The Great Rotation: Long Live the Old Economy — Weekly Treasure Hunt #04

Tech is bleeding capital. Here's where it's landing

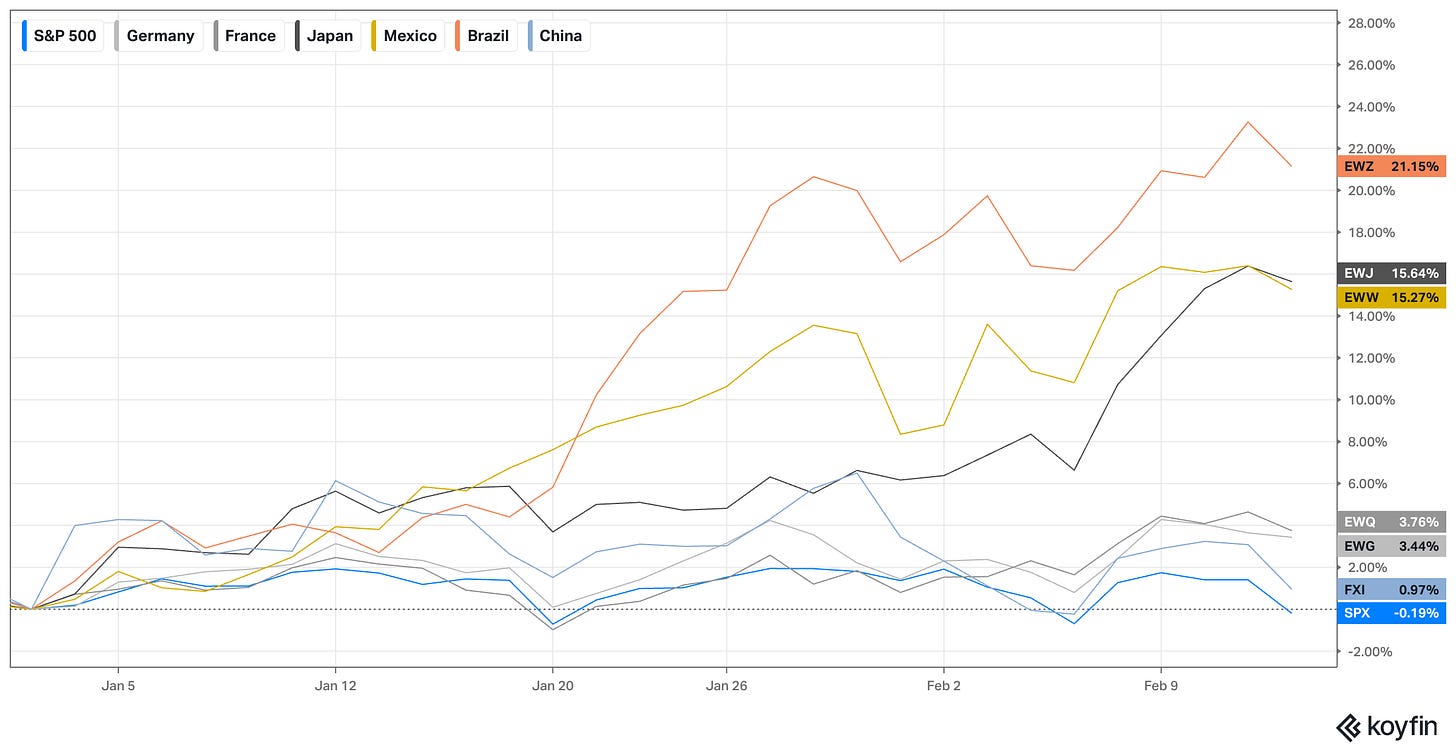

In the last issue of Treasure Hunting Weekly, I already wrote about whether the oil sector is a buy. But oil is just one of the sectors ripping this year. In fact, what we are seeing so far in 2026 is a rotation out of tech into cyclicals. It is also a move out of the US, or at least out of the S&P 500 which is very tech heavy. The US has had its worst start to the year relative to peers in a long time.

While this trend initially started with a weakening dollar once Trump took office, the latest driver appears to be the potential disruption by AI. Naturally, the last great tech wave (the internet) is the most fragile to the next one (AI). However, it is not hard to see how almost every sector will be changed by AI, just like the internet eventually changed every industry.

