The Power of Being Early: A Microcap Case Study

Why understanding the “discovery cycle” is still the greatest edge for retail investors

I was always amazed when I read about the returns that some microcap investors were able to generate. It seemed so surreal that while the broader indices were averaging 10% p.a., these guys were sometimes getting returns of 30, 40 or even 50% p.a. The most famous is probably Buffett's claim that if he had $1 million, he would even guarantee 50% returns.

In my search for answers, I discovered a crucial piece of the puzzle that I believe helps explain—at least in part—this outperformance. In this article, I’ll focus on one key strategy for generating superior returns.

Being early

The concept of “being early” or once referred to as the “discovery cycle” is nothing new. Paul Andreola famously presented it a few years ago (video below) and I would say it is probably one of the most important videos a new investor can watch. If you truly understand the discovery cycle of microcaps, you understand a key piece of successful investing.

The logic behind the discovery cycle is that as a company gets discovered by investors, the multiple of the stock increases, providing the necessary “twin engines” of outsized returns: EPS growth and multiple expansion.

The funny thing is that now that there are hardly any microcap IPOs, most of the names are actually being rediscovered. The best example is IVFH. There was a lot of buzz about the company in 2013 — only to see the company diversify into e-commerce, the number of shares double, and the share price halve. In the end, nobody wanted to hear from the company for 10 years. Until activists James Pappas, Jeff Gramm and Denver Smith took over the board and Bill Bennett became CEO. The company got rediscovered.

The discovery cycle in practice

I'd like to present a case study of a stock that (in my opinion) is one of the best examples of how the discovery cycle plays out.

Case study: Koil Energy (KLNG).

