Trainwreck or contrarian buy? —Weekly Treasure Hunt #02

Hunting for value in "ugly" charts, tracking insider buys, and diving into a market leader with a new CEO.

What an eventful start to the year. The US military captured Maduro, Claude is making everyone jobless, but that doesn’t matter because everyone is up 10%+ YTD, apparently.

In this week’s treasure hunt:

Why I missed the 78% run in LatAm (and what I’m doing now).

Notable insider buys… and a cheap stock trading at 5x EV/EBIT

Assessing the damage in the Travelzoo chart.

A market-leading distributor with a new CEO executing a turnaround.

The 78% return I’ve missed

It’s really funny how much the world has changed in the past four years. Well, in your day-to-day life, the world has changed very little to nothing, but investment-wise, I feel the change is quite big. I was just listening to a podcast that did some predictions for 2026. The last time I listened to the podcast was at the beginning of 2022. The only theme that had stuck was inflation. Otherwise, what used to be “tech will outperform” is now “commodities will continue to outperform.”

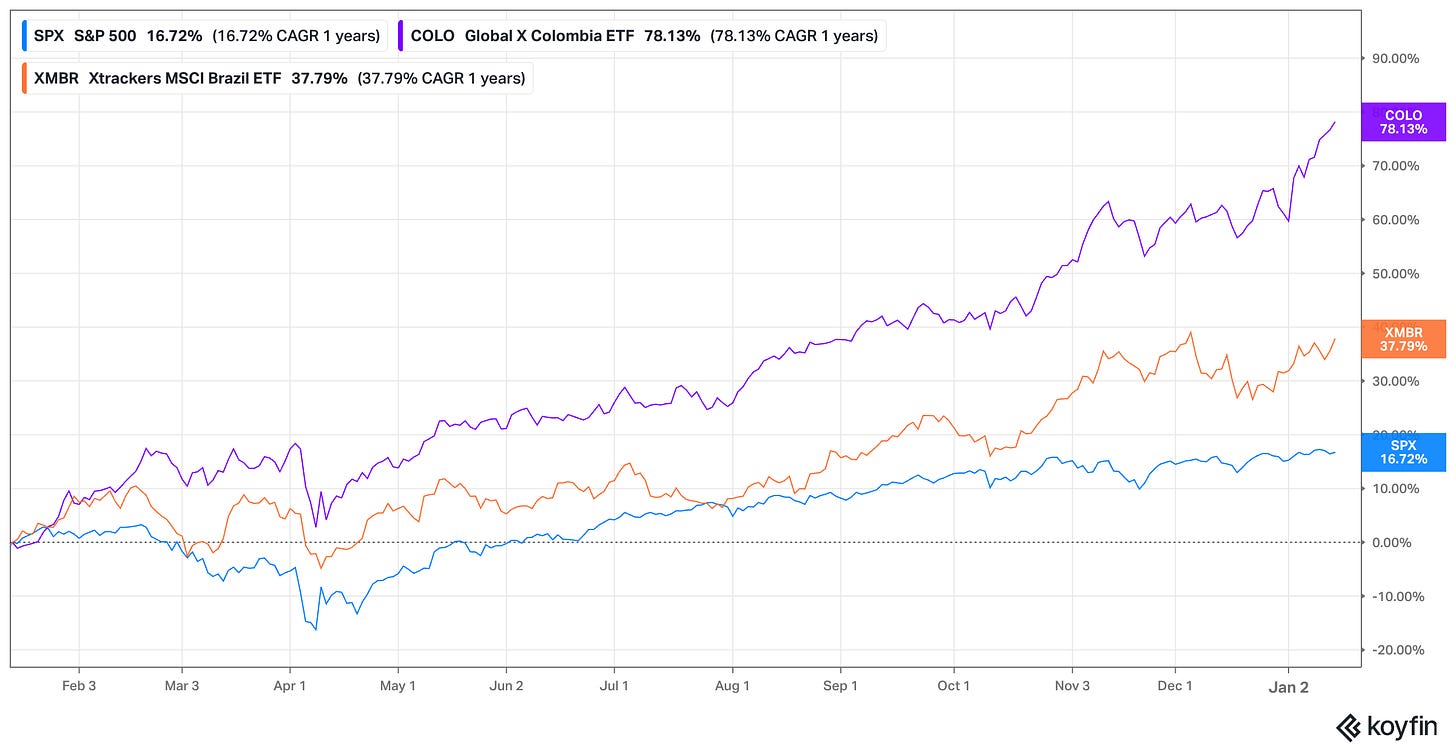

The run in commodities is really impressive, and I think it's something that no one would have predicted 4 years ago. The other common theme seems to be that Latin America will continue to perform well. As a resource power hub, that is, country-by-country shifting to the right, it seems very well positioned. And obviously markets have caught up to that. With low starting valuations, it has already made good moves. I would have made way more money if I had just put my portfolio into a Colombian ETF one year ago.

As a stock-picker in microcaps, I must admit, it is really a tough pill to swallow. Sure, hindsight is 20/20, but boy, what a performance. I could have just chilled all year in Rio, learned to surf, AND made 78%.

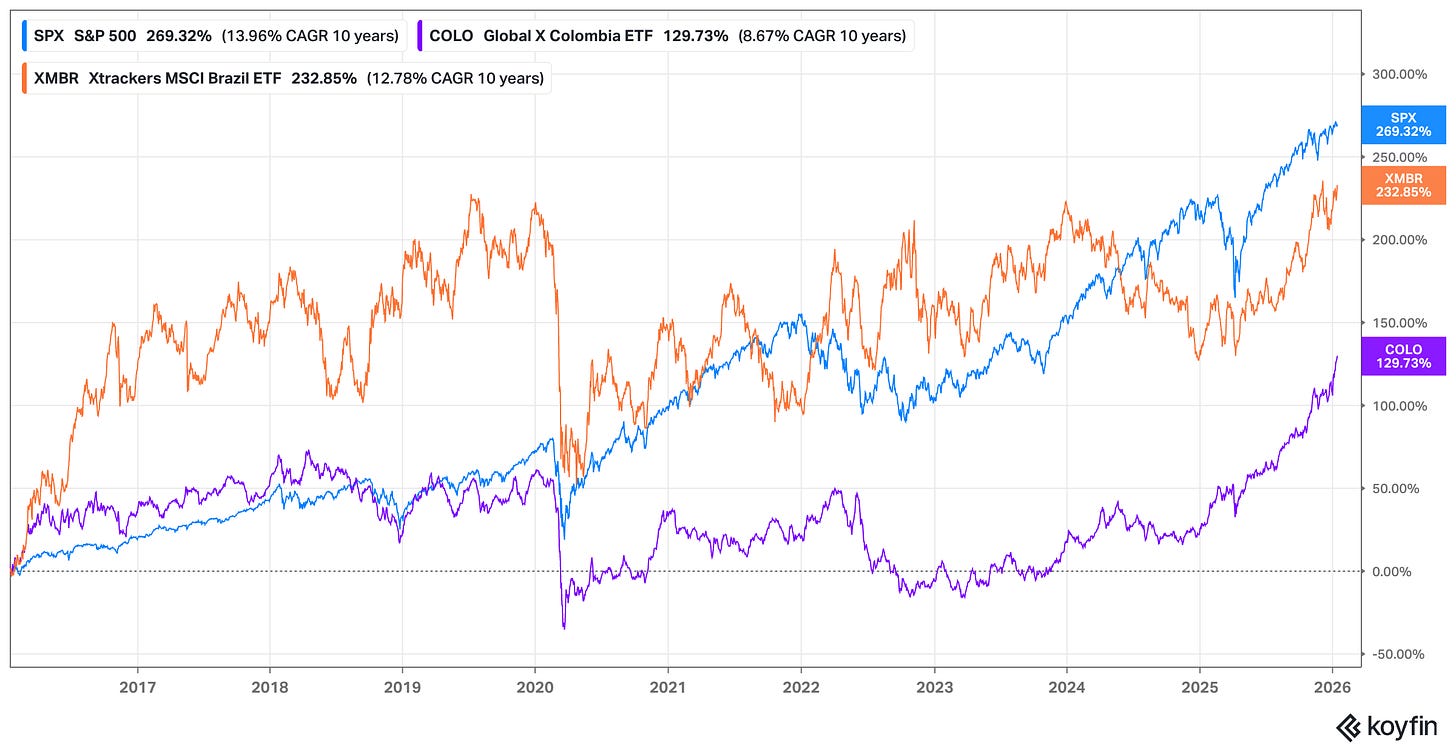

Looking back 10 years, the picture obviously looks different:

