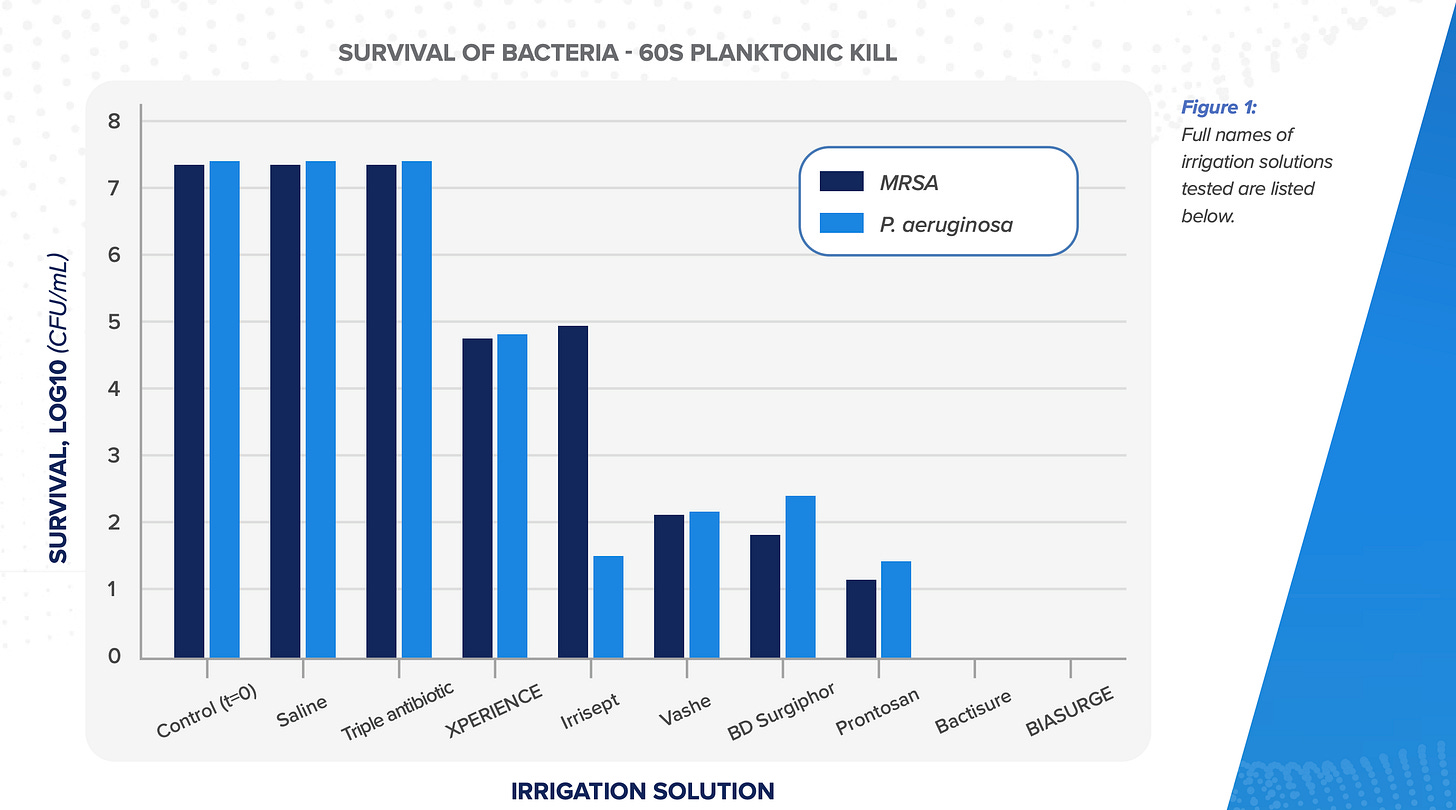

BIASURGE is a no-rinse irrigation solution used by surgeons to clean wounds during an operation. It is a powerful surgical wash that has two competitive advantages: it kills biofilm-producing microbes and prevents their attachment to implant materials, and it doesn’t need a rinse afterward. The key difference to CellerateRX’s unique value proposition is that BIASURGE is an improvement offer (a potential best player in an existing category) whereas CellerateRX was a greenfield opportunity when it came out. So, while CellerateRX arguably has a stronger value proposition, BIASURGE, once it starts to grab market share from its competitors, could in theory scale faster than CellerateRX did in its early days because hospitals already allocate a budget to irrigation solutions.