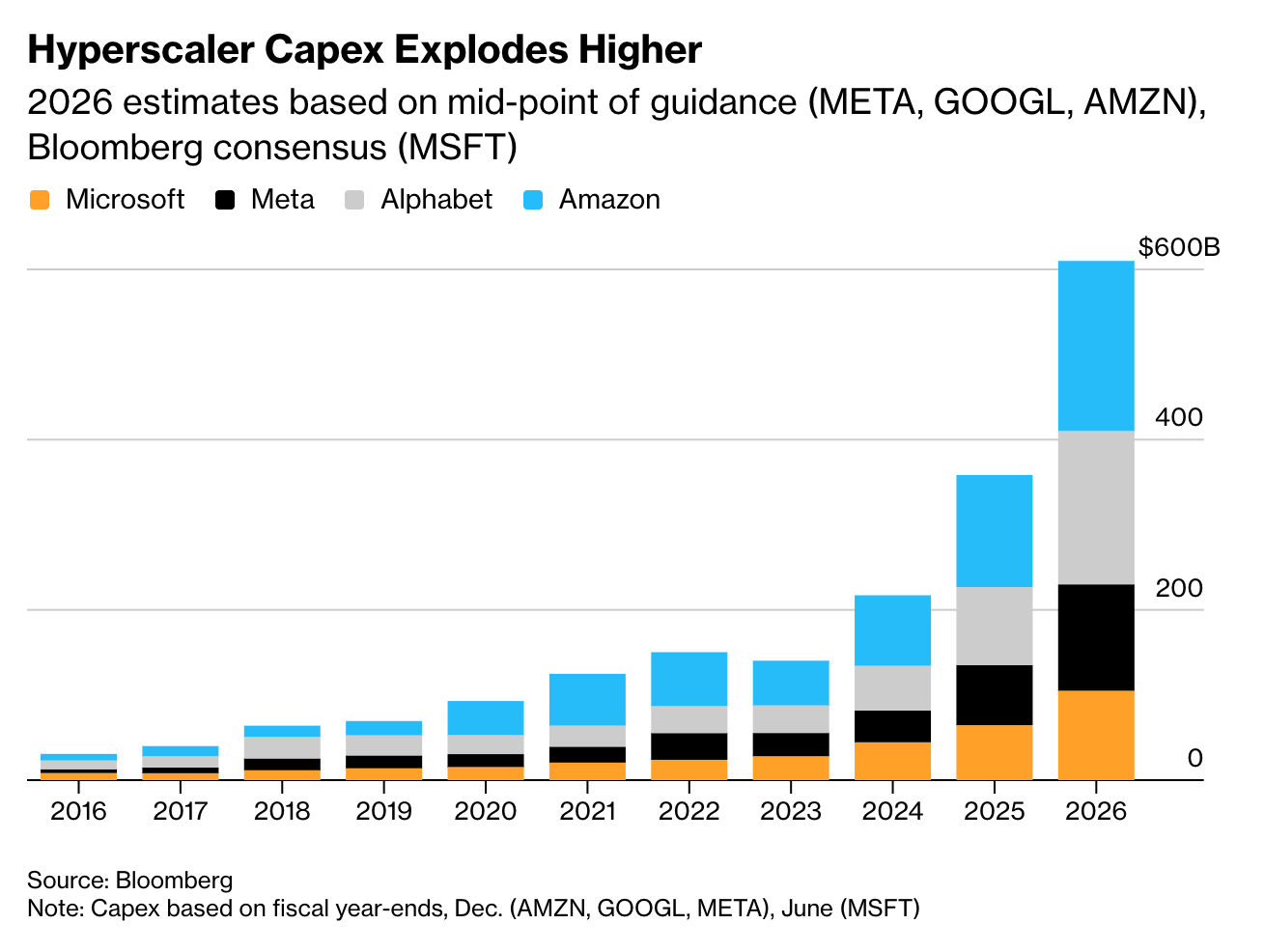

But not only that, the Mag 7 are spending as much on CapEx as never before. What once were asset-light compounders now look more like oil producers. I have no stance on who is winning or not, but it seems logical to me that these companies, which are still attributable for a good chunk of the S&P 500, are less attractive now than they were four years ago.

This is obviously a drag on the index.

Moreover, the second and third tier of software companies look even worse. I came across this post from the founder of SaaStr, one of the go-to conferences for software companies.