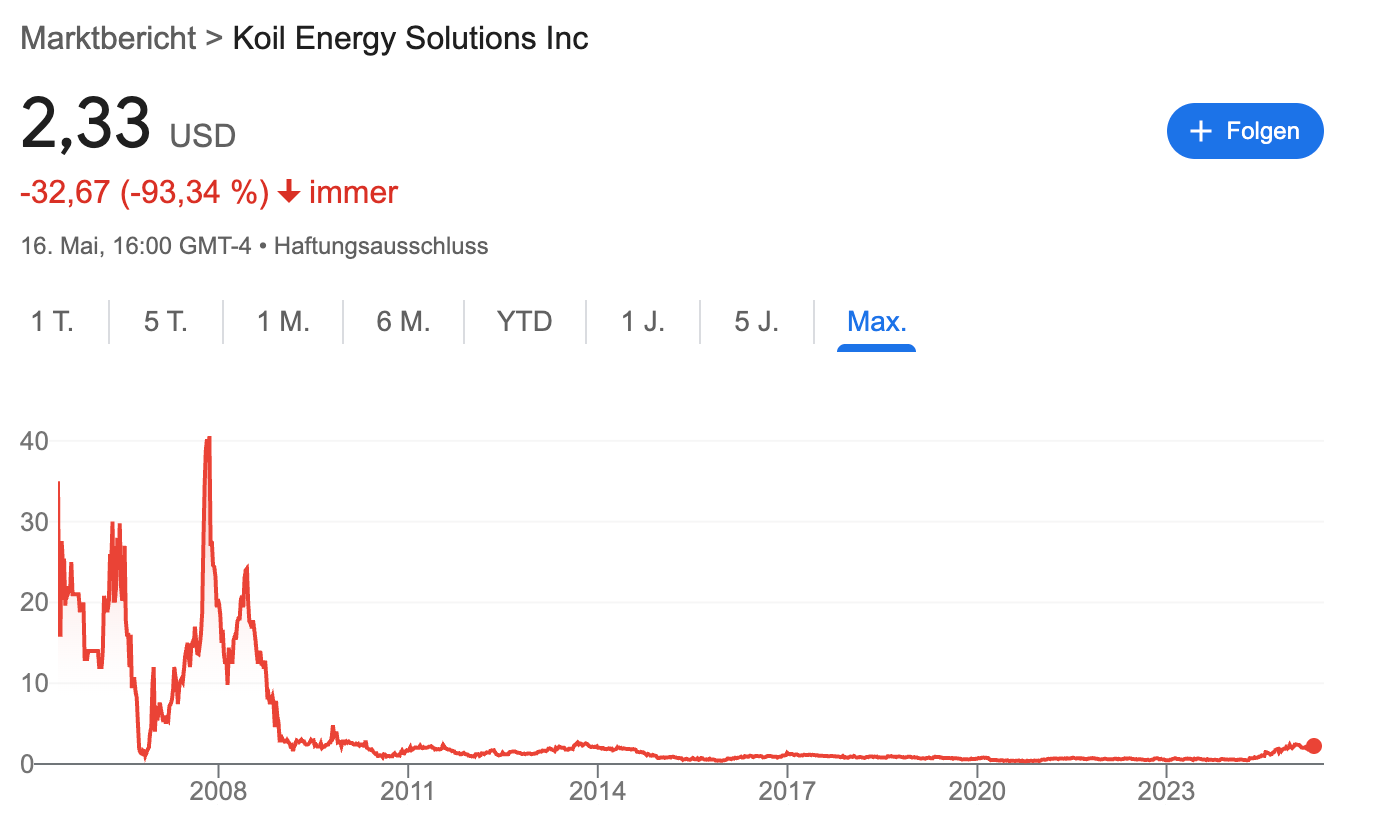

I wrote up Koil in July 2024, you can find the write-up here, back then shares were trading at around $0.85 — now less than a year later shares are trading at $2.33. How did this happen, let's start at the beginning:

Koil Energy went public in 2006 through a reverse merger with MediQuip Holdings, Inc. At that time, Koil Energy was still called Deep Down Inc. Two years later, they raised $40 million through a private placement. This meant that the company had been public for almost 20 years. Talk about a “discovery”. But those 20 years had been anything but a success for shareholders.

A look at the fundamentals shows the same thing, lack of success, lack of profits to be exact.

No wonder in all these years the company barely got investors excited. If you cannot even earn a profit during the oil boom years in 2014, then you probably can never earn money.

Timeline of discovery

May 2022 — Oil prices begin to recover after COVID-19, peaking at $113 per barrel.

Novemeber 2022 — The company changes its name from DeepDown to Koil Energy (KLNG). 1

June 2023 — Company announces a $4 million contract win in the Gulf of Mexico.2

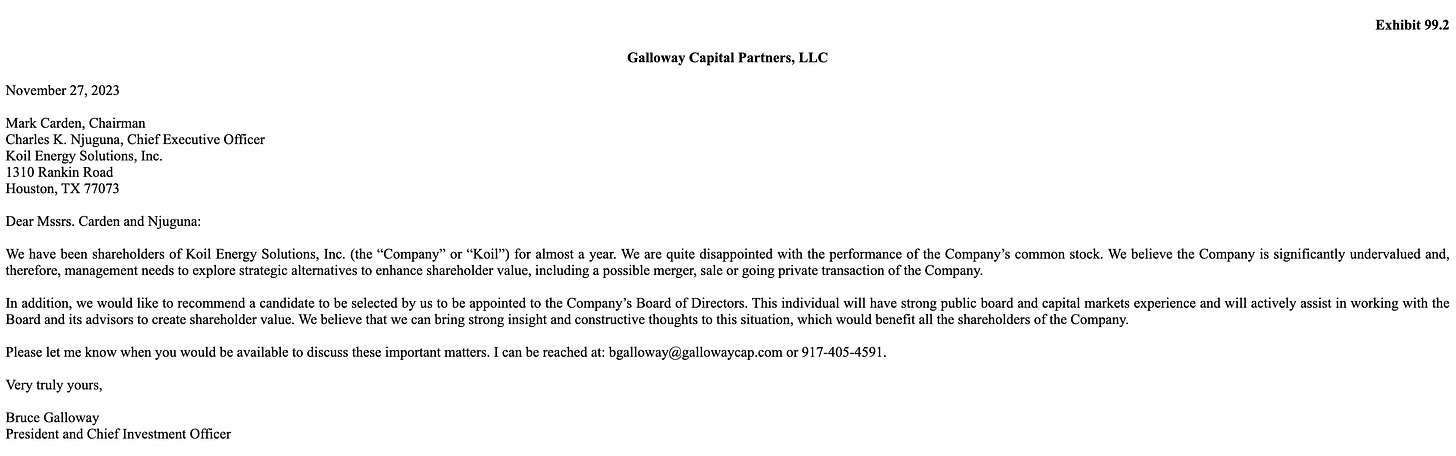

November 2023 — Bruce Galloway writes a letter to the board in which he expresses his frustration of being a shareholder.

December 2023 — Koil Energy announces a “Multi-Million-Dollar Contract for Innovative Flying Leads from Gulf of Mexico Operator.”3

March 2024 — Erik Wiik, who was first hired as consultant for their growth road map, becomes CEO.