Another difference to CellerateRX is that the use case for BIASURGE is bigger. While CellerateRX only makes sense for certain surgeries with high-risk patients, BIASURGE could, in theory, be applied to every surgery because every wound needs to be washed.

Competition

The main competition to BIASURGE is Irrisept, which was acquired by private-equity firm ARCHIMED in 2024. Irrisept is the market leader in this segment, but has two disadvantages compared to BIASURGE: it kills less bacteria2 and needs a rinse after applying it, whereas BIASURGE is a no-rinse solution.

I believe Irrisept got a headstart compared to BIASURGE. BIASURGE is currently available in 1L bags, whereas Irrisept is offered in smaller bottles (150 mL and 450 mL) as well. Could this have hindered adoption for BIASURGE? Maybe. However, Sanara is working on other doses as well. Irrisept claims <$80 per use. Older transcripts of Sanara have communicated that one 1L bag costs $200. I don’t know how much you would need for one surgery, but it’s fair to assume that BIASURGE is a bit more expensive than Irrisept.

The star in the pipeline

One product that has a similar greenfield opportunity is OsStic. OsStic is basically a “bone glue” that surgeons can use to glue shattered bone pieces back together, especially in tricky areas where metal screws and plates are too big or clumsy to work. It’s a synthetic injectable bone void filler designed to help reduce periarticular fractures and provide provisional fixation of fracture fragments. OsStic has received FDA Breakthrough Device Designation for periarticular fractures and is set to launch in Q1 2027.

The market opportunity in periarticular fractures is roughly 100,000 surgeries a year in the US. From there, they could expand into other surgeries as well. The product will have a much higher price point than CellerateRX or BIASURGE, likley in the $2500 range, making it less of a volume and a more specialised product.

There is one upcoming competitor: TETRANITE from RevBio. While they started mainly in dental, the product has received FDA approval for a 20-patient pilot trial in complex wrist fractures (extremity fractures)3. By my understanding, this will be the closest competitor that (for the beginning) focuses on a different subset of surgeries (extremity vs. periarticular). Overall, for a new category like this, one can argue that having one competitor focused on adjacent surgeries could increase awareness for the new category in general.