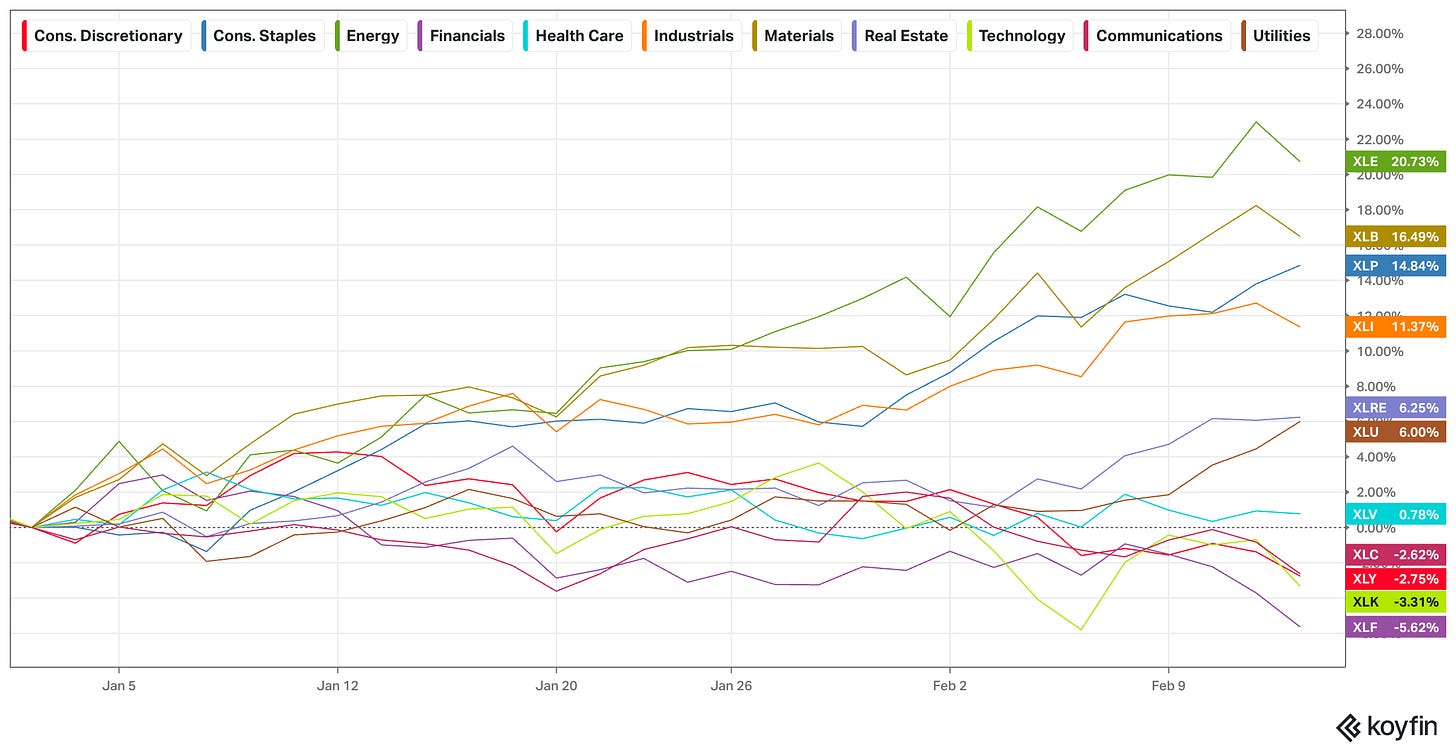

So where is the money flowing? Energy is the sector with the strongest YTD performance, followed by materials, staples, and industrials.

Long live the old economy.

But something else is rotating within the oil sector: Is Argentina the next power house for Oil?

The Permian in the US has been the home of US shale and recognized as probably the highest quality oil field in the world. However, it appears that this story is close to over. Some sources claim 60% of Tier 1 Permian acreage is depleted, the EIA forecasts that US crude production will decline in 2026-271, and large-cap producers only have 7.5 years of inventory left (smaller ones just 2.5 years)2. Harold Hamm recently shut down drilling in the Bakken, a warning sign for the whole industry3.

Viva la vaca muerta. Long live the dead cow.

With break-even prices lower than in the Permian ($36-45 vs. $58), Vaca Muerta (”Dead Cow”) in Argentina is becoming a more and more attractive destination for oil producers. And the gap is only widening, an Enverus report projects US shale breakevens could rise to $95 per barrel by the mid-2030s as core inventory depletes.4

I would argue that we have somewhat of a perfect storm that could make Vaca Muerta one of, if not the most attractive oil field in the Americas.

Why it is technically superior to the Permian

Productivity: Vaca Muerta wells produce approximately 30 barrels per foot of lateral drilled, compared to the Permian average of just 15–23 barrels5.

Vertical Thickness: The formation is 30 to 450 meters thick (averaging 150m), allowing for “stacked development” (multiple wells at different depths) that increases resource density per acre6.

While it might be more expensive to drill there compared to the US (e.g., higher sand prices), the field is just much more productive.

Two things have held the field back: First politics and second infrastructure. But both are inflecting.

Let’s touch on both:

Politics. Since Milei took over, he has already implemented new regulations that make Argentina more attractive, such as the RIGI Framework (Incentive Regime for Large Investments) and dismantling capital controls to allow cash flows to exit the country.