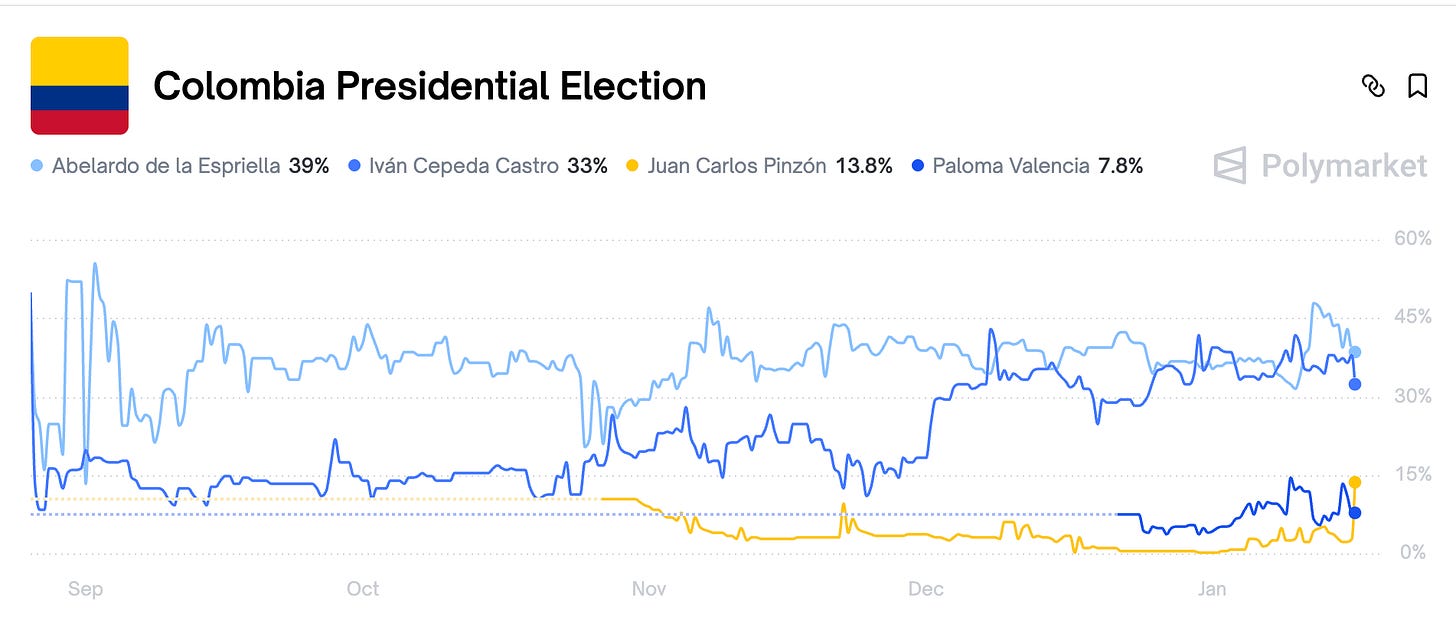

If you wonder why I picked Colombia and Brazil, it is because these are the two countries with upcoming elections this year. Both countries have been governed by left-wing presidents, and both presidents have low approval ratings.

I, and apparently the market as well, think that a right-wing candidate in Colombia is more likely to be elected than in Brazil. Colombia has historically voted right-wing/center-ish. Current president Petro cannot be re-elected. Favorites right now are right-wing newcomer de la Espriella, and left-wing successor of Petro’s politics, Cepeda. There is also still a chance someone else makes the race, like Pinzón or Valencia.