The opportunity

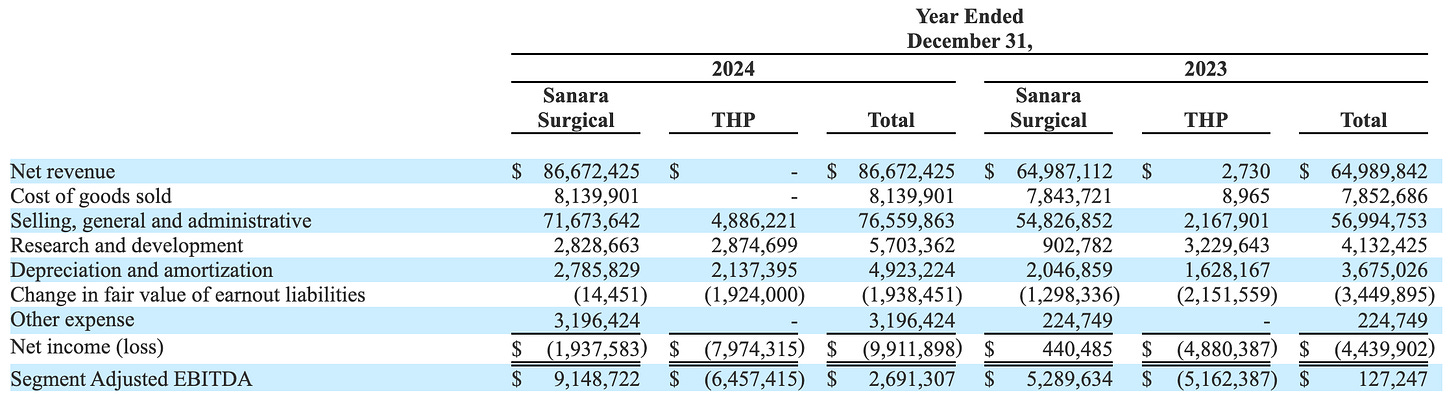

First, a look back. In 2020, Sanara MedTech started its division TissueHealthPlus (THP), back then under the name WoundDerm. The goal was to build a “Value-Based Care” platform for chronic wounds. The result after 5 years was this: No revenue and $7 million+ cash burn a year.

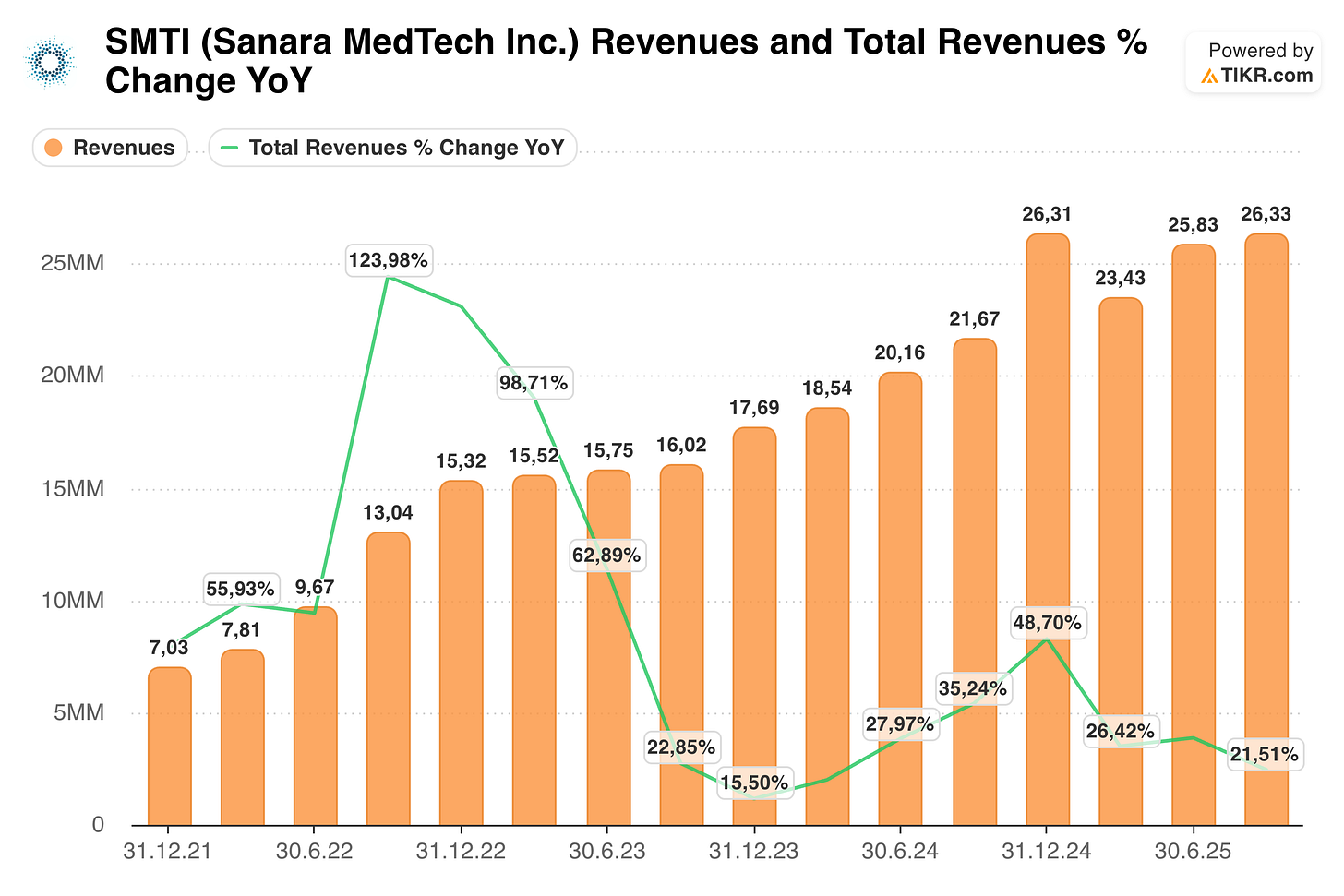

This meant for shareholders they saw no share price appreciation in the last 5 years, despite the fact that the surgical business went from $24 to $102 million in revenue and EBITDA turned from negative to $16 million (TTM).