Just this week another reform passed, allowing 12-hour shifts in Argentina. Milei is serious about pursuing his goals to make Argentina business-friendly and an energy net-exporter.

Infrastructure. The other thing that held Vaca Muerta back was the infrastructure. But with ADNOC, the 4th largest oil company, backing a $17B infrastructure push, this is changing fast.7

There are major projects coming online in 2026, like the Oldelval Expansion, which will double the capacity of the existing trunk line to Puerto Rosales (from ~36,000 m³/d to over 80,000 m³/d)8. Then there is Vaca Muerta Sur (VMOS), a 437 km dedicated oil pipeline and a massive deepwater export terminal at Punta Colorada capable of handling VLCC (Very Large Crude Carrier) supertankers9.

The King of Vaca Muerta: VISTA Energy (VIST)

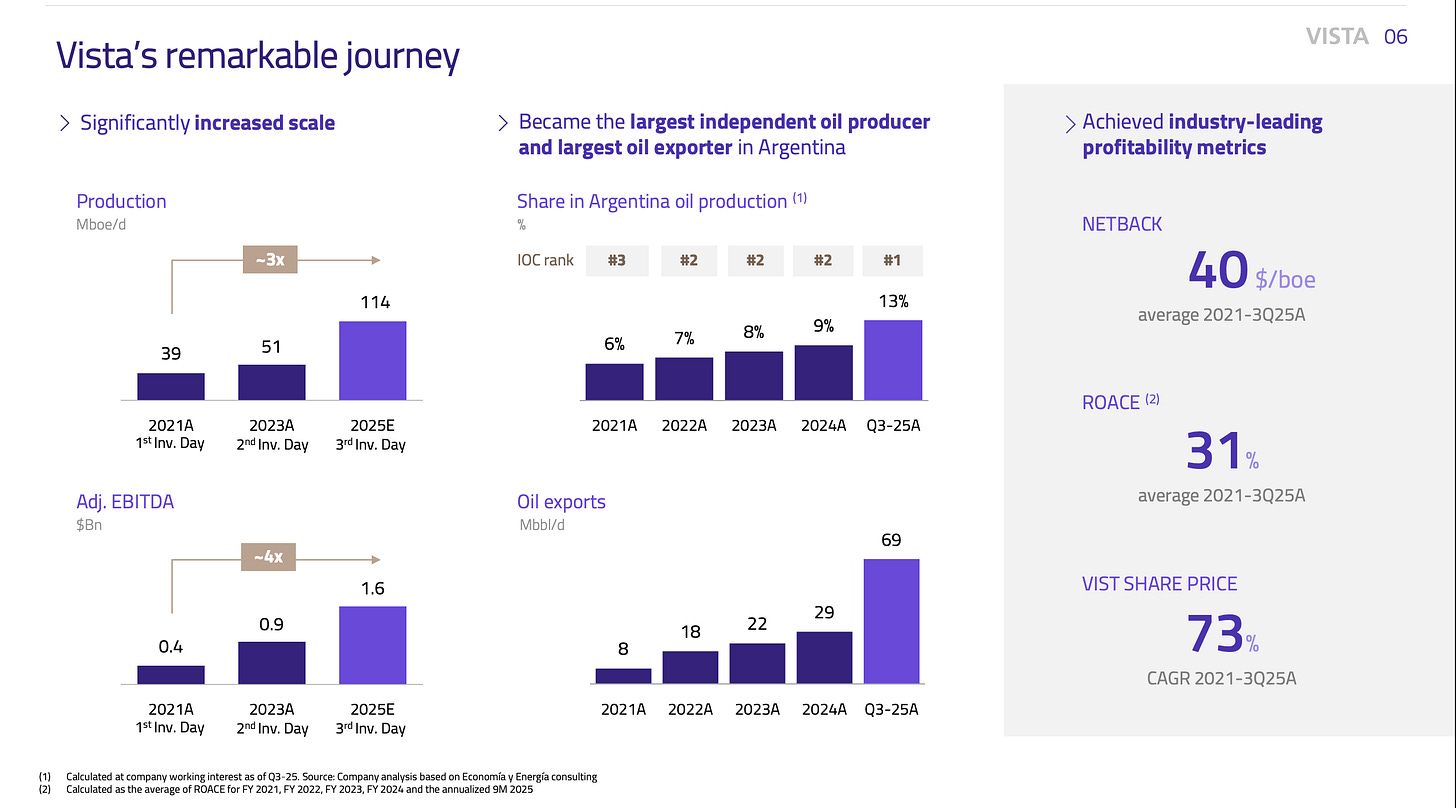

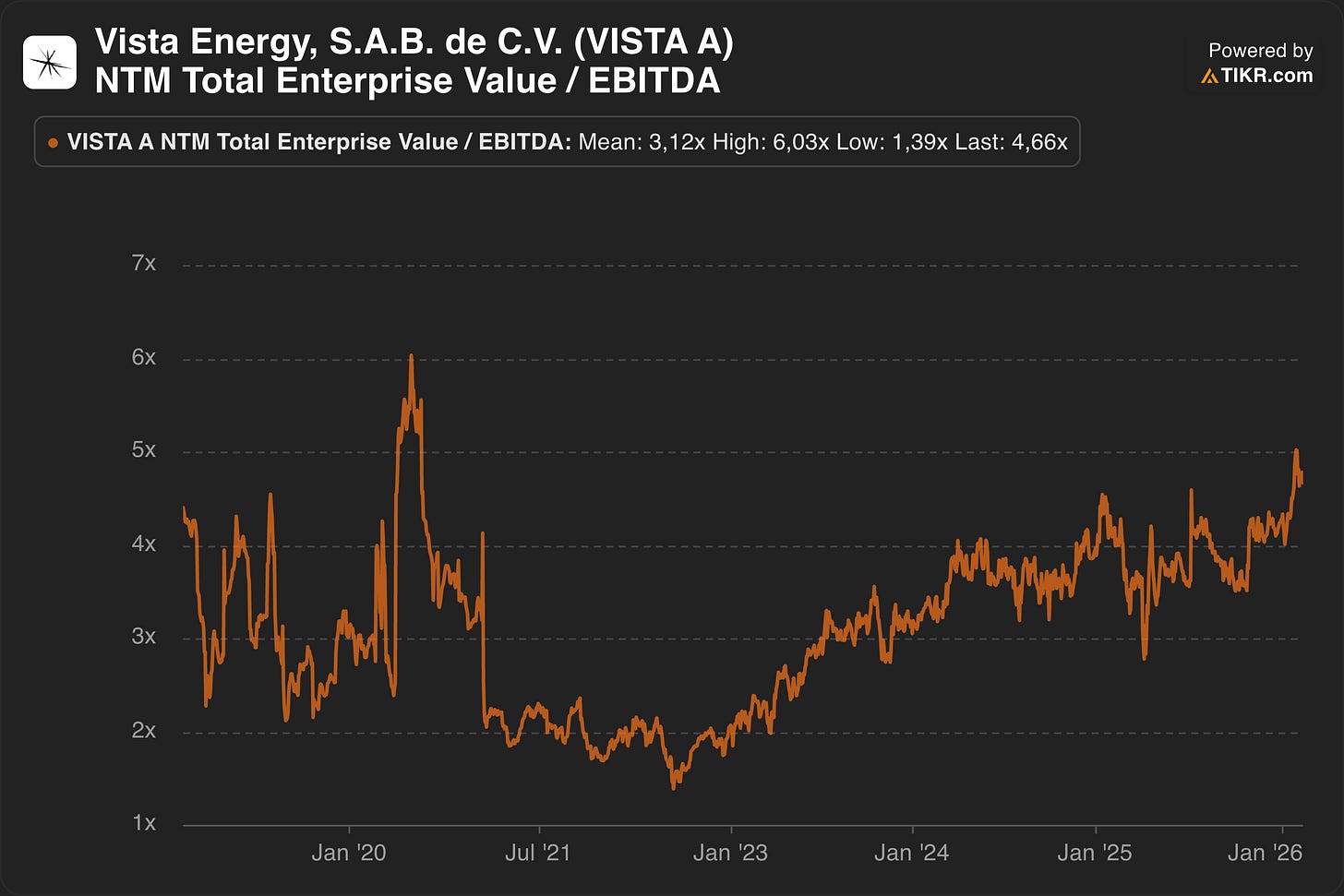

How has this story played out for investors? 73% CAGR since 2021.