Importantly for the market, as long as Cepeda does not win, every one of these other three candidates would be an improvement from the current anti-oil administration.

Anyway, as a stock picker, it is an interesting development, and while the overall landscape of Colombian companies is not really investable, there will surely be some beneficiaries. Most of them are likely in the oil sector.

Talking about the oil sector…

Interesting Insider Buys

A company I have been following for a while now, and even talked to in Vegas, is McCoy Global (MCB.TO). The company had some insider buying by multiple insiders, including directors James Rakievich and Alexandre Ryzhikov, as well as officers Bing Deng and Lindsay McGill. It could mean they are making progress regarding their orders in the Middle East. I wrote about the company here, back in May.

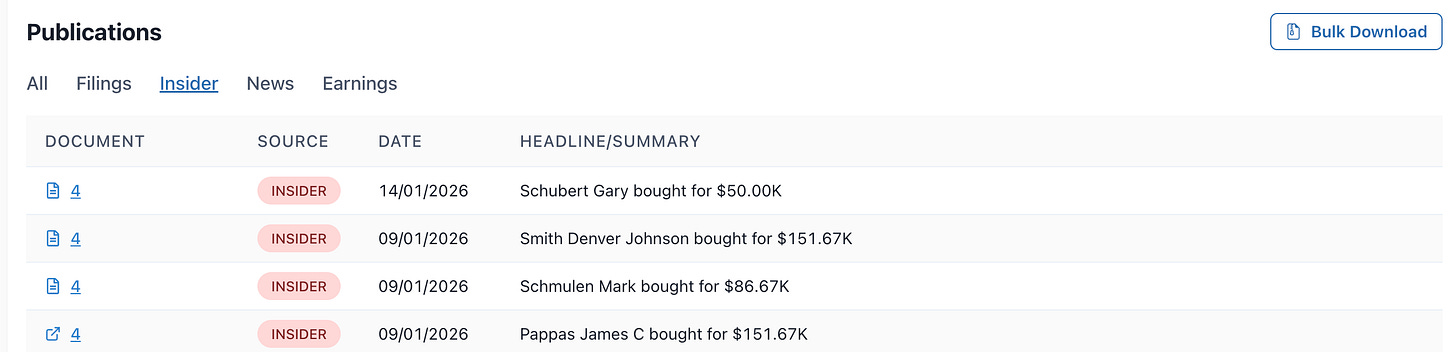

Another company with notable insider buying was Innovative Food Holdings (IVFH) (Disc. I own shares).

The buys have been in the $0.30 range, and shares have already recovered from their lows. Notably, Ian Cassel also increased his position.

Before I would consider increasing my currently small position, I would like to see operational progress—the warehouse sale and some cleaning up in Q4 from the horrible Q3 results. But eyes are on it.

A company I am also following since mid-2024: Q.E.P. (QEPC)

It is very cheap and has purchased 100k shares from its former CEO, Lewis Gould. (H/T John W. on X)

The company has a market cap of $125M, with $36M in net cash. They earned $19.8M in EBIT last year, and will likely earn at least $18M this year. Putting the stock at merely 5x EV/EBIT. I don’t know about their growth prospects, so re-rating would likely depend on smart capital allocation. If they start repurchasing a bunch of shares here, it could be a buy.

