Spar Group (SGRP) trades at less than 3.5x EV/EBITDA with several potential catalysts

Former value traps unlocks value

Edit: This is a closed idea, Spar Group is in talks to be acquired by private equity fund Highwire Capital for $2.50 per share. The merger has been approved by shareholders, but the deal is not closed yet. I no longer own shares of Spar Group (SGRP)

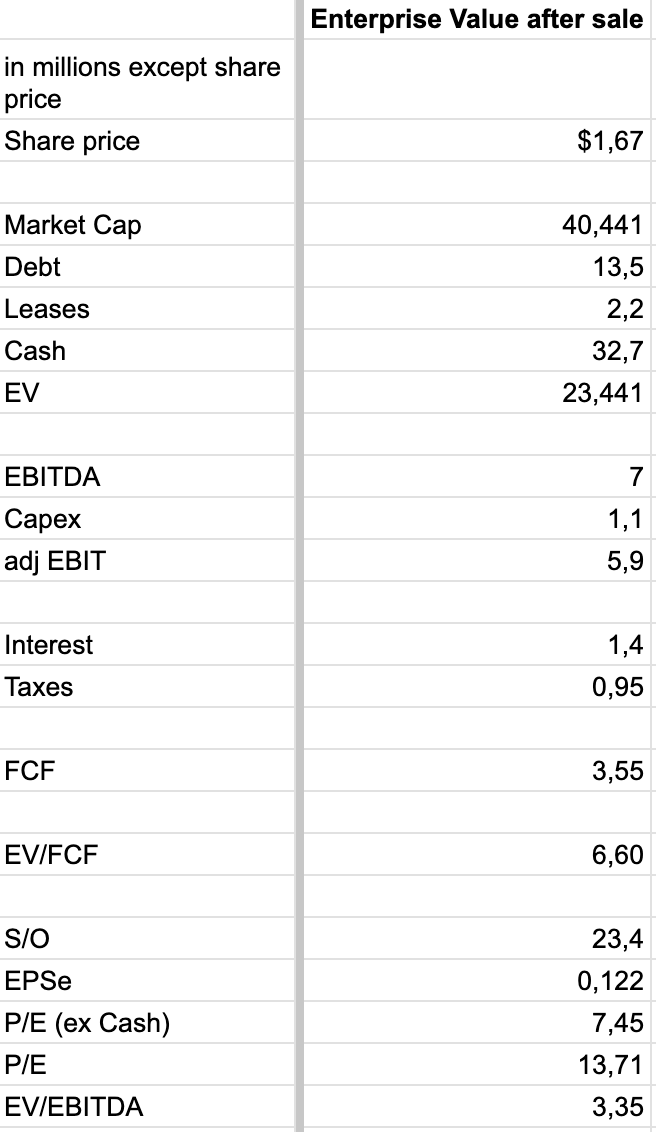

After the sale of its joint venture partnerships, Spar Group will have about 40% of its market cap in net cash and trades at less than 3.5x EV/EBITDA (15% FCF yield). Share buybacks and M&A serve as potential catalysts going forward.

Overview

The Spar Group is a marketing services company that helps retailers increase their sales. They offer a wide range of services:

Merchandising is the largest part of their revenue, they help stores to increase their sales by improving the presentation of products in the store, promotional strategy of the products, inventory and price audits.

They also offer store remodeling services to help clients renovate stores, close underperforming stores or open pop-up stores. In addition to retail, they also benefit from increased e-commerce sales through their distribution services arm.

They mainly provide their clients with staff for their distribution centers. In the last years they have also worked on their own software, SPARView technology, which helps their clients to analyze and optimize their merchandising actives.

In short, they are usually the last person to touch a product in the retail store and help their clients increase their sales. They work primarily with contractors rather than their own employees to deliver their services. As with any agency, the business model itself offers no competitive advantages, but long-term relationships with well-known brands provide the company with predictable and stable cash flows - to give you an overview of the companies they work with:

Despite being a microcap, its market capitalization has been below $30 million for most of the past few years. Not only does this company work with big brands, but it also has big revenue numbers. Revenues over the last five years have been around $250 million. Spar Group is a large company in a microcap stock.

The trend over the last few years has been for retailers to have a harder time recruiting people, especially when unemployment rates are low, they have a lot of competition in the job market. They often hire part-time employees. At the same time, store openings seem to be accelerating, with Walmart, for example, announcing to open 150 stores earlier this year. This translates into more business for Spar, as retailers rely on trained third parties to remodel stores.

Turing the value trap…

In February 2021 the current CEO was appointed. Mike Matacunas has worked before as CEO at Five Hill Capital, an investment firm and as CAO at Dollar Tree, where he led the integration of the acquired Family Dollar. One year later, he reintroduced earnings call, the first time since 2015.

He also came to an agreement with the largest shareholders and founders of the business, to buy back their preferred shares. By 2024, the overhang should be completely eliminated. At the end of 2022, management announced that it had initiated a process to evaluate strategic alternatives.