After they appointed Elizabeth Taylor as CFO and Seth Yon as CEO, a couple of months later followed the announcement of the shutdown of THP. However, the stock dipped that day by more than 30% from $30 to $20. The reason for that, I believe, was largely caused by their guidance for Q4. Investors fear that the growth story is over:

“With respect to our net revenue over the balance of the year, as a reminder, our net revenue in the fourth quarter of 2024 grew 49% year-over-year. This exceptional performance benefited in part from increased demand for BIASURGE following the disruption caused by Hurricane Helene last fall, which caused industry shortages of IV fluids and saline solutions.

As we have shared previously, of the $26.3 million of net revenue generated in the fourth quarter of 2024, we believe approximately $1.8 million was attributable to this unique dynamic. Excluding this $1.8 million headwind, we expect our revenue in the fourth quarter of 2025 will increase in the high single digits to low teens on a year-over-year basis compared to strong year-over-year growth in the fourth quarter of 2024.”

- Q3 2025 earnings call

First, I think even if growth would decrease materially, the market’s reaction was probably fueled by potential tax-loss selling and general frustration with the company’s capital allocation decisions in the past. After assessing the opportunity, I do think they can continue to grow by 15%+ for a couple of years. Here are the potential growth drivers:

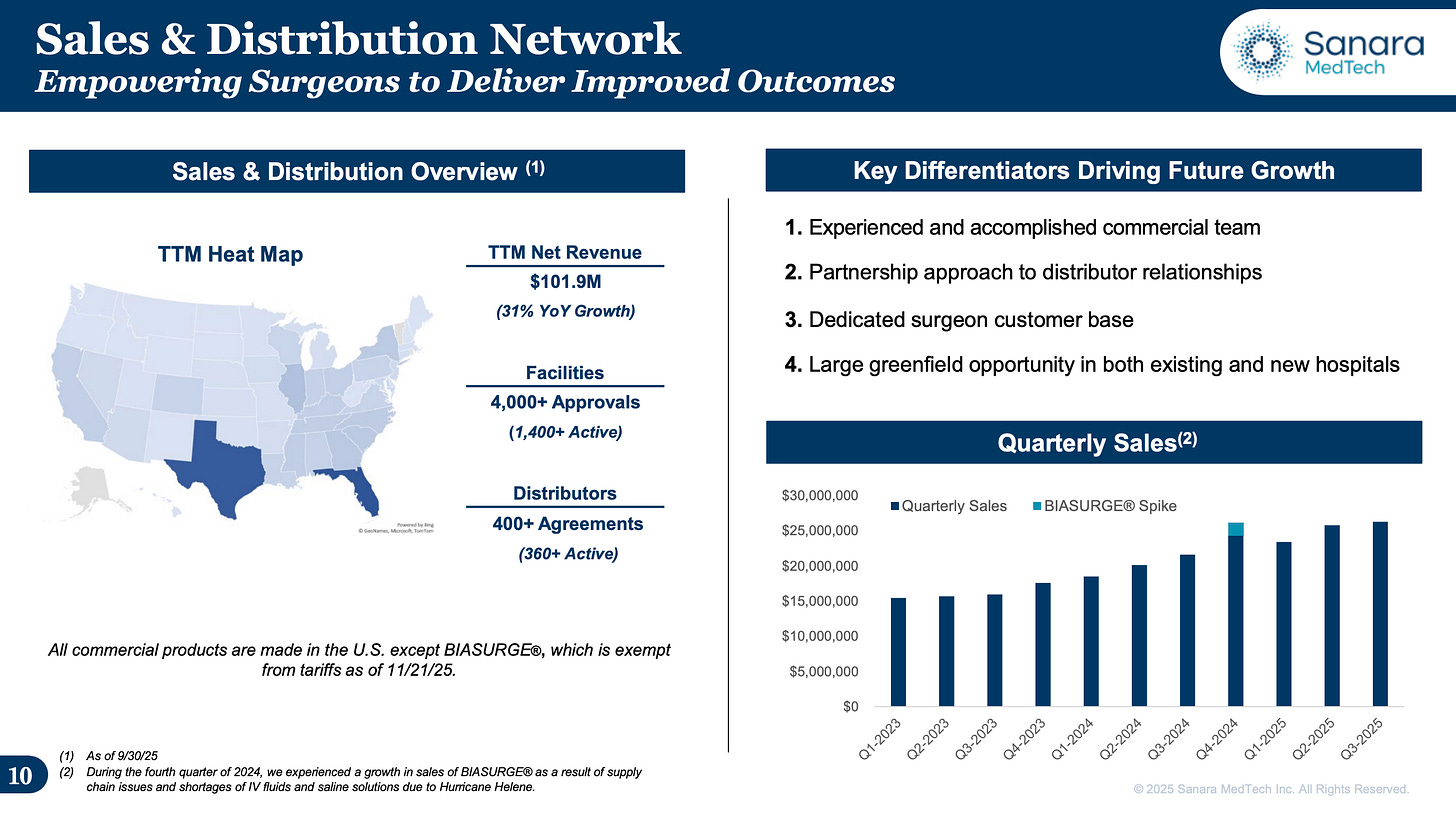

The Model Their model is as follows: Get approval from a hospital (currently 4,000 hospitals approved) and sell into these hospitals with their distributors (1,400+ active hospitals they’ve sold into).

There are many layers they can grow with just CellerateRX. First, they can sell into more hospitals (closing the gap between approved and active). They can increase the number of distributors. And as I said, distributor is not equal to distributor in terms of size, so there’s still a lot of room within the current distributors as well.

#1 Growth Within One Hospital (within Ortho & Spine + adjacent surgeries)