May 2024 — Koil Energy reports a breakout quarter and earns $0.05. That catapults shares from $0.50 to $0.75. While they did not hold an earnings call back then, they issued an investor presentation, for the first time. This indicated that the new CEO might be a bit more communicative with the capital market, backed by a strong first quarter and a bright outlook. At this time, the stock was trading at a runway P/E of 5!

July 2024 — I publish my write-up on the stock.

August 2024 — An outstanding Q2 sees them earn $0.08 per share. They also issue a new presentation and hold an earnings call. At this time, it was clear that Q1 was not just a fluke. Shares rise from $0.95 to eventually $1.40.

September 2024 — Koil Energy participates in its first investor conference, the Sidoti Virtual Conference. The stock is also featured on MicroCapClub that same month. Until then, the stock was a well-kept secret. New investor awareness and a bull market drove the stock to its highs of $2.37. All this despite a weaker Q3 in which they “only” earned $0.04 per share.

April 2025 — The company announces a great Q4, with record revenues and full-year earnings of $0.21 per share. Also in the same month, IFCM filed a 13G4, owning 6% of the company and KLNG presented in Vegas.

You see each action had a clear impact on the chart, as displayed below:

My journey with the stock began in December 2023 when I read Bruce Galloway's letter. While I was aware of the “boom” in the offshore oil sector, looking at the company's financials, there was little that attracted me at the time, but I decided to follow this company. After all, the general setup could eventually become compelling. And it did, I bought my first shares after the Q1 results. While the share price was significantly lower, the situation was also more uncertain. It was not so obvious that the results were the result of internal changes rather than just higher demand from subsea oil providers. But with a low valuation, a clean balance sheet and Bruce Galloway as a shareholder, I thought the downside was protected.

In August, after their Q2 results, I doubled my position. Thanks to my previous knowledge and small portfolio, I was able to act quickly and get my orders filled at about $1 per share. That morning, I really felt like I was alone in the world, or at least alone on the bid. The company earned $0.13 for the first half of the year. No questions asked on the earnings call — and for a small window of 15 minutes after the open, I was able to buy shares at $1.02 and $1.10. My advantage was not that I was smarter than the market, I just had time and no money. That is our edge as retail investors.

This is also why it is so important to be early and to understand the discovery cycle. It doesn't take a genius to make money this way. Just hard work and a small amount of capital.

Sounds nice, but is it too late now?

If we look at the Koil Energy story from the perspective of the discovery cycle, as long as the company continues to execute, we are still in the retail phase.

The company presented in Las Vegas and was well received by investors. Erik is a competent CEO and the growth story seems to be attracting Mircocap investors. However, this is still a $25 million market cap company trading on the OTC. Aside from smaller, sophisticated funds, institutional investors still cannot buy this company.

As long as the company keeps executing, the story here is far from over. I was lucky enough to buy shares probably right at the “discovery catalyst” which was after their Q1 2024 earnings — that does not mean the company is super well known now, or that it is too late.

What I want to showcase here is why focusing on small, illiquid OTC stocks can be a fertile hunting ground. It is great to hear or read that, but to experience this discovery first-hand burns that knowledge into your head. The advantage, we as retail investors have, is simply outstanding. In my mind, focusing on Large Caps as a retail investor, is like a cheetah signing up for a turtle race.

Disclaimer: This is not investment advice and meant for entertainment purposes only, I hold a position in Koil Energy (KLNG) and Innovative Food Holdings (IVFH) and therefore may be biased in my opinion. Please be aware that this is an illiquid microcap, please only buy and sell with a limit-order.

https://www.koilenergy.com/Investors/Press-Releases/Press-Release-Viewer/?i=114156

https://www.koilenergy.com/Investors/Press-Releases/Press-Release-Viewer/?i=120333

https://www.koilenergy.com/Investors/Press-Releases/Press-Release-Viewer/?i=129156

https://www.sec.gov/Archives/edgar/data/1110607/000179879225000002/xslSCHEDULE_13G_X01/primary_doc.xml

Great read, thanks Sebastian. It’s always interesting to read-up on discovery processes. Certainly helps for pattern recognition and to assess future opportunities.

I think it’s btw also very interesting to look at companies where the discovery process has probably topped. I think it’s usually when a company has beocme a Fintwit favourite and the business quality is somehow overestimated by the crowd. Has led to a couple of hard landings. :-)