“On September 8 (2022), we announced that the Board had initiated a process to evaluate potential strategic alternatives to maximize shareholder value. This process includes a full range of options, including a sale, merger divestiture going private as well as other potential value creation opportunities to accelerate our growth and return profile as a publicly traded company.”

- Earnings Call from Q3 20221

This strategic process finally came into an end (I suppose?) with the sale of their joint venture deals.

“We announced selling our 51% interest in Australia, China and national merchandising services in the United States. And today, we are announcing our agreements to sell the company's joint venture positions in Brazil and South Africa, which you closed sometime during the second fiscal quarter of the year. These divestitures simplify our portfolio, financial structure and operating model. This simplification provides more focus on our core business that is growing by double digits and our ability to capitalize on the shifting macro trends.

- Earnings Call from Q4 20232

Two days later, the board authorized the repurchase of up to 2,500,000 million shares outstanding within the next year. This would represent more than 10% of outstanding shares. 3

Financials

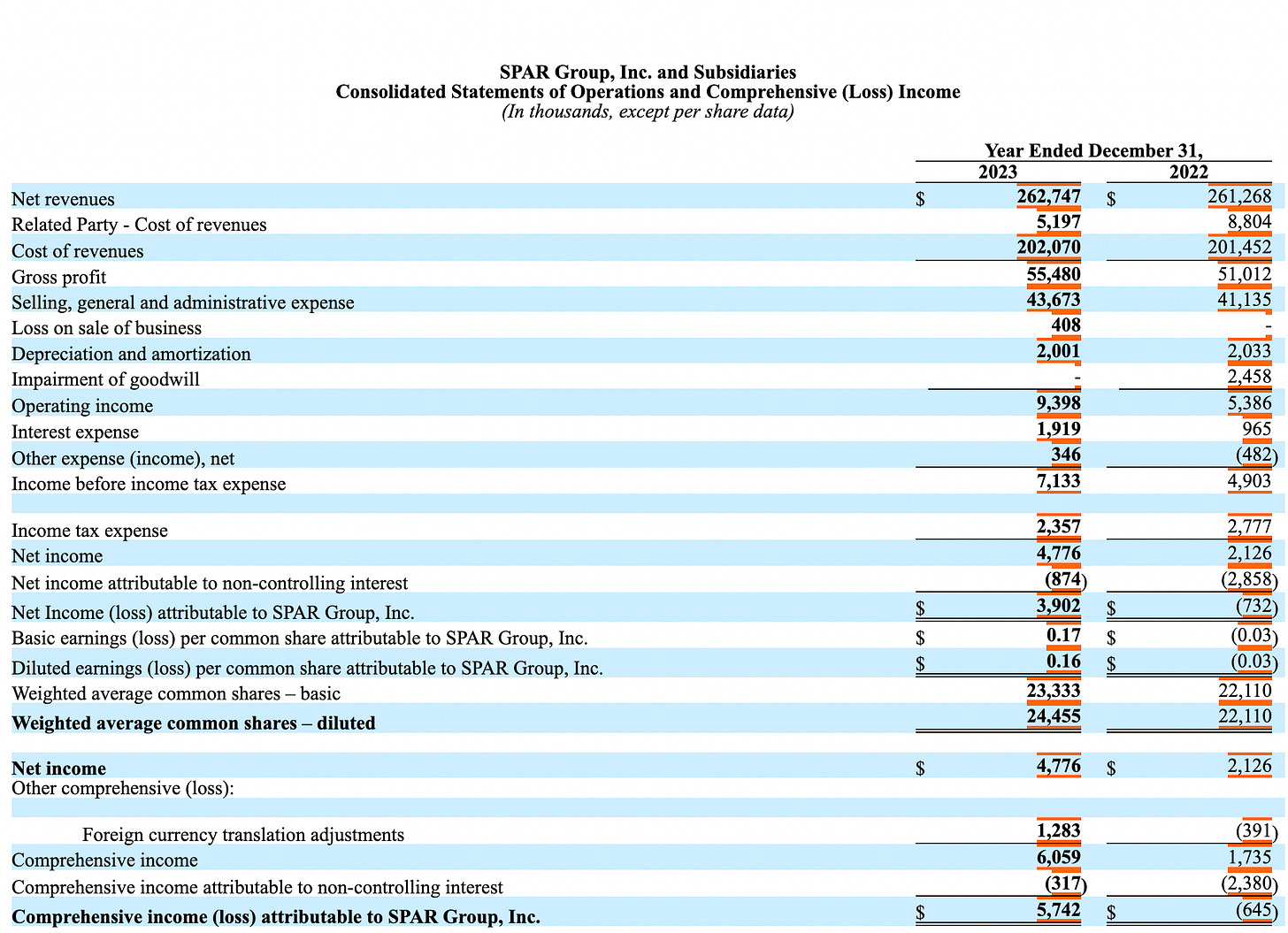

The income statement has been somewhat challenging to interpret due to the presence of related party transactions, a significant amount of minority interest, and foreign currency transactions. Following the divestiture of their joint venture partnerships, these will be largely eliminated. The related party transactions are linked to the joint venture partnerships, as well as the minority interest and the majority of the foreign currency exchanges.