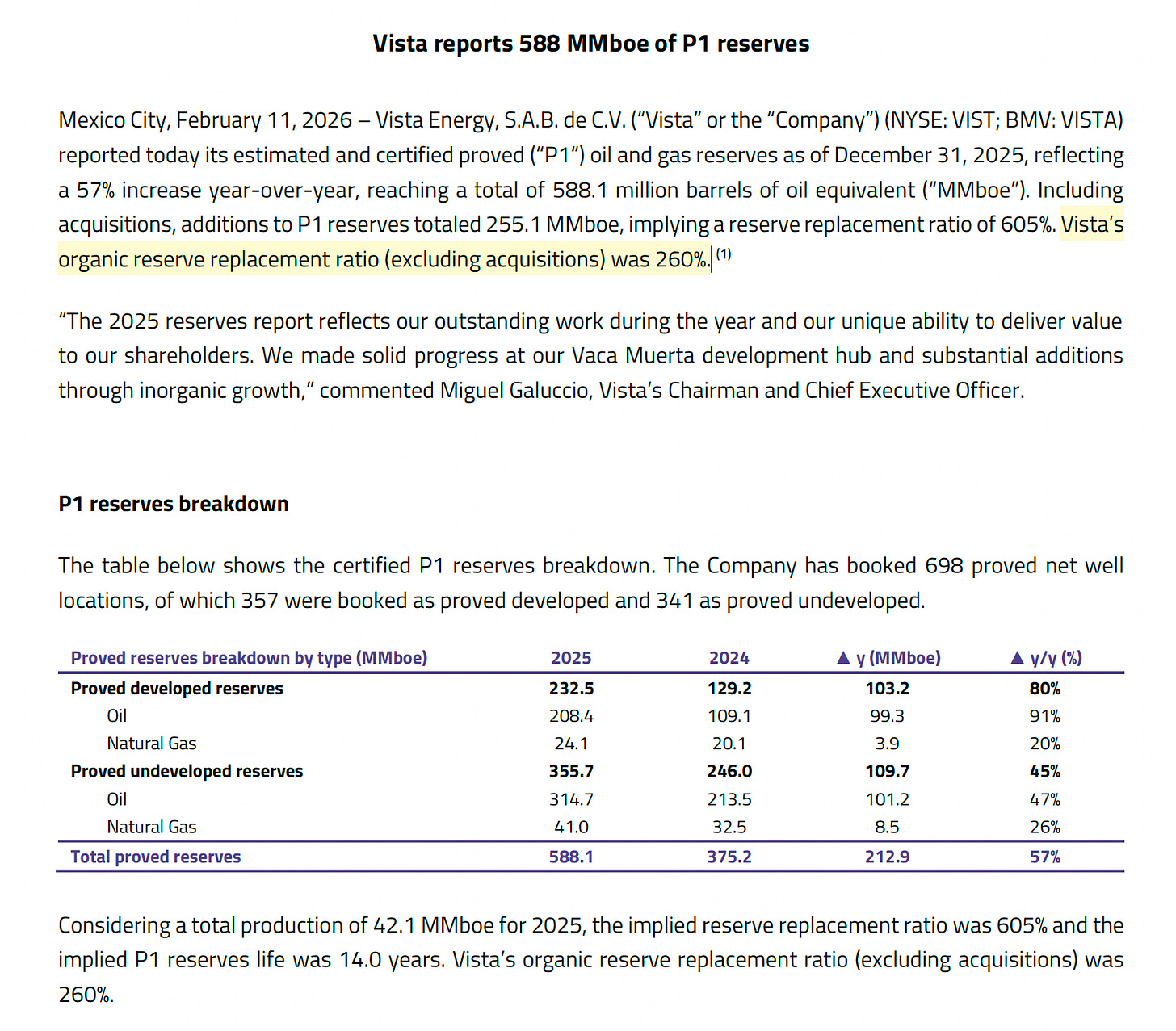

To continue on the Vaca Muerta trend, look at the organic replacement ratio from Vista Energy.

Yes, VIST is a well-known story by now. But Vaca Muerta is still in its early days, country risk under Milei is lower than two years ago, and if anything, this oil field should trade at a premium, not a discount.

Vaca Muerta aside, the rotation is also creating opportunities in the US. Here are three US names that fit the theme.