Worst-looking chart of the week

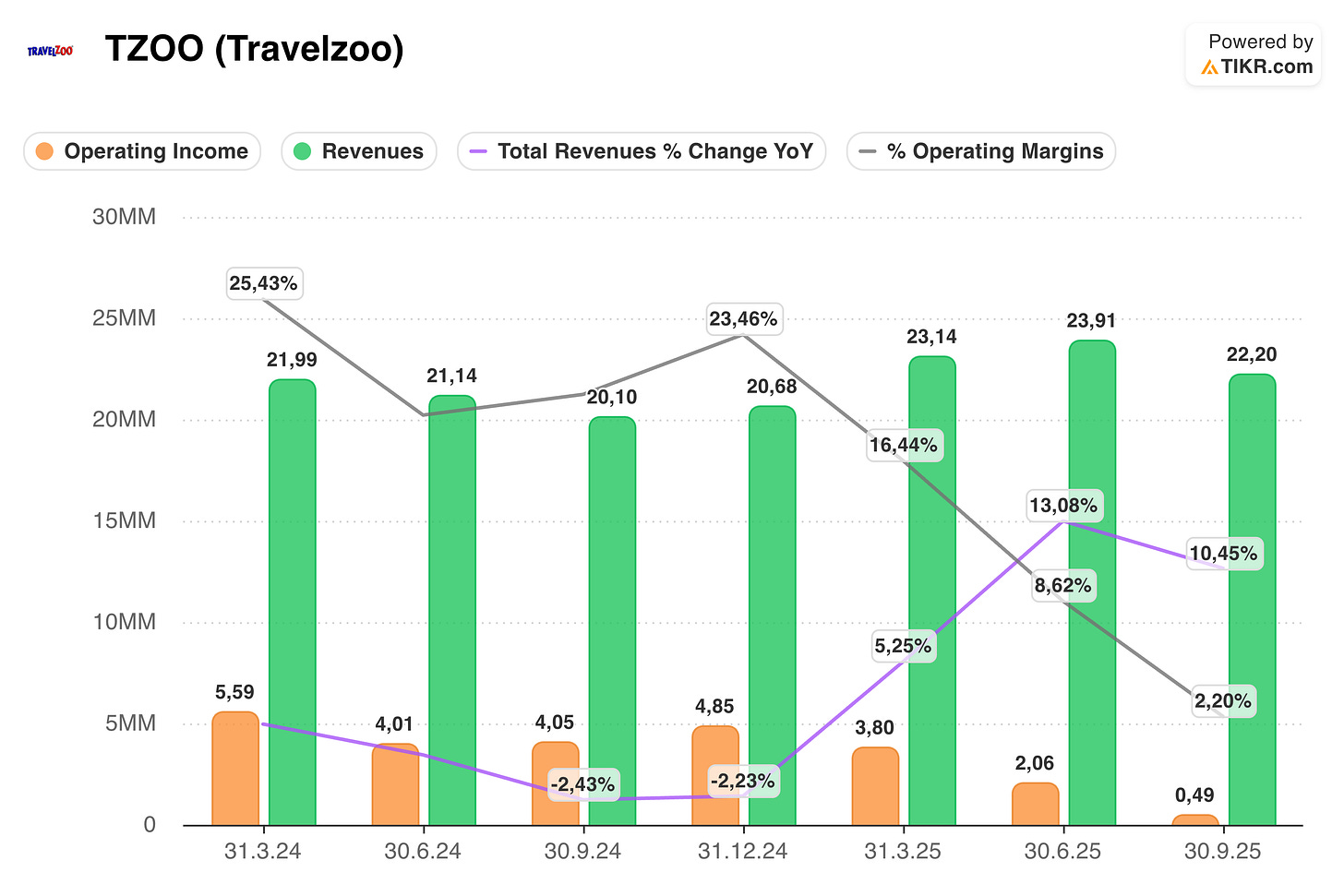

It doesn’t matter if markets are green or red; one push notification I always get is “new 52-week low for TZOO.”

This is the textbook of a falling knife.

The big question is, is it a train wreck or a contrarian buying opportunity?