Say in hospital A they currently have five 1099 reps selling their product to the spine surgeons. The rep is therefore “the spine guy.” Within the same hospital, they may have already covered all spine surgeons, so they could expand into plastics. They already have the relationship with the distributor (and in most cases already had the conversation that they ultimately want to expand into other reps as well), so they could go to the “plastics rep” as well, within the same hospital. Further, there are a lot of hospitals where their penetration within the key segment ortho & spine is still low. So even within the current active hospitals, there’s still plenty of room to grow, either within the key areas or by expanding.

#2 Increasing the Number of Hospitals Sold Into

The next simple way is increasing the number of hospitals they sell into (i.e., closing the gap between approved and actively selling into). This would likely also correlate with the distributor agreements signed, and both numbers have been growing nicely over the past years. In Q2 2024, the number of agreements with distributors was 300+, now it’s 400+. Number of active hospitals sold into in the last twelve months was 1,100+, now it’s 1,400+. Both trends trends are encouraging and point towards growth.

Penetration Upside If you take an ASP of $700 for CellerateRX and assume $80 million in revenue from the product, that would lead to 114,000 cases sold. By my research, there are 1.6 million spine surgeries a year, 3 million attributable ortho (joint replacement, trauma), and roughly 1 million plastics (ex. beauty related). Meaning 5.6 million surgeries in total. Probably 40% of those would fall into the high-risk bucket (obese, diabetic, smoker, old age, etc.), meaning roughly 2 million surgeries per year where CellerateRX usage would make sense. This would imply roughly 5% penetration rate. While some numbers here will be off, it’s safe to assume that the penetration within CellerateRX is still low. Whether it’s 3%, 5%, or 7% doesn’t matter much to make the point. What penetration rate is achievable? I don’t know, maybe 15%, maybe 20%. Point being is that the growth runway for CellerateRX is still there, just from a market perspective.