Three US Stocks that fit into the rotation

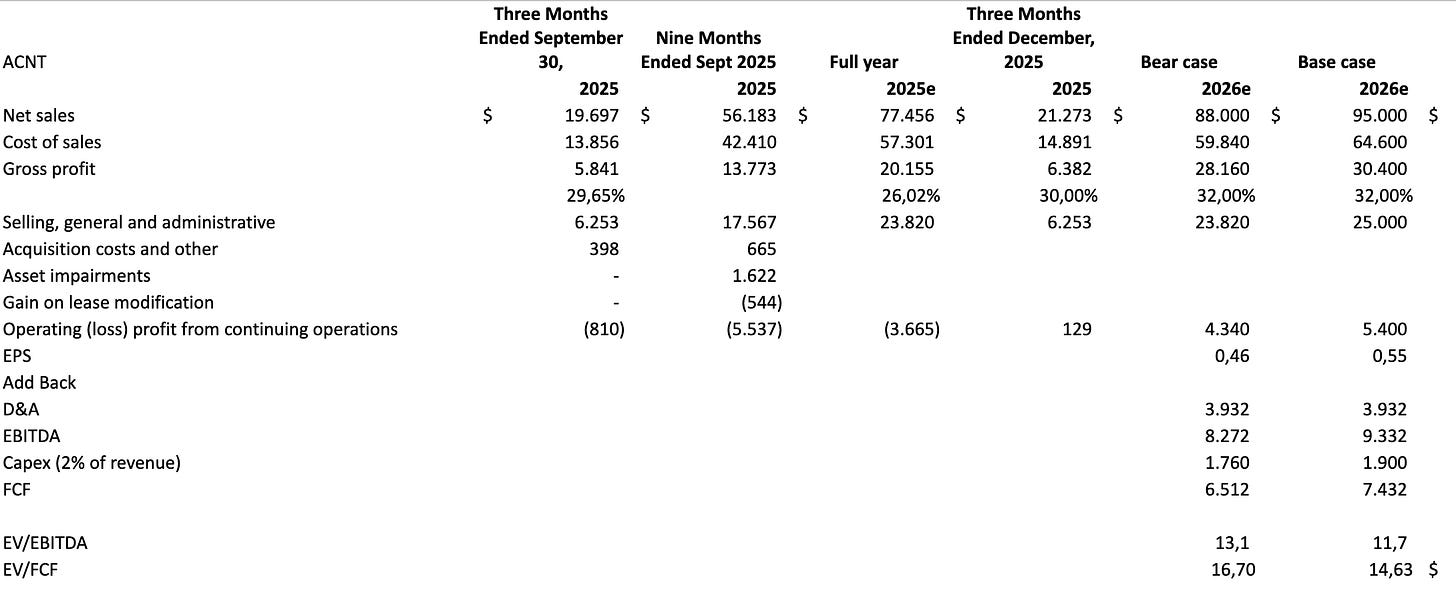

1) Ascent Industries - Specialty Chemicals

Ascent has transformed under the leadership of Bryan Kitchen into a specialty chemicals pure play. After divesting their steel business, they’re sitting on $58M in net cash against a roughly $160M market cap. The chemical market is still soft, but thanks to recent business wins, I expect revenue to grow from roughly $77M in 2025 to $88-95M in 2026.

While shares aren’t as cheap as they were last November, I think there’s still a lot of value ahead. Management repurchased roughly 7% of shares in 2025 and authorized a new buyback program for up to 2M shares — that’s 22% of shares outstanding. Another potential catalyst would be an acquisition.