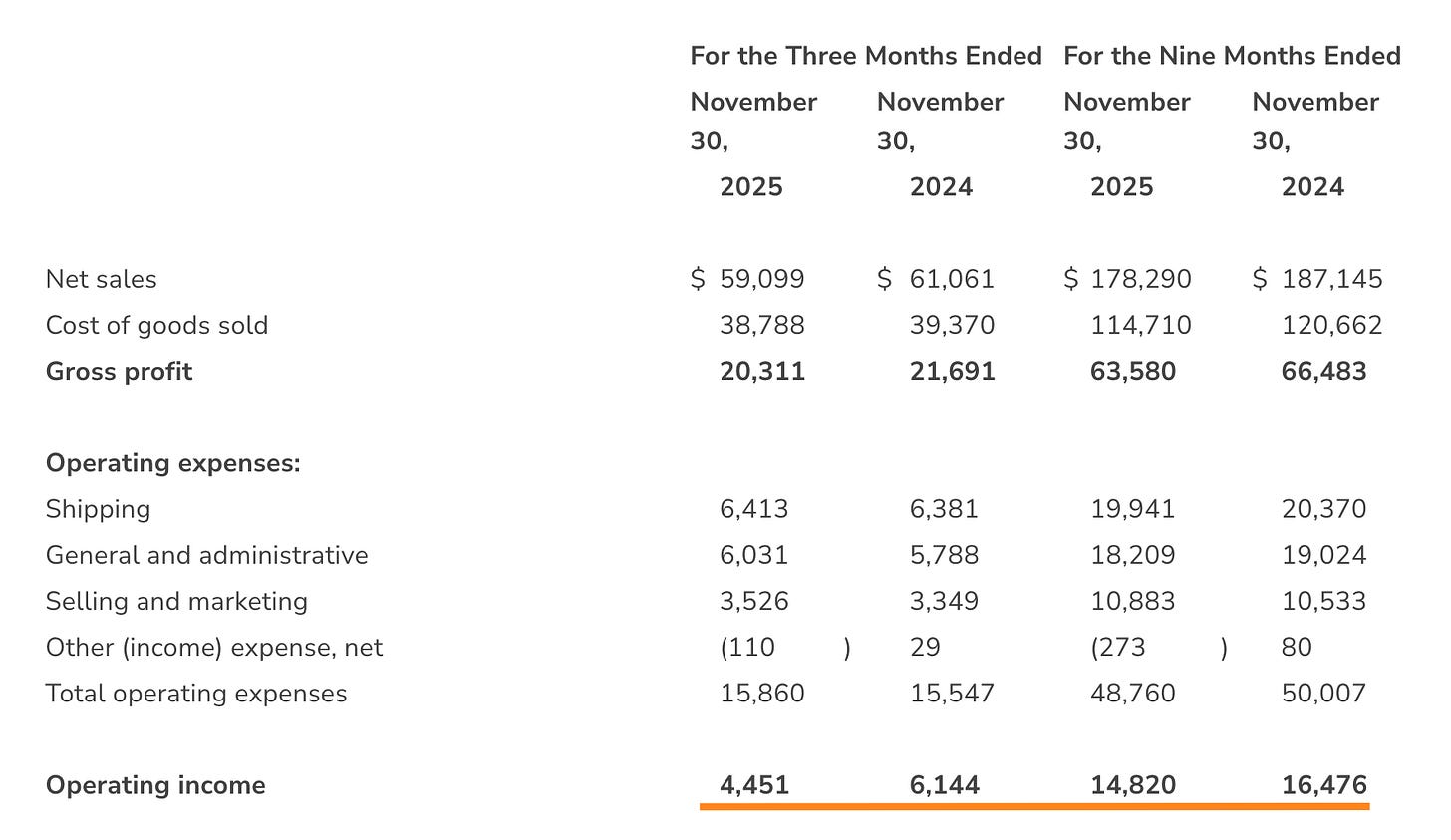

Travelzoo (TZOO) is a global publisher of exclusive travel deals that shifted its business model from getting paid via advertising to a paid membership model at $40/year. However, they now have to spend money upfront to acquire these paid subscribers, and those acquisition costs get expensed immediately while the revenue is recognized over the course of the year—even though they receive the full $40 upfront. So the GAAP numbers look worse because the expense hits today, but the revenue gets spread out over twelve months. The market has been selling off on this constant decrease in operating profits each quarter this year.

Regardless, bulls argue that they can get back to previous profitability levels ($4-5M/quarter). In that case, shares would trade at less than 6x earnings. However, there are some red flags, like a majority shareholder with weak governance. Not sure if that’s worth the risk, but I’ll put it on the watchlist.

Speaking of watchlist:

Top Watchlist Pick for this week

A classic turnaround setup: This market-leading wholesaler and distributor has been crushed by mismanagement. Here is why the new CEO's cost-cutting plan makes it a top watchlist pick.