In many instances, we can make money by investing in a complex set up that becomes straightforward. I believe that SPAR Group is an example of this. Up until now, the company had two share classes, related party transactions, and minority interest, which made the conversion from EBITDA to EPS challenging. However, in the near future, these factors will no longer be an issue.

But there is more, I have adjusted the financial statements for currency exchange gains and losses, the goodwill impairment and the sale of the business in 2023.

As we can see, gross margins have been improving significantly in the last years.

In Q4 2023 they posted gross margins of 22.8%. This was largely driven by their merchandising business in the USA, which is their most profitable operation.

It generated $52.5 million in revenue in 2023, an increase of over 20% from 2022.

It is notable that this business has previously contributed only 20% of revenues.

Based on my assumptions for 2024, revenue is expected to reach approximately $140 million. This would mean that the most profitable business they have should contribute to close to 40% of overall revenue. This could have a further material impact on their margins going forward. Furthermore, the company expanded its operations in Canada, increasing revenue from $8.2 million in 2022 to $12.5 million in 2023. While this represents a relatively small portion of the business, it is poised to become a larger contributor in the future. This could potentially lead to an overall increase in revenue.

In the last quarter, they posted EBITDA margin of 6% and 3.78% for the full year (attributable to SPAR Group). For 2024, I expect them to do about $140 million in revenue (before any M&A or huge growth initiatives).

Regarding my estimate for EBITDA margins, their merchandising business appears to have double the margins of their remodel business. Remodels were weak in 2023 and are expected to be stronger in 2024, which could be a drag on further margin improvement. However, the merchandising business should now account for more than 40% of total revenue, so even if the lower-margin remodel business picks up, there could still be margin improvements.

Valuation

Assuming a 5% EBITDA margin on $140 million in revenue in 2024, the resulting valuation would be as follows:

Over the past decade, the stock has averaged a multiple of 6.21x EV/EBITDA. This figure is based on overall EBITDA, not on EBITDA attributable to SPAR. Therefore, the actual multiple on EBITDA to SPAR would be higher. In comparison to the past decade, the company is now more attractive to investors. Just a re-rating from the current valuation to the average valuation should offer around 85% upside.

Furthermore, there are two potential catalysts: the buyback program and potential M&A. If management performs well in capital allocation and my assumption about the earnings power and margins of the remaining business proves to be too conservative, there is a lot more upside than the 85% mentioned.

Despite management owning little shares, I believe they have done a solid job so far. Also, absent from those catalysts, I believe their core business is in a very healthy position. The developments in their new distribution arm, growth in their core merchandising business in the US, and remodeling in Canada, along with the potential for further, higher-quality growth from their software, could lead to further improvements of earnings power.

Risks

The biggest risk would be a bad acquisition. Basically, the whole board has a background in M&A, and I think a good acquisition makes sense for the company. But a bad acquisition could potentially destroy shareholder value. The second risk is a recession. The business is not recession-proof, but in a potential recession, retailers could hire Spar Group instead of employees to keep their cost structure more flexible.

Disclaimer: This is not investment advice and meant for entertainment purposes only, I no longer hold a position in the discussed company and therefore may be biased in my opinion. Please be aware that this is an illiquid microcap, please only buy and sell with a limit-order.

I bought the stock at an average price of $1.47 per share and may be biased in my opinion.

https://app.tikr.com/stock/transcript?cid=407116&tid=2644557&e=1813459772&ts=2687696&ref=jxjwja

https://app.tikr.com/stock/transcript?cid=407116&tid=2644557&e=1875989099&ts=3075803&ref=jxjwja

https://investors.sparinc.com/news-releases/news-release-details/spar-group-announces-share-repurchase-authorization

Excellent write up. Do you know why they added a new 8 mil debt this qtr? Also, how did you arrive at the EV?

I am only familiar with the private label operations they had overseas in Asia and for them being focused on doing private label e.g. a supermarket chain outsources private label to them... The problem is that eventually the chain can figure out how to do it themselves and cut them out as the pricey middlemen + private label people have told me SPAR charges too much aka its cheaper to source products (this is for Asian supermarket chains who are closer to the suppliers & have Chinese speaking staff) and do everything in-house - assuming you can find experienced private label people to work for you directly and do it... In fact, I know some SPAR people who ended up working for their supermarket client when they decided to cut out SPAR the middlemen or when SPAR scaled back their ops in Asia (after loosing a key client from Japan...)... I guess you can say they are like CBRE or JLL - there will always be a need for middlemen in some industries BUT I am not familiar with SPAR's other middlemen type activities you mentioned or what the market is like for those... Not sure if they even still have sourcing or buying offices in Asia - big American retailers would...