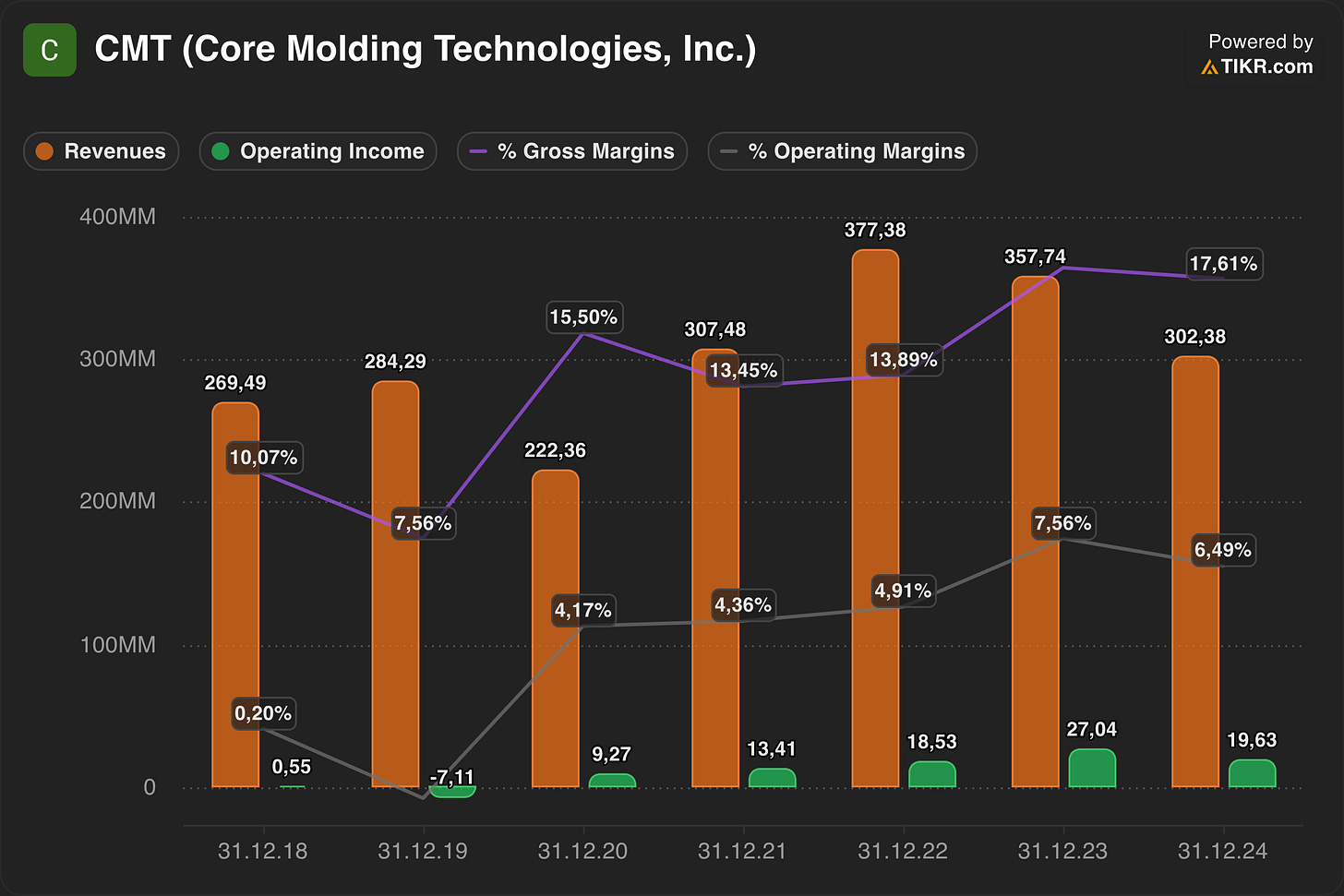

2) Core Molding Technologies (CMT) — Trucking Recovery

This is a bet on the recovery of the trucking market. Core Molding is a supplier of molded parts for the trucking industry. They lost their Volvo business some years ago and recently won it back. Despite that loss, they stayed profitable the entire time. With the Volvo contract and other wins, the company is guiding towards annual product revenue exceeding $325 million within the next two years.

3) Ampco-Pittsburgh Corporation (AP)

Ampco has two divisions: Forged and Cast-Engineered Products and Air and Liquid Processing (ALP). After exiting their unprofitable UK segment, the company is positioned to benefit from the same industrial tailwinds driving the rotation we're seeing. My friend Christian Schmidt wrote a thorough (and free) deep-dive on the catalysts aheah, I recommend reading it here:

Disclaimer: I own shares of Ascent Industries (ACNT). I do not own shares in any other company mentioned in this article. Nothing in this newsletter constitutes financial advice, and all content is for informational and entertainment purposes only. I am not a financial advisor. You should always do your own research and consult a qualified professional before making any investment decisions. My positions may change at any time without notice.

https://www.eia.gov/todayinenergy/detail.php?id=66844#:~:text=EIA%20forecasts%20U.S.%20crude%20oil%20production%20will%20decrease%20slightly%20in%202026,-Data%20source%3A%20U.S.&text=In%20our%20latest%20Short%2DTerm,d%20less%20than%20in%202025.

https://www.msn.com/en-us/money/markets/us-frackers-explore-new-frontier-shale-abroad/ar-AA1W355k

https://www.bloomberg.com/news/newsletters/2026-01-16/oil-wildcatter-hamm-is-halting-drilling-in-the-bakken

https://www.forbes.com/sites/davidblackmon/2025/09/28/new-report-projects-95-future-breakeven-price-for-us-shale-oil/

https://www.rystadenergy.com/insights/argentina-s-unconventional-wealth-key-to-its-hydrocarbon-prosperity

https://www.researchgate.net/publication/307937995_Organic-rich_Stratigraphic_Units_in_the_Vaca_Muerta_Formation_and_Their_Distribution_and_Characterization_in_the_Neuquen_Basin_Argentina

https://www.lanacion.com.ar/economia/plan-ambicioso-la-cuarta-petrolera-mas-grande-del-mundo-se-sumo-al-proyecto-que-buscara-exportar-gas-nid12022026/

https://www.techint.com/en/news/2026/duplicar-norte-a-new-infrastructure-push-behind-vaca-muerta-s-expansion

https://jpt.spe.org/chevron-shell-finalize-argentinas-vaca-muerta-sur-pipeline-partnership

Very interesting, thanks. I'm a happy shareholder of Saipem (SPM.MI). Not as undervalued as few months ago, but not still fair priced, especially if we anticipate a success of the merge with Subsea 7.

Beyond oil&gas, do you think that healthcare could be the next one to benefit from the Great Rotation?