#3 New Products This will likely take the longest time but offers great, and totally underappreciated, upside by the market. They don’t disclose BIASURGE revenue, but based on royalties paid in 2024, I assume it was between $4.4-8.8M—with $1.8M attributable to the spike in Q4 2024. Either way, it’s still small, likely around 5% of total revenue. The opportunity lies in the cross-selling with existing CellerateRX customers. The company describes it as a one-two punch where the customer is buying CellerateRX and you add BIASURGE to that bag as well. While the product also needs new approval in the hospitals, they already have the relationships in place and can slot this product into their existing distribution structure. The same goes for OsStic. In theory, BIASURGE and OsStic both have the potential to become $50+ million in revenue products.

Hence, I think the runway for growth is still long. The only two arguments against it (that the market is focusing on right now) are: the guidance for Q4 and the law of large numbers.

“I would give some perspective on the guidance, as even without the hurricane bump the growth rate was still 38%.

As far as Q4 performance and looking at that, as Elizabeth had mentioned, we grew 49% in Q4 of 2024. If you take out that adjusted $1.8 million, it’s still about 38%, which obviously was just a very, very significant growth quarter for us.And even inside that 38%, when you think about the $1.8 million that we grew as a result of the saline shortage, that was solely on just new accounts. So we had other growth as well coming from BIASURGE in existing accounts as well. That’s not captured in that $1.8 million.

So we know we had a really significant number. We still believe in a very strong quarter this coming quarter as well. And again, I don’t think that the expectation going into the fourth quarter should be concerning to anybody.”

- Q3 2025 earnings call

Sanara MedTech had similar patches when they faced stronger comps. Sure, 123% is different than 48%—and overall revenue (including the bump) will be flat compared to the 15.80% at the end of 2023. So yes, the company will obviously grow slower than in 2022-2024. But I think for the next few years they can grow by 15%+.

And, at the end it all comes down to..

Valuation

When the company was growing 50%+, it also had a different valaution than now:

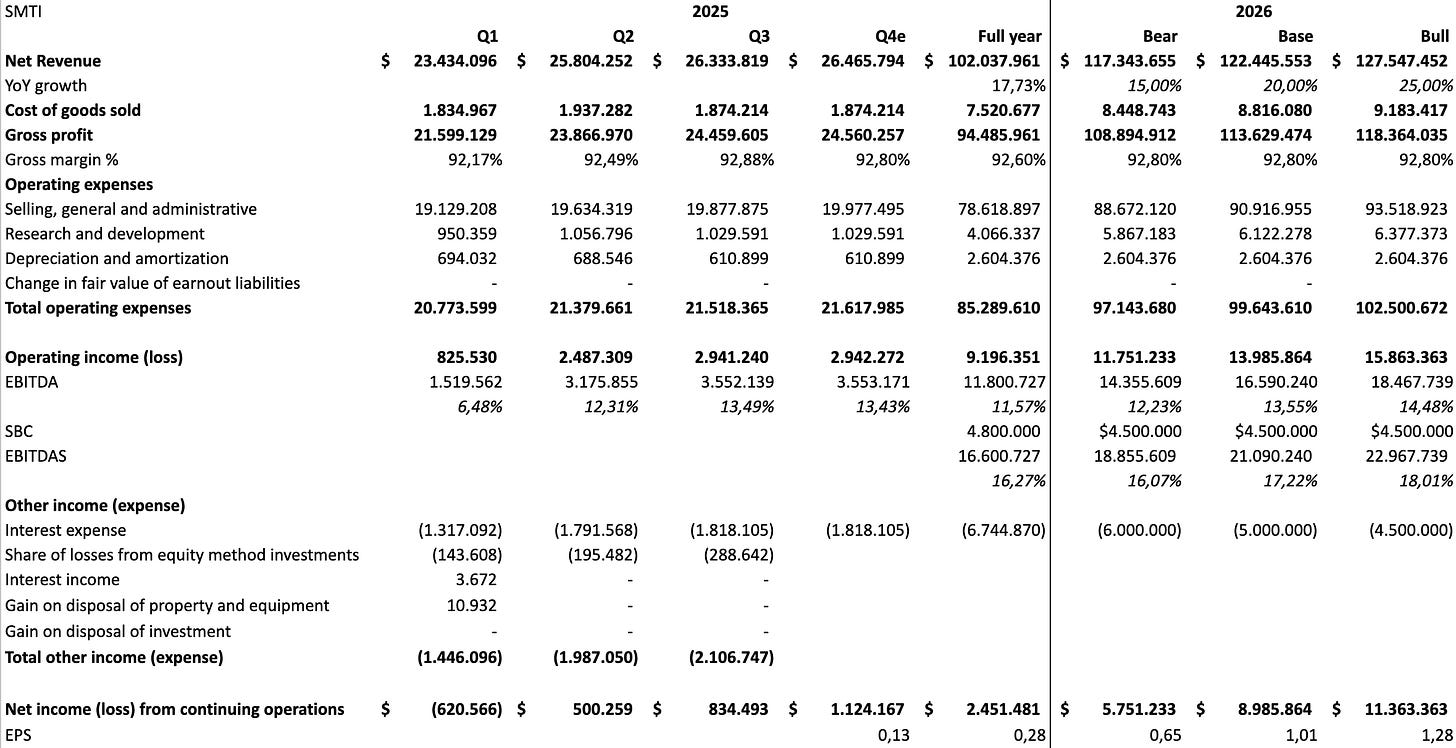

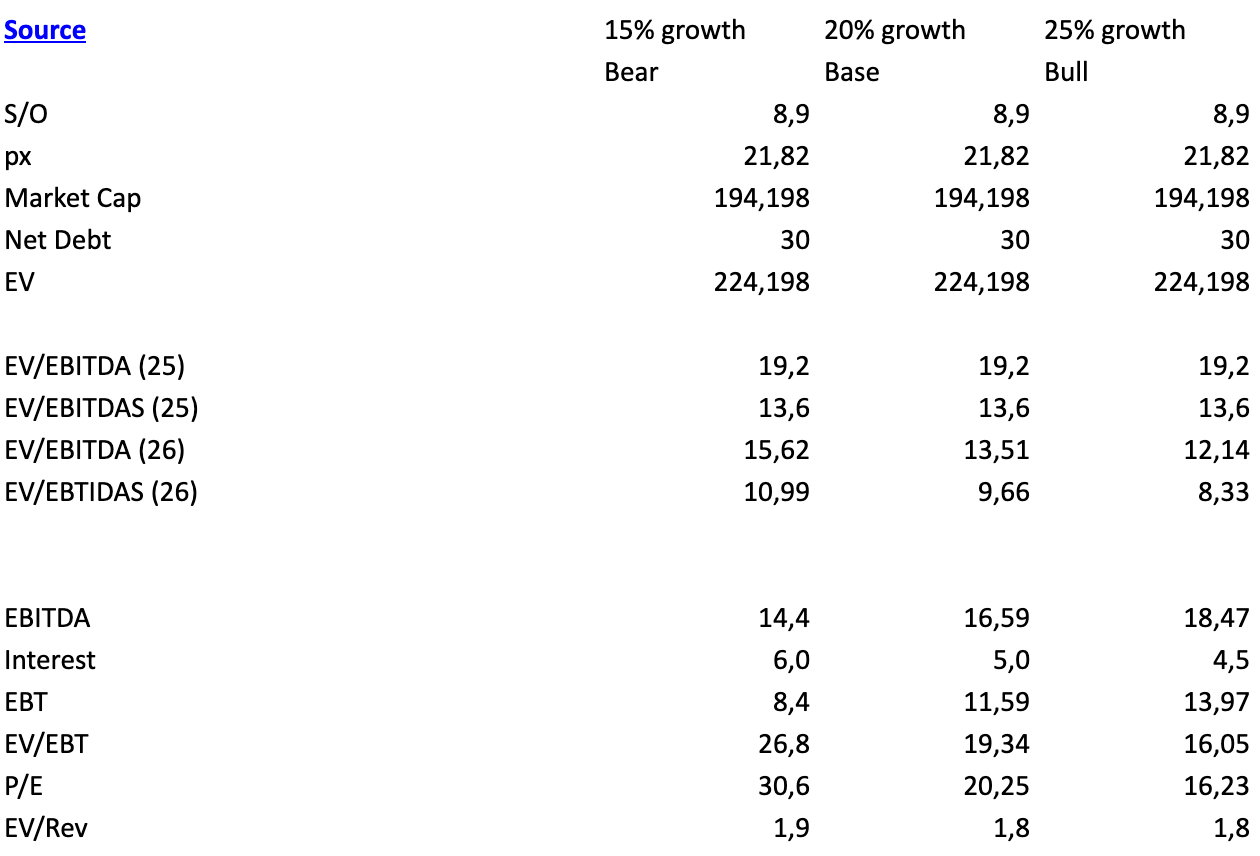

For next year, I model three scenarios between 15-25% growth. The more time I’ve spent on this name, the more confident I am that the base or bull case is more likely than the bear case, and I think the company will also start communicating their growth aspirations by the start of next year. Their SG&A line consists of their RSMs, which should increase only slightly, general and administrative costs that should stay pretty flat, and the commission paid to the 1099 reps, which scales with revenue. Hence, I expect only some operating leverage.

The other variable is their interest payment. Currently they have $45 million in debt and pay a staggering 13.5% interest rate. They have publicly stated to be able to refinance that debt. I assume lower interest expenses by Q1 2026. Any way you slice it, the company appears to be cheap, too cheap in my opinion:

We can use a couple of private transactions to estimate a fair value of Sanara MedTech. ACell was acquired for 4x EV/Sales and was growing 13% at that time. Acera Surgical did roughly $90 million in revenue and was recently acquired for $725 million + $125 million in milestone payments, meaning 8-9.25x EV/Sales.

Conclusion

While Ron Nixon is the genius behind Sanara and basically created the company, ultimately he failed to create shareholder value. The changes this year are evident, in my opinion, that Sanara has entered a new era. The era of being a disciplined, simple growth story. Seth Yon has been with the company for a long time, when there were just 8 employees. He worked his way up from Director of Sales to CEO in his 7 years at Sanara. Elizabeth, the new CFO, has worked in the hedge fund industry before. After talking to them, I came away thinking that Sanara is now being run way more for shareholders than before, and I believe this will become apparent through more disclosures, better capital allocation, and rewarded with an appropriate multiple of 3-5x EV/Sales. You can think of this like when Apple went from Steve Jobs to Tim Cook.

Risks:

Growth stalls due to “law of large numbers”

BIASURGE never takes off

OsStic launch costs money but takes too long to become material

Catalysts:

From Q1 onwards "clean" quarters without THP spend, and therefore profitable

Stronger growth rates from Q1 onwards coompared to Q4 guidance

Launch of OsStic

Refinance of debt

The Joint-Venture with ChemoMouthpiece could inflect once a dedicated reimbursement code is obtained for the product.

Discovered by institutions

This SMTI write-up is a one-off free deep dive that’s usually reserved for paid subscribers only. If you want full access to future write-ups like this, real-time updates on SMTI and other names, and my actual portfolio, upgrade to a paid subscription here.

Disclosure: I am long Sanara MedTech (SMTI) and may buy or sell shares at any time without notice. This write-up is for informational purposes only and is not investment advice.

Special Thanks to Christopher Plahm from Tall Pines Capital who helped me get up to speed on my research.

https://sanaramedtech.com/news/sanara-medtech-inc-announces-the-publication-of-a-5335-patient-study-demonstrating-a-significant-reduction-in-surgical-site-infections-when-activated-collagen-celleraterx-surgical-powder-was/

https://sanaramedtech.com/wp-content/uploads/2025/08/BIASURGE-Research-Prevention-of-Microbial-Biofilms-on-Implantable-4.17.2025.pdf

https://www.businesswire.com/news/home/20251031329353/en/RevBio-Receives-First-FDA-Approval-for-a-Bone-Glue-to-Treat-Extremity-Fractures-in-a-Clinical-Trial

Just one note: In the EBT calculation in the valuation screensshot you forgot to subtract D&A or was that on